It’s time for Washington state to have an equitable tax code. Currently, it disproportionately relies on people with low incomes while giving the wealthiest people tax breaks. That’s just upside down. What’s more, those most heavily burdened by our upside-down tax code are people with low incomes, many of whom are people of color. The Working Families Tax Rebate (WFTR) is an important tool to help turn our tax code right-side up and to help undo the systemic inequities that have created an uneven playing field for people of color.

The Washington state legislature enacted the WFTR in 2008, but it was never funded. It is one of the most effective ways Washington can work to correct our state’s reliance on regressive sales taxes that overburden lower-income families. The rebate uses the federal Earned Income Tax Credit (EITC) program, a powerful anti-poverty tool, as a basis for eligibility. The WFTR would provide qualifying low-wage workers with an annual boost to their income in the form of a tax credit.

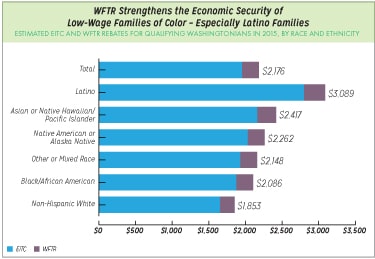

Funding the WFTR would advance racial equity by supporting the economic security of Washingtonians of color who are working in low-wage jobs. Our new WFTR fact sheet shows how the WFTR would benefit families in all of Washington’s 39 counties from all racial backgrounds. For example, our analysis shows that, if the WFTR were funded:

• Recipients would invest $98.5 million back into local economies throughout Washington state, nearly half (49 percent) of which would go to communities of color.

• The rebate would improve the lives of many children of color, given that 51 percent of qualifying children in EITC-eligible households are children of color.

• Approximately 498,000 Washingtonians in all 39 counties of the state would be eligible for the WFTR, which means residents in all counties would see some economic gain.

[Click on image to see full PDF that includes this graphic]

Take a look at our fact sheet for more information on how the Working Families Tax Rebate would advance equity for our state and its people.