For media inquiries, contact Campaign Communications Specialist Leila Reynolds

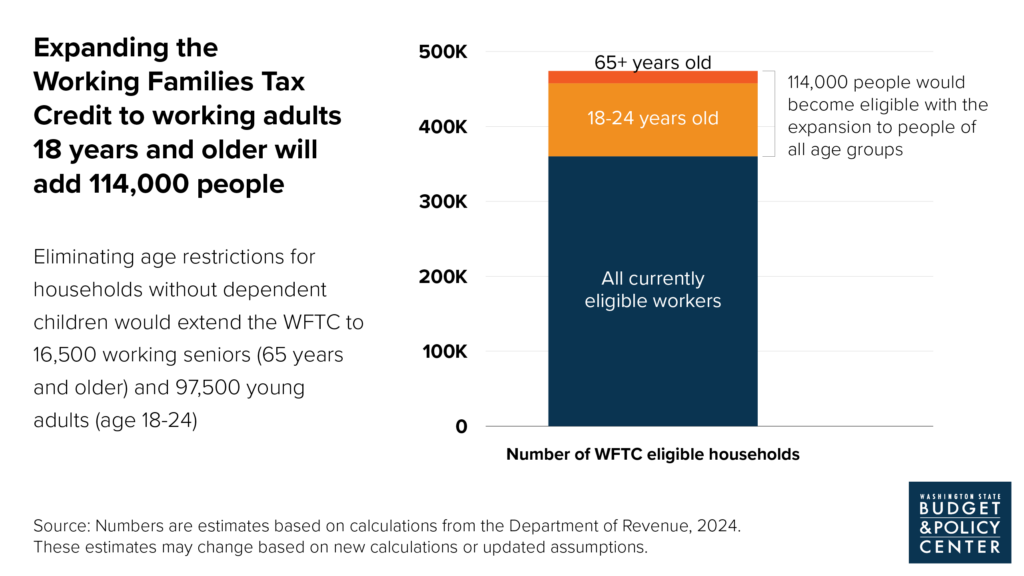

The Working Families Tax Credit is an annual cash refund of up to $1,255 for low to moderate income households in Washington that launched in 2023. Already, over $114 million dollars has been put back into the pockets of people and families. However, an age restriction keeps people ages 18-24 and 65 years and older from qualifying for the credit unless they can claim a qualifying child on their tax return. Our new report, “The Working Families Tax Credit should support more low-income households” highlights the need for lawmakers to remove an arbitrary age restriction that keeps working seniors and young adults from qualifying for our state tax credit, unless they have a dependent child, and puts forward more ideas on how lawmakers can equitably expand the credit for more low-income households.

Seniors and young adults without kids need a cash boost

One finding from the report shows that the young adults with low incomes who are currently excluded from our state tax credit are more likely to be leaving the foster care system, be LGBTQ+, or be people of color. Young people ages 18-24 make up 8% of Washington’s workforce, yet 55% struggle to meet their basic needs. Including working seniors ages 65 years and older would also give our elder population a boost, as senior poverty has risen 13% in Washington state between 2021 and 2022.

Click on the graphic to enlarge.

Lawmakers can remove the age restriction by passing House Bill 1075/ Senate Bill 5249. Read the fact sheet on the age expansion here, and learn more about the community coalition supporting the expansion at www.WATaxCredit.org.

We can do more for low-income adults left out of the Working Families Tax Credit

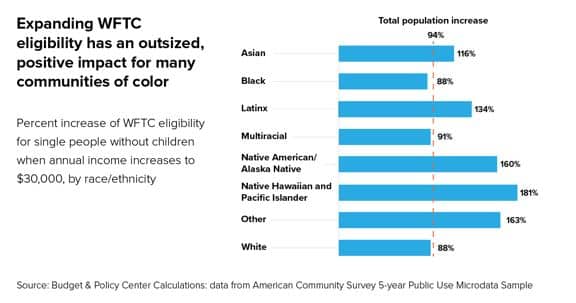

Additionally, the report highlights how raising the baseline income threshold for low-income adults to $30,000 would help fill the gap between low wages and rising costs, and have an outsized impact for communities of color.

People without dependent children at home are a diverse group who are often helping to care for family members or support them financially, even as they struggle to keep up with the costs of basic needs. This demographic is the only group taxed further into poverty by our federal tax code, and they must meet a very low-income threshold to qualify for our state tax credit – $17,640 for a single person, or $24,210 for a couple. Raising the credit’s income threshold to $30,000 for single adults without dependent children would help put more cash into their pockets to buy groceries or cover rent, and provide a more equitable baseline for lawmakers to build upon for families with kids. It would also provide an outsized impact for communities of color, especially for Native Hawaiian and Native households in WA.

Click on the graphic to enlarge.

The report provides further recommendations lawmakers can turn to when making future equitable expansions, including making the credit payments automatic for people who are already receiving benefits, and boosting the amount of the credit for people without children to a more meaningful amount.

Read the full report, “The Working Families Tax Credit should support more low-income households” and check out the fact sheet on the age expansion here.