This is part 1 of 2 in a series of posts analyzing the impacts of the federal megabill. Read part two here.

At a time when everyday people are being squeezed by rising costs and inflation, the need for public services that support the well-being of all our communities is especially critical. Many people – including people with disabilities, elders on fixed incomes, and veterans – rely on programs like Medicaid and food assistance to meet their basic needs.

Despite that, Congressional Republicans recently pushed through a federal reconciliation bill that cuts services that can literally save lives. These lawmakers ignored the calls of their constituents who reached out and showed up to their town halls to implore their elected leaders to maintain funding for health care, child care, elder care, and other programs that lower costs and provide tools for working people to build good lives.

The bill, H.R.1, has gone by many names but make no mistake: this harmful Republican megabill represents the biggest wealth transfer in history, paid for by gutting core benefits and services that communities rely on. H.R.1 is the culmination of an effort by the Trump administration and Congressional Republicans to defund essential services that support working families, bankroll efforts to benefit wealthy individuals and corporations, and push forward a harmful anti-immigrant agenda. This post provides a high-level overview of some key components of the bill, drawn from analysis by the Center on Budget and Policy Priorities.

1. The bill puts food assistance and health care out of reach for many people who need it

This bill includes massive cuts to the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, and Medicaid. These two programs are pillars of the federal support system for hardworking people and families in Washington. Both programs will have harsh changes to eligibility, including punitive work requirements and time limits. The bill also shifts costs of administration and benefits to states, meaning states will need to either backfill the cost of administration, or further cut the program.

The legislation cuts food assistance by:

- Shifting the cost of benefits and administration to states. Beginning in October 2027, the federal government will stop covering 100% of SNAP benefits costs in states with high “error rates,” forcing states to pick up the tab. Error rates measure whether states issue the right benefit amounts – they don’t track fraud, but instead reflect things like paperwork mistakes or system errors. Washington’s 2024 error rate was 6.1% – just above the 6% threshold – meaning the state would be required to begin paying a share of SNAP benefits. That cost could continue to climb depending on future error rates, leaving Washington responsible for three-quarters of the cost of running the program for the first time. Together, these changes represent a dramatic shift away from the federal government’s longstanding responsibility to fund food assistance, putting Washington taxpayers on the hook for hundreds of millions of dollars – while still potentially forcing cuts to food assistance programs.

- Expanding a requirement that SNAP recipients work a minimum of 20 hours per week or face a three-month limit. Currently, the SNAP work requirement applies to adults aged 18 to 54 and exempts parents with dependent children. This bill expands SNAP’s harsh and red-tape-laden work requirements to adults ages 55 to 64 as well as adults with children 14 and older. Additionally, this law removes the exemptions that were previously in place for veterans, people experiencing homelessness, and young people aging out of foster care. This change will particularly affect parents, family caregivers, and people with disabilities or health issues that make it difficult for them to engage in paid work.

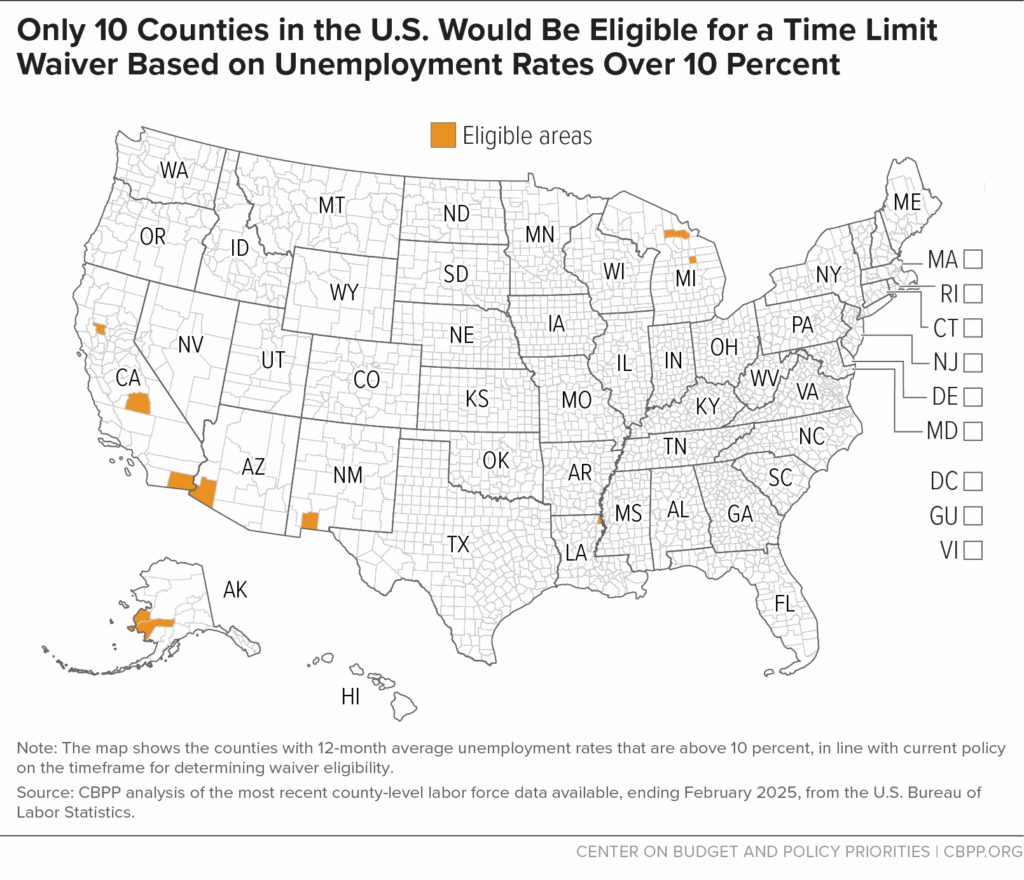

- Effectively removing the ability for states to seek waivers from harsh time limits. The reconciliation bill changes the eligibility criteria for states to waive the three-month time limit for people to receive SNAP if they do not meet the work requirement. It removes the current option for states to request a waiver if there is an insufficient number of jobs in the area and restricts waivers only to counties that have over a 10% unemployment rate. Under these changes, only ten counties in the country would be eligible for a time limit waiver.

Click on graphic to enlarge

Note: This graph provided by the Center on Budget and Policy Priorities. See their analysis here.

- Eliminating SNAP eligibility for people granted refugee status, asylum, or certain other humanitarian protections. This means many residents will not have access to food benefits. Only U.S. citizens, lawful permanent residents, Cuban or Haitian entrants, and citizens of nations in the Compacts of Free Association (the Federated States of Micronesia, the Republic of the Marshall Islands, and the Republic of Palau) will be eligible going forward. This is a stark departure from our country’s longstanding, bipartisan commitment to supporting people fleeing violence and persecution.

The legislation cuts health-care access and increases health-care costs for recipients by:

- Establishing a new, punitive work requirement for nearly all Medicaid recipients. Under this new law, people from the ages of 19 to 64 who receive Medicaid benefits through the Affordable Care Act’s Medicaid expansion group, including parents with children 14 and older, must show they are working 80 hours per month to qualify and maintain benefits. For many individuals and families who rely on Medicaid for life-saving medical services, this work requirement may be impossible to maintain due to illness, injury, caregiving needs, or long-term medical conditions. Others, including people who are already working, will face red tape in the form of paperwork issues or challenges with documenting exemptions. And for some, the new work requirement may put them above the income threshold to receive Medicaid coverage but also leave them without health coverage through their employer if their job doesn’t offer it. It is important to note that American Indian and Alaska Native individuals are exempt from the bill’s work requirement under federal trust and treaty obligations.

- Adding red tape by requiring people receiving Medicaid expansion coverage to confirm that they are eligible twice per year. The new law requires people enrolled in the Medicaid expansion to verify that they are meeting work and income requirements every six months – under previous law, enrollees needed to verify their eligibility once a year. This change adds to the administrative burden on households and state agencies and will disrupt access to care, which contributes to people delaying care or facing high medical bills.

- Increasing costs directly for Medicaid expansion recipients, who already have low incomes. The new law requires all states to impose cost sharing (also known as out-of-pocket costs, which commonly include copays, coinsurance, and deductibles) of up to $35 for many services if someone in the Medicaid expansion has income above 100% of the Federal Poverty Level, which is $26,650 for a family of three. Currently Washington state does not require Medicaid adults to pay a co-payment for services. Research shows that even a modest co-payment discourages people with low incomes from seeking services, which will worsen health outcomes as some people avoid care due to cost.

- Blocking new provider taxes (i.e. taxes on hospitals and nursing facilities) and increases on existing tax rates. States rely on these taxes to fund health-care services. With the new law, states will need to find other ways to generate that revenue or be forced to further reduce Medicaid spending, coverage, and payment rates.

Something especially egregious to note is that Republican Congressional members made the politically motivated decision to delay these sweeping cuts to Medicaid until 2027 – in other words, until after mid-term elections take place in the fall of 2026.

2. The bill makes permanent changes to the tax code in favor of wealthy individuals and corporations

The gutting of Medicaid and SNAP helps pay for tax code changes that will further pad the bank accounts of the wealthiest households and corporations. The legislation:

- Makes Trump’s previous tax cuts permanent. The tax code changes in the 2017 Tax Cuts and Jobs Act under the first Trump administration, which concentrated benefits on the wealthiest in the nation, were set to expire at the end of 2025. H.R.1 makes those tax code changes effectively permanent, codifying tax policy that exacerbates wealth inequality, and providing little benefit to low- and moderate-income households. A wealth of research has already demonstrated that the richest 40% of Washington households overwhelmingly receive the benefits from these tax code changes.

- Gives the Child Tax Credit to wealthy families, while cutting off people with the lowest incomes and children in immigrant families. The Child Tax Credit provides much-needed support to qualifying families with kids. Advocates have sought robust and transformational changes to the program to increase stability for working families. However, H.R.1 extends the credit to wealthy households earning over $200,000 and strips benefits away from families with mixed-immigration statuses. It also includes a requirement that households make at least $2,500 to qualify, effectively ensuring that the poorest households won’t receive the full credit. The bill also includes a requirement that at least one parent have a Social Security Number to qualify, regardless of the child’s status, preventing families only filing with Individual Taxpayer Identification Numbers (ITINs) – many of whom are immigrants – from being able to claim the credit. Estimates show that 4.5 million citizen children nationwide and 137,000 children in Washington

could lose access to this critical economic support. - Changes the Estate Tax to benefit ultra-wealthy families. The new law increases the amount a wealthy couple can pass on tax-free to their heirs to $30 million ($15 million for a single person).

- Makes cuts to clean energy incentives. In an effort to roll back climate policy enacted under the Biden administration, the new tax code phases out credits for clean energy. This includes eliminating the electric vehicle (EV) and residential clean energy credits by 2026 and phasing out wind and solar credits for projects beginning in 2026 and 2027. These changes will increase energy costs – raising Americans’ electricity bills by up to 10% or $400/year, and kill energy and manufacturing jobs – by some estimates eliminating over 900,000 jobs.

3. Harmful funding provisions will especially impact rural communities and immigrants

In addition to paying for tax cuts that benefit the wealthiest few, cuts to Medicaid and SNAP will also pay for increased funding for mass deportations. This will continue to tear families apart and have negative effects on the industries we all rely on, such as health care and agriculture. Additionally, although Republican lawmakers included a new fund for rural hospitals under the guise of making up for Medicaid cuts, it was simply done as a political stunt and won’t actually address the harm of these cuts. The legislation includes:

- Unprecedented funding for Immigration and Customs Enforcement (ICE). One of the most devastating parts of the reconciliation bill is an unprecedented influx of funding for the Department of Homeland Security to detain and deport immigrant adults and families. The bill more than quadruples ICE’s detention budget. The Trump administration has made clear that the purpose of the increased funding is to keep more people in inhumane conditions for an indefinite time and expedite removal processes that will circumvent due process. All of this will tear families apart and cause psychological trauma and long-term mental health risks to children, families, and communities.

- Insufficient solutions for rural hospitals. The reconciliation bill establishes a rural health fund on the pretense of supporting rural hospitals that will be impacted by the Medicaid eligibility and financing changes. However, Congressional Republicans used this fund as a bargaining chip to win votes, and it does not come close to providing the support needed by rural hospitals that are in jeopardy of closing at an alarming rate. Furthermore, based on how states can use the allotments they receive, the funding may not necessarily be used to support rural health providers. The Trump administration is already touting the fund as a way to invest in digital technology such as telehealth, rather than focusing on paying rural providers to make up for cuts to their Medicaid reimbursements

For more analysis of how Congressional Republicans cruelly targeted immigrants in the federal budget and what Washington lawmakers can do protect immigrant communities, read our blog post, “House Republicans’ budget proposal targets immigrants and cuts basic needs in order to give a handout to the wealthy.”

For analysis on how these cuts impact our state budget – and how Washington state lawmakers can and must act to protect working people and families from the fallout – read our accompanying blog post, “What the harmful Republican megabill means for people and families in Washington.”