As state and local governments continue to grapple with the devastating cuts to public programs from the federal reconciliation bill passed by Republicans in Congress, it’s important to have a clear understanding of how everyday people are faring. The U.S. Census Bureau recently released new poverty data that show about one in 10 people in Washington did not have enough income to meet their basic needs in 2024. Washington’s poverty rate has remained largely unchanged over the past five years and will only increase once the federal budget cuts take effect. State lawmakers must enact progressive revenue to adequately fund programs that help our communities achieve financial security.

Overall poverty and health coverage rates stayed the same, but barriers to economic opportunity for people of color have increased

In 2024, 9.9% of Washington residents had income below the poverty level.1 The poverty threshold was $16,320 for a single-person household and $31,812 for a household of four with two children. Washington’s poverty rate equates to over 776,000 people who were unable to meet their basic needs last year, which is roughly the populations of Tacoma, Spokane, Vancouver, and Bellingham combined.2

The overall percentage of people with income below the poverty line has largely stayed the same since 2018. Racial disparities had also been decreasing since 2019 but reversed trend last year. In 2024, there was a near 12% difference between the racial group with the highest rate of poverty (American Indian or Alaska Native at 18.8%) and the group with the lowest rate (Asian at 6.9%). This is up from a 9.6% difference between the highest rate (American Indian or Alaska Native at 17.3%) and the lowest rate (Asian at 7.7%) in 2023. This widening gap happened as poverty rates decreased for most racial groups but increased for people who identify as American Indian or Alaska Native, Hispanic or Latino, and “Some other race.”3

Racial inequities do not occur by chance. For decades, policymakers have made decisions that legalized racial discrimination in taxation, employment, education, housing, the criminal legal system, and other public institutions. These policies extract resources from people of color, particularly Black and brown communities, at the benefit of white households.

The new Census numbers show that Washington’s health coverage rates follow a similar pattern to its poverty rates. Overall, 6.5% of people in Washington lacked health care coverage in 2024. The state’s overall uninsured rate has largely stayed the same since 2015, but racial disparities increased between 2022 and 2024.

Compared to the overall uninsured rate of 6.5%, people who identified in the Census as “Some other race” were more than three times as likely to be uninsured – at 22.9%, which is equal to a little over one in five people. People who identify as Hispanic or Latino and American Indian or Alaska Native were uninsured at rates that were twice as high as the overall rate. About one in six people who identify as Latino were uninsured and about one in seven people who identify as American Indian or Alaska Native were uninsured in 2024.

At the same time as these disparities have grown, lawmakers have allowed our inequitable tax code to continue to overwhelmingly benefit massive corporations and the richest 1%. And they have failed to adequately fund public assistance programs that would greatly benefit communities of color. These racial inequities will only increase with the impending federal cuts to many public programs.

Federal budget cuts will push more people into poverty

The new Census numbers don’t reflect the full impact of cuts and policy changes to public support programs from the federal reconciliation bill. Congressional Republicans gutted funding for Medicaid and the Supplemental Nutrition Assistance Program (SNAP), despite large pushback from advocates and community members. This will only increase the number of people who can’t see a doctor, access life-saving care, or put food on the table.

The Health Care Authority (HCA) estimates that up to 320,000 people in Washington could lose Medicaid coverage due to the federal changes. People who buy their own health care through the Affordable Care Act marketplace could also see their premiums increase by up to 15%. And the expiration of the enhanced premium tax credit, which helps 216,000 people in Washington save an average of $1,300 per year on health care costs, would increase people’s premiums by 65% if Congress does not take action to extend the credit.

Tens of thousands of people across Washington are also likely to face food insecurity because of federal changes to the SNAP program. The Department of Social and Health Services estimates that 137,000 people could lose their SNAP benefits if they fail to meet the harsh new work requirement that Congressional Republicans expanded to adults ages 55 to 64 and adults with children 14 and older. Additionally, around 33,000 refugees and people who’ve come here seeking asylum would also lose SNAP benefits because of the changes to eligibility for people with certain immigration and humanitarian statuses.

Progressive revenue is necessary to ensure people can meet their basic needs

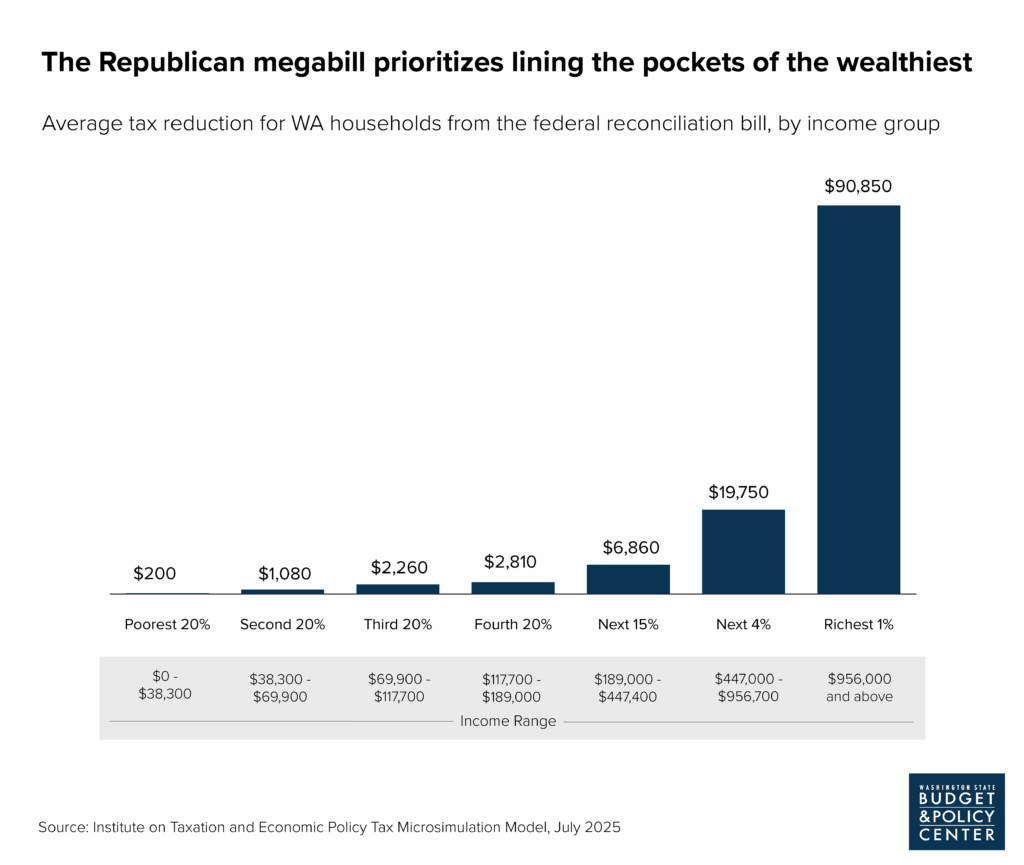

Now, more than ever, we need progressive revenue to backfill the federal cuts and protect people from being pushed further into poverty, losing health coverage, and going hungry. The state tax code already heavily favors the wealthy few, and these individuals will soon see an even greater transfer of wealth. Under the federal budget bill, Washington’s richest 1% will receive a $90,850 tax reduction, while the lowest 20% of income earners will receive on average a $200 tax reduction.

Click on graphic to enlarge

Maintaining the status quo does not serve the majority of hardworking Washington residents and will only exacerbate inequities. Lawmakers must take bold action to make the wealthy and big corporations pay what they owe in taxes and pursue progressive tax policies that support all people in Washington.