This is part 2 of 2 in a series of posts analyzing the impacts of the federal megabill. Read part 1.

Everyone should be able to put food on the table and access health care services when they need it. For decades, the federal government has recognized its role in providing these basic needs to people who are unable to afford them on their own. However, as detailed in the first part of our analysis on the federal reconciliation bill passed by Congressional Republicans, this legislation guts core services such as food and health care assistance that working families rely on, in order to give a windfall of cash to the wealthiest 1%. In Washington state, ultra-wealthy people already get a special deal on their taxes, which leaves our state budget chronically underfunded. Given the passage of this bill, it’s imperative that state lawmakers do everything they can to protect people from the damage these cuts will inflict on people’s lives and well-being.

It’s important to note that we are still learning the magnitude of the impact that the harmful Republican megabill will have on Washington state. That’s in part because much of the guidance on how these policies should be administered is in the hands of federal agencies, which will determine when and how some of the changes will be implemented. However, some effects will be more immediate than others. Here’s what we currently know and can anticipate in terms of the impact on Washington state:

More people will be unable to afford groceries

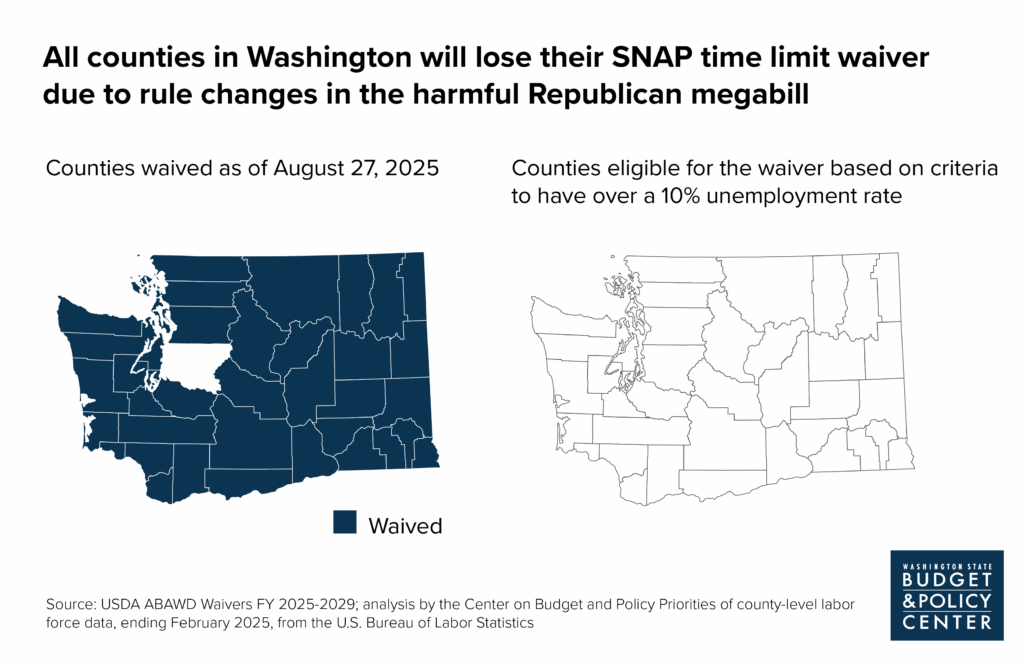

Thirty-eight out of 39 counties in Washington state currently receive a waiver to the three-month time limit for participants in the Supplemental Nutrition Assistance Program (SNAP) who do not meet the work requirement. This waiver is a life saver for many people who are experiencing food insecurity and don’t have the resources to consistently put food on the table. However, because of the new limitations on states’ ability to apply for waivers, beginning January 2026, no county in the state will be eligible for this waiver. People could start feeling the effects of these cuts as soon as April 2026.

Decades of research have shown that the harsh three-month time limit does not increase workforce participation. Rather, people who are unable to meet the work requirement due to systemic barriers will need to find other means of food assistance. In Washington state, food banks are already struggling to meet the high need for food. Now, an estimated 170,000 people stand to lose their SNAP benefits due to the rule change. Approximately 42,000 veterans in Washington – many of whom face physical or mental health challenges related to their service – will also be subject to this harsh time limit, putting them at risk of losing food assistance after just three months. Altogether, this represents a drop of almost 20% in SNAP enrollment, meaning one in five SNAP recipients will lose food assistance.

Additionally, around 33,000 refugees and people who’ve come here seeking asylum would also lose SNAP benefits because of the changes to eligibility for people with certain immigration and humanitarian statuses.

Click on graphic to enlarge

Health care will be more expensive and harder to access

Washington is estimated to lose 18% of its Medicaid funding over 10 years, equivalent to as much as $46 billion. The Health Care Authority estimates that up to 320,000 people in Washington could lose Medicaid when these changes begin to take effect.

It should go without saying, but just because health insurance is taken away doesn’t mean people stop needing medical care. People need adequate access to health care for stability and long-term well-being. Cuts to Medicaid will put pressure on other aspects of the medical system, such as urgent care and emergency rooms, when people delay seeking treatment until an emergency arises.

The already strained state budget will face an even bigger deficit

Washington state earlier this year faced a budget deficit rivaling that of the Great Recession. Legislators and the governor cut nearly $8 billion from the state operating budget and resorted to predominantly regressive revenue streams to try to keep community services intact.

Revenue forecasts have continued to show declines in revenue from taxes like the Business & Operating (B&O) tax and sales tax. These taxes are deeply regressive, meaning that the people with the lowest incomes pay the highest share of their income towards these taxes. Further, these taxes also demonstrate that Washington’s tax code – which is largely a holdover from the 1930s – cannot keep up with a modern economy, because it does not effectively tax the wealth of those with the highest incomes or of massive corporations.

Because states will need to absorb the additional costs resulting from federal cuts, state lawmakers will continue to face budget shortfalls until they take additional measures to adequately and equitably raise revenue to support communities.

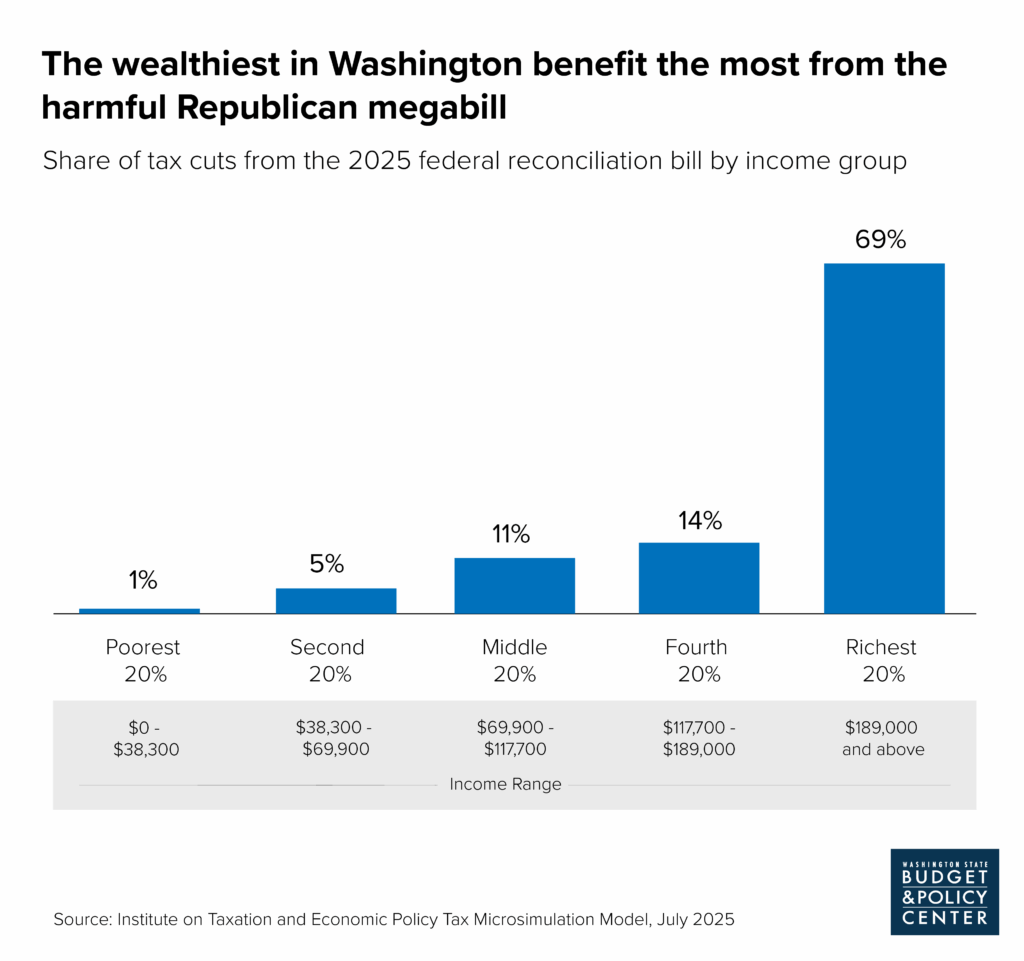

Washington’s wealthiest will get yet another tax break

This federal bill represents the largest transfer of wealth for Washington state’s wealthiest individuals and companies who already receive concentrated tax breaks in our state. Analysis from the Institute for Taxation and Economic Policy (ITEP) shows that Washington’s richest 1% will see a $90,850 tax reduction under the new federal changes, which is enough to put a downpayment on a new yacht. In contrast, the lowest 20% of income earners receive on average a $200 tax reduction, which will be wiped away by impending cost increases to everyday expenses caused by other economic policies from the Trump administration like tariffs.

Click on graphic to enlarge

Washington state lawmakers already prioritized pushback from the ultra-wealthy and hugely profitable corporations in the 2025 legislative session, which led to the downfall of several commonsense progressive revenue proposals, including a tax on extreme wealth and a tax on large employers of the highest earners.

Protecting Washington in the long term will require legislators and Governor Ferguson to address the upside-down tax code

Coming out of the 2025 legislative session, Washington state is just beginning to feel the harmful impacts of nearly $8 billion in budget cuts. These challenges will only increase with the additional cuts from the federal budget. To prevent more people from going hungry, losing access to lifesaving medical care, and being unable to meet their basic needs, lawmakers must overhaul the state tax code so that there is sufficient revenue to fund public programs.

Washington’s outdated tax code currently does not allow the government to consider a person’s ability to pay when calculating taxes. So, whether it’s property tax, the tax you pay to do business, or the tax you pay on your day-to-day items, the state tax code largely applies uniformly across income groups. This design favors people who have a wealth of resources and requires people with the least to pay the highest share of their income in taxes. Now, on top of the benefits from our state tax code, the wealthiest will also receive the biggest transfer of wealth through federal tax policy.

Our legislators and Governor Ferguson must not delay in acting to ensure that a person’s ability to pay is factored in the taxes they owe. Progressive revenue proposals such as a tax on extreme wealth and a tax on large employers of the highest earners can help our state achieve strong financial health without over-relying on people with the least ability to pay. Until then, the wealthiest in Washington will continue to get a special deal.