Special interests that are opposed to closing the tax break on capital gains misleadingly claim that the House’s proposal would harm small, individually- or family-owned businesses, such as restaurants, auto repair shops, gas stations, and family farms. In reality, this common and sympathetic perception of small business owners is being exploited to shield ultra-wealthy shareholders and partners in investment hedge funds, shell corporations, and other elite financial arrangements from paying higher taxes.

Many “small businesses” are very wealthy individuals engaged in finance activities

Historically, small business ownership has been a pathway to prosperity among hardworking lower- and middle-income households striving to build better lives for themselves and their families. But since the 1980s, extremely wealthy households have increasingly pooled their wealth by forming partnerships and small, private corporations called “S corporations.” In many cases, financial advisers and attorneys for the wealthy draw up these business entities for their clients so they can take advantage of significant federal tax benefits allowed for these types of business structures.

It’s important to note that many S corporations and partnerships are rightly considered to be small businesses because they carry out important economic activities, such as hospitality services, legal services, manufacturing, and other traditional small business activities. But the bulk of wealth for these kinds of business arrangements comes from a small number of elite investment partnerships, like hedge funds, that cater exclusively to the richest 1 percent. As of 2011, 70 percent of business income generated by partnerships comes from those engaged in finance and holding companies (shell corporations)¹.

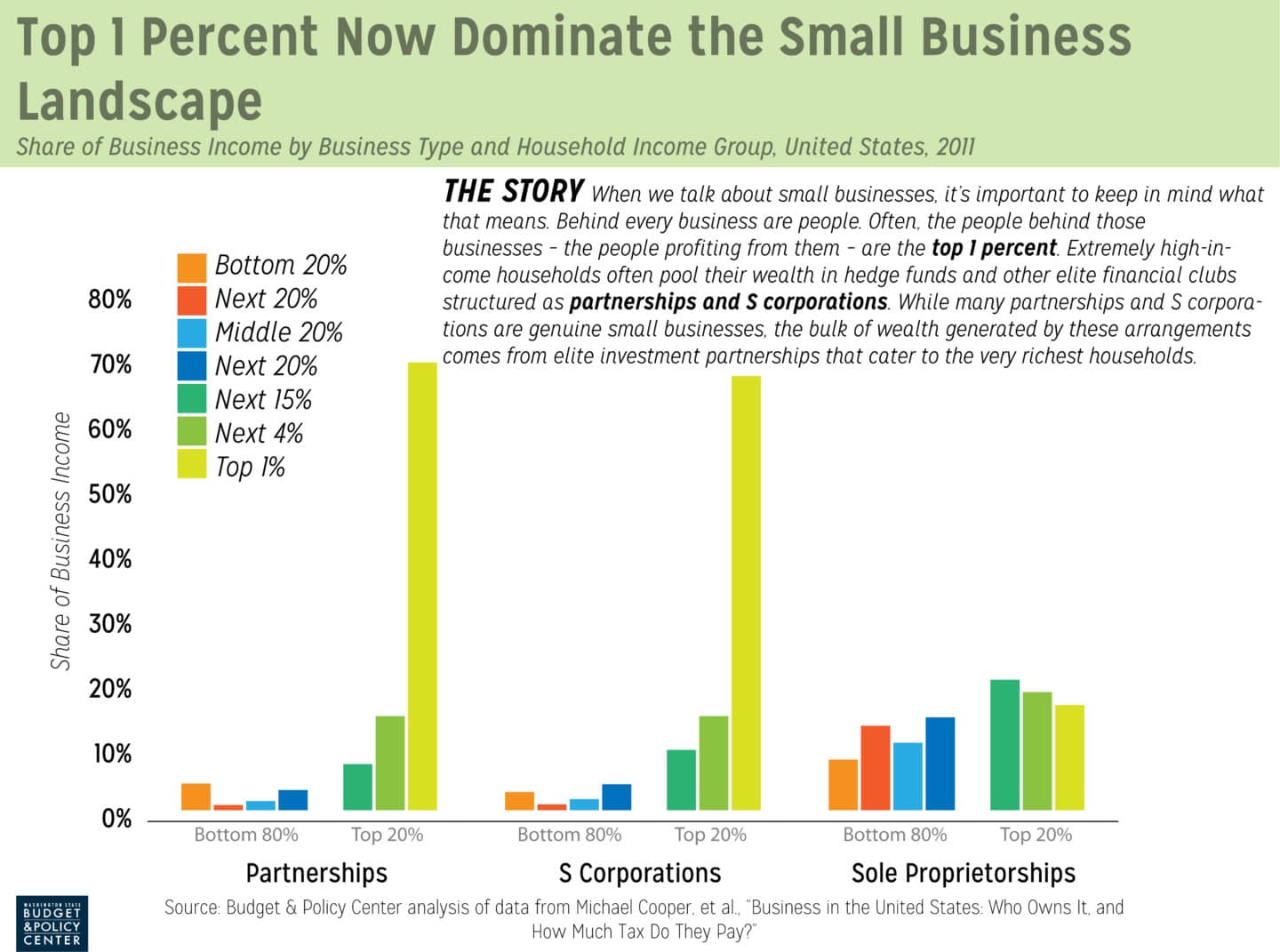

The explosive growth in elite partnerships and S corporations involved in finance activities since the late 1980s has led to an extreme concentration of all small business wealth and income among the very richest households in the United States. As the graph below shows, 69 percent of income from partnerships and 66 percent of income from S corporations now accumulate to the richest 1 percent. As of 2011, someone in the richest 1 percent is 50 times more likely to have any positive small business income than someone in the bottom 50 percent of the population.

Click on graphic to enlarge.

Being linked with genuine small business owners – those who are not engaged in these elite finance activities – has become politically convenient for extremely wealthy people with assets in hedge funds and investment firms. Hedge fund and investment firm partners know they can likely defeat any effort to raise their taxes if the public believes doing so would impact owners of convenience stores, small farms, or auto repair shops.

Most true small businesses don’t receive capital gains as part of their ordinary business activities

Partnerships and S corporations do not directly pay federal taxes on their ordinary business income and capital gains. Instead, ordinary business income and capital gains are “passed through” to the individual partners or shareholders, who in turn pay taxes on them as part of their personal federal income taxes. Under the proposal from House Democrats, wealthy households that live in Washington state who receive pass-through capital gains from exclusive investment partnerships would be taxed on those gains, to the extent they exceed $25,000 ($50,000 for married couples) per year.

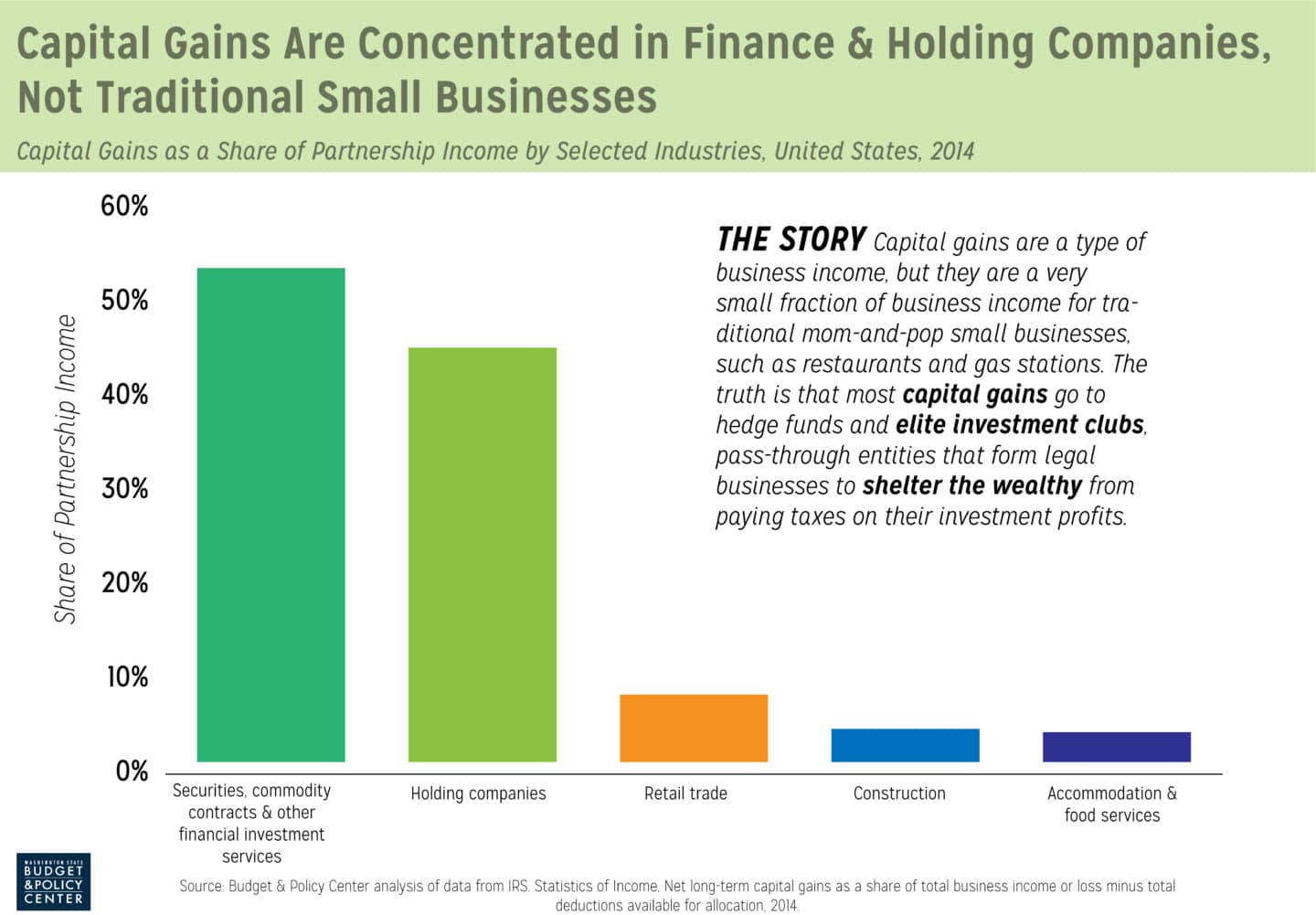

But most genuine small businesses don’t receive capital gains as part of their ordinary business activities. Only 3.3 percent of total business income from sole proprietorships comes from finance-related activities, which are the most likely to reap capital gains². And when it comes to partnerships, the overwhelming majority of capital gains (80 percent) accrue to securities brokerages, holding companies, and other high-end financial management firms that cater to the richest households (see graph below). Capital gains are negligible among partnerships involved in farming, retail trade, manufacturing, and other activities not related to finance.

Click on graphic to enlarge.

The current proposal includes numerous exemptions that would benefit small businesses

Finally, groups that advocate for so-called small businesses with investments in hedge funds and other wealth-accumulation vehicles argue that traditional small business owners would pay the proposed capital gains tax when they sell their business. But this claim ignores numerous exemptions that would benefit small businesses in the current proposal – including those on small business equipment, farmland and farm equipment, livestock, timber, and more.

Perhaps even more importantly, by exempting the first $25,000 for individuals ($50,000 for married couples) in all capital gains from taxation, the proposal from House Democrats would prevent capital gains tax increases for many households selling ownership stakes in a partnership or S corporation. That’s because the median gain from the sale of a partnership or S corporation is less than $5,000, well below the proposed exemption threshold, according to 2010 data from the nonpartisan Congressional Budget Office. And 70 percent of capital gains from the sale of a partnership or S corporation in that year went to millionaires and billionaires.

It is undeniable that the bulk of capital gains taxes would be paid by the powerful few, who have manipulated the tax code in their favor to the detriment of traditional small business owners who serve our communities through their businesses. On balance, small business owners will benefit from investments in strengthened public services that reinforce their businesses and their communities – and these improvements would be made possible by eliminating the tax break for capital gains enjoyed by the very wealthiest Washingtonians.