But during the current legislative session, lawmakers are still struggling to find common ground on how to invest in schools and other key priorities. It’s essential that legislators take a bold, equitable path to fund our state’s most important investments and to bring greater balance to our tax code. The Budget & Policy Center has developed a plan that would do just that. This plan, called Accountable Washington, includes a package of reforms that would infuse $2 billion annually into our communities in the coming years, while significantly reducing taxes for Washington households with middle and low incomes. Additional details of the plan are available in this fact sheet.

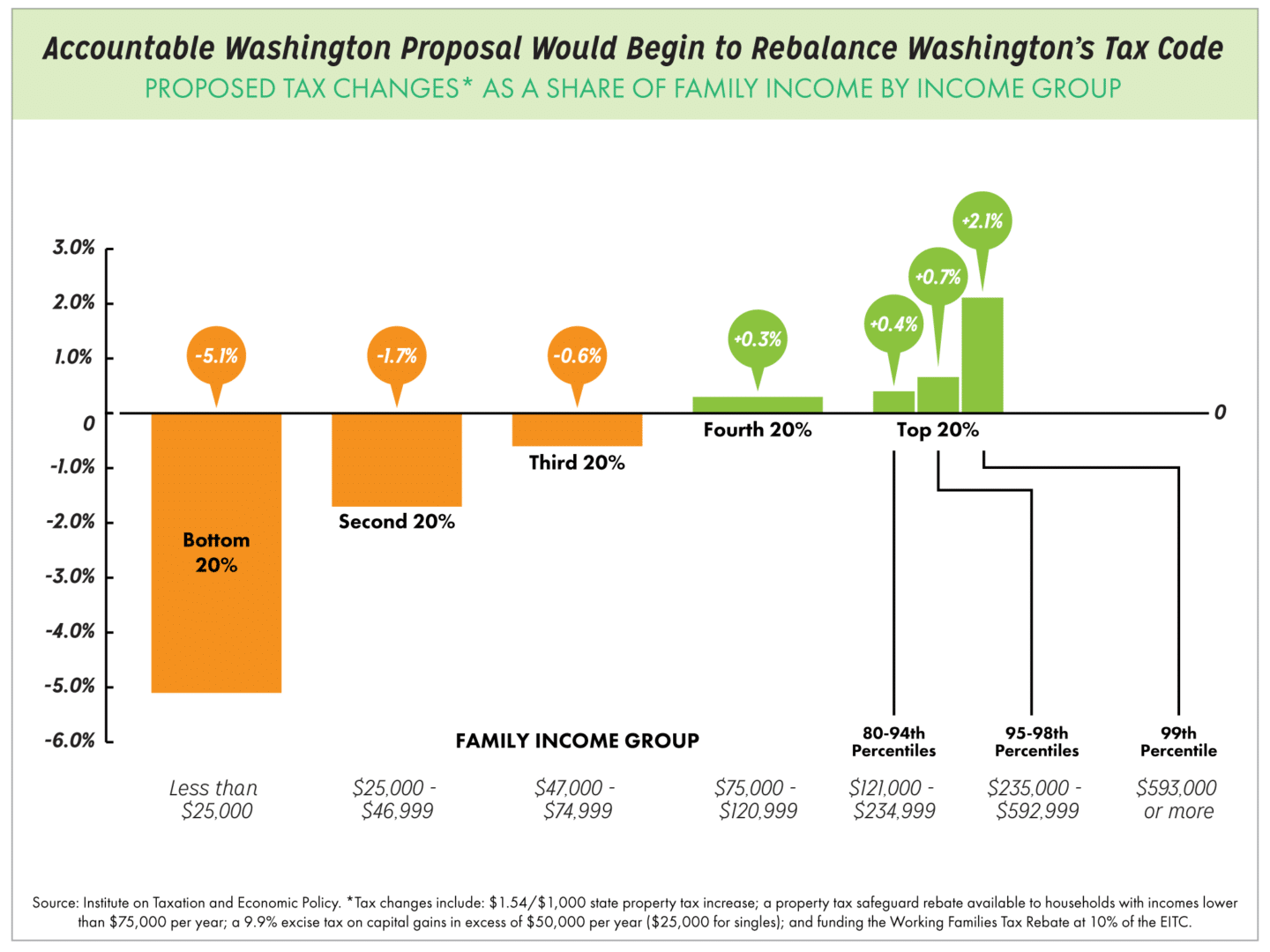

As the chart below shows, taxes would decline by an average of 5.1 percent among the households with annual incomes that fall in the bottom fifth of Washingtonians. Households in the middle of the income scale would see their taxes decrease by 0.6 percent. By contrast, the richest 1 percent would see their taxes rise by 2.1 percent of annual income – a small price to pay for heightened investments in our communities.

Click on the graphic below to see an enlarged version.

Given the urgent need to fund state Supreme Court-mandated improvements to schools across the state, all of Washington’s children would be an important beneficiary of Accountable Washington. Further, this plan would ensure that lawmakers can fully funds schools while also keeping up investments in other programs that serve Washingtonians – such as responsive emergency services, clean water, food for kids who are hungry, and job supports for working parents.

While looking to enact solutions to ensure we have adequate state investments, lawmakers should also be mindful not to raise new revenue on the backs of low- and middle-income households. These households already pay up to seven times more in state and local taxes as a share of their incomes than people at the top of the income scale.

Accountable Washington would begin to clean up and rebalance our inequitable tax code in a way that raises billions of dollars in much-needed new resources. Here’s what it would do:

- Enact smart, equitable reforms to the property tax, including eliminating an indiscriminate restriction on property tax revenue and offering in its place a new, targeted property tax rebate, which we call the safeguard rebate, for families earning $75,000 or less. Property taxes are the most significant source of funding for schools, and both state and local property taxes are at the center of the school funding debate. Under Accountable Washington, lawmakers can make the property tax code more sustainable and more equitable by raising the state property tax rate by $1.54 per $1,000 of assessed value and enacting a safeguard rebate to offset these increases for households with low and middle incomes.

- Rebalance the tax code by enacting an excise tax on capital gains at a rate of 9.9 percent on profits from the sale of stocks, bonds, and other financial assets of more than $25,000 (or $50,000 for couples). Washington is giving away a $2.8 billion capital gains tax break to the wealthiest Washingtonians. While 41 other states have this common-sense tax, Washington gives the wealthy a break on huge profits they receive simply from moving their wealth around. Almost 90 percent of this capital gains tax would be collected from the richest 1 percent of Washingtonians. Gains from the sale of a primary home, retirement accounts, college savings plans, and other common investments would be excluded from the tax.

- Lift up working families by funding the Working Families Tax Rebate (WFTR). Based on the federal Earned Income Tax Credit (EITC), this rebate is a smart fiscal policy to help struggling families make ends meet. The EITC is one of the most powerful federal anti-poverty tools on the books. Including the WFTR in the Accountable Washington proposal keeps taxes from taking too big a bite out of family budgets for the lowest-income Washingtonians.

- Clean out 21 wasteful tax breaks that divert money out of classrooms and into the hands of special interests. To be clear, not all of Washington’s 700 tax breaks are bad policy, but many are outdated and no longer serve their original purpose. And others are simply giveaways to the powerful interests that finagled them into the tax code in the first place. Everybody benefits from excellent schools, clean air and water, safe roads, and accessible health care, so everybody should pitch in and pay their share.

Our lawmakers have an historic opportunity to make some long-awaited repairs to our broken tax code, not only to provide a world-class education for Washington’s 1.6 million kids, but also to serve their parents, their teachers, their neighbors, and their entire communities. We believe they can do that through Accountable Washington.

Check out this fact sheet on the proposal for more details.