Updated on February 21, 2020

Tomorrow, the Washington State Economic and Revenue Forecast Council update its estimates of how much tax revenue the state can anticipate in the next three years. These estimates will be the foundation of how legislators build their budget proposals, which they will release soon.

Due to the ongoing growth of the state economy, the most recent revenue forecasts have projected increases in the state’s total revenues for the remainder of the 2019-21 biennium and the 2021-23 biennium. State revenue collections were also $162.4 (2.5%) higher than forecasted for the month of January, which is a strong indicator that tomorrow’s forecast will project another boost in revenue available to invest in the years ahead.

If our crystal ball is right, this additional projected revenue would allow the legislature to make investments beyond the Governor’s budget proposal in key areas. For example, legislators could use the resources to reinvest in programs that support people with low incomes, invest in early learning, or fund our state’s Working Families Tax Credit.

Here are four things legislators and advocates should keep in mind as they review the forecast:

1. Just because the economy is growing does not mean that growth is shared

People who earn low wages and people who do valuable, but unpaid work like caregiving, drive the economy and help create wealth – but this prosperity is not shared equitably. Black, American Indian and Alaska Native, Latinx, Pacific Islander, and mixed-race households in Washington are all more likely to be in the bottom 20% of state earners than white households due to racist policies and discrimination. Our state tax code only compounds these inequities: low income households pay six times their share of incomes in taxes as the wealthiest 1%. Washington can’t move ahead until our upside-down tax code is fixed and the wealth communities help build is more equitably shared.

2. State tax revenues are still not sufficient to meet community needs

Lawmakers must make tough choices year after year because the state does not generate enough revenue to meet community needs. For example, over the past decade, lawmakers made drastic cuts to WorkFirst/TANF that pushed tens of thousands of Washington families into deeper economic hardship.

3. We could fund community investments if our state revenues actually tracked economic growth

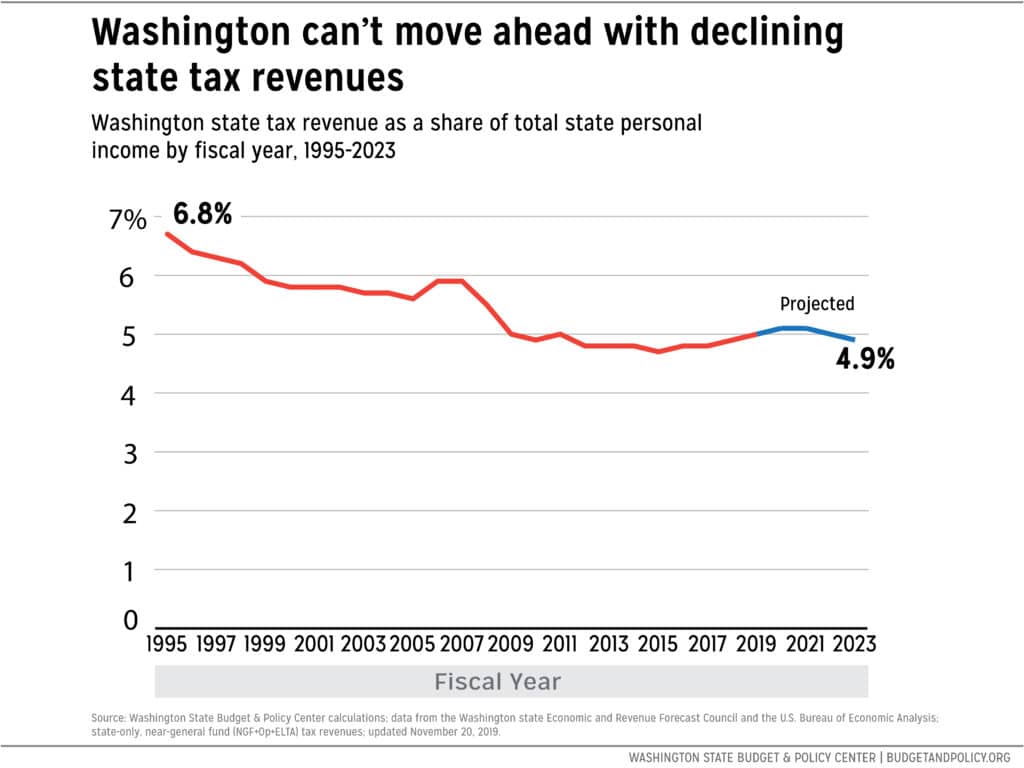

Washington state revenues are not keeping up with economic growth. The state now captures only 4.9% of the total economy, compared to 6.8% in 1995 (see the chart below). That’s billions in lost revenue that could have been used to reinvest in WorkFirst/TANF, fund the Working Families Tax Credit, and more.

Click on image to enlarge.

The good news is that lawmakers can reverse this trend.

4. The surplus revenue projection is not an excuse to shy away from meaningful tax reform

A positive revenue forecast is great news for the state, but legislators should not shy away from common-sense, revenue-raising proposals that can also help balance our tax code. Lawmakers can – and should – move ahead with a capital gains tax and pass an excessive compensation tax to raise even more money for community investments.

You can find full details of the forecast tomorrow, February 18, at 9 a.m. at this link.

Our crystal ball was right! The Washington State Economic & Revenue Forecast Council forecasted an increase of $606 million for the 2021-23 biennium and $321 million for the 2023-25 biennium.*