Updated on July 24, 2020

More than 270,000 undocumented immigrants live and work in Washington state1 and contribute to the well-being of our communities. Many work in industries that are being impacted by COVID-19, yet they are wrongly being systematically excluded from economic relief efforts. Immigrants in Washington state have been excluded from over $700 million in economic assistance so far.

Governor Jay Inslee and legislators should address this exclusion by investing at least $100 million into creating a new Washington Worker Relief Fund and working to create a permanent system to provide support to undocumented workers. The Washington Worker Relief Fund would provide emergency economic assistance to undocumented Washingtonians so that everyone has access to relief they need during the pandemic. This fund would ensure that all Washington workers are protected from economic impacts of COVID-19. Importantly, it would also recognize the economic contributions of immigrants.

Immigrant households contribute millions in taxes

Undocumented immigrants in Washington state work in essential jobs like health care and food production, work in other industries that have been shut down by this crisis, and own small businesses. They also pay sales taxes when they spend money in local economies and businesses.

In fact, undocumented immigrants pay over $300 million in state and local taxes in our state every year, including paying sales tax when making purchases and paying property taxes as homeowners, renters, and small business owners. Washington has the highest effective tax rate on undocumented immigrants of any state.

In addition to state and local taxes, new estimates show that the labor of undocumented workers in Washington state has resulted in nearly $400 million of contributions to the state and federal unemployment trust fund over the past ten years. Yet these workers are systematically denied protection when they become unemployed.2

Immigrant workers contribute to our economies, but are left out of COVID-19 relief

Despite their important contributions to our economy and to funding public services, immigrant households are frequently excluded from public benefits due to xenophobic prejudice about who is “deserving” of public assistance.

Undocumented immigrants pay over $300 million in state and local taxes in our state every year, including paying sales tax when making purchases and paying property taxes as homeowners, renters, and small business owners

Recently, exclusions in the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act mean that undocumented and mixed-status households in Washington state didn’t receive the stimulus payments of $1,200 per individual and $500 per child.

And, undocumented immigrants who have lost jobs have been excluded from standard unemployment insurance protections as well as expanded benefits included in the CARES Act. The lack of unemployment insurance protections for immigrant workers has ripple effects through communities and harms entire families. Approximately 1 in 10 children in Washington are at risk of greater economic hardship due to the lack of unemployment insurance for undocumented workers and exclusion from other supports.3

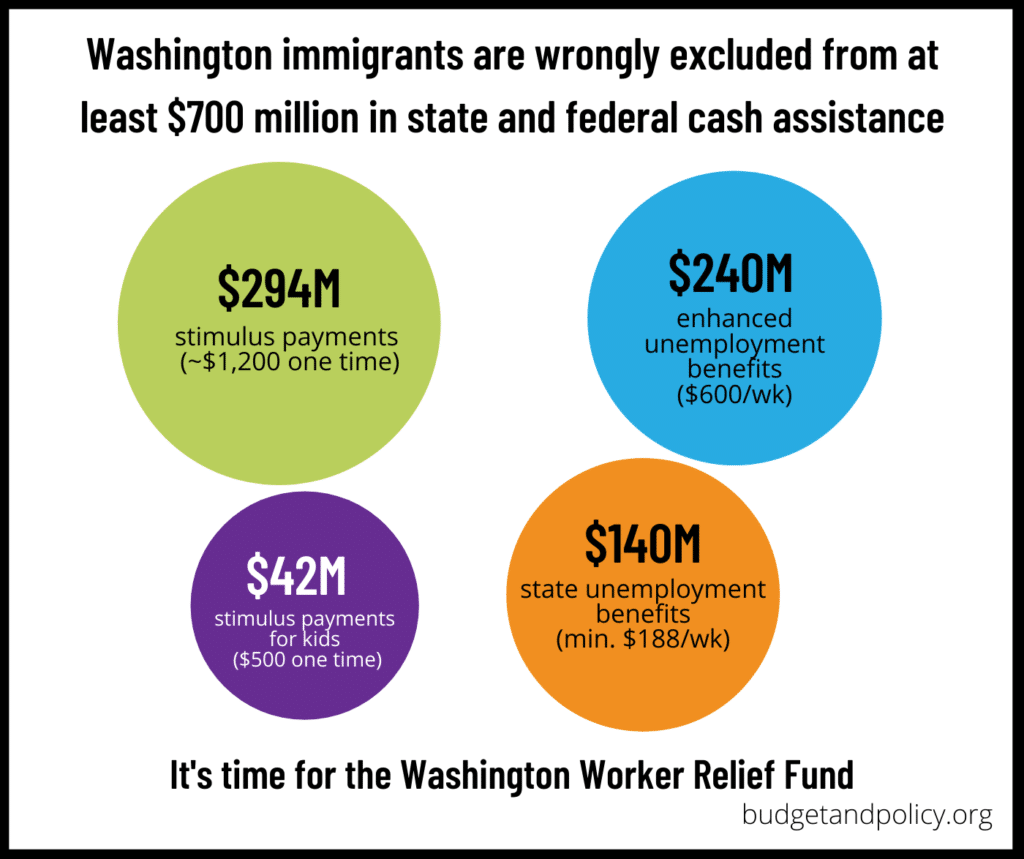

We estimate that this cumulative impact of these exclusions is more than $700 million in missing cash assistance (See figure below) – money that otherwise would be helping immigrant households pay for necessities and money that would be flowing through our economy.4

Creating the Washington Worker Relief Fund is an important first step to make sure that the economic contributions of immigrant households in Washington state are recognized and that immigrants are included in economic relief efforts responding to COVID-19.

Take action today to call on Gov. Inslee and legislators to create a WA Worker Relief Fund that supports undocumented Washingtonians.

This analysis was completed in collaboration with OneAmerica, Northwest Immigrant Rights Project, Fair Work Center, Entre Hermanos, the Washington Immigrant Solidarity Network, and many other organizations across Washington state working to support a Washington Worker Relief Fund. This relies on analysis from the Migration Policy Institute, the Fiscal Policy Institute, the Institute for Taxation and Economic Policy, and the Center for Migration Studies.