As lawmakers review newly-released tax revenue projections from the Washington State Economic and Revenue Forecast Council, we’re here to remind our elected officials that these estimates don’t reflect many people’s lived experiences. Even in the midst of an economic and public health crisis, the wealthiest are amassing more wealth at the expense of everyone else. And, due to our state’s upside-down tax code, much of the improved tax collections will come from those who struggle to make ends meet. To truly support essential workers, teachers, parents, and others who will drive the economy through our state’s recovery, lawmakers must move beyond a status-quo budget and inequitable tax system.

Enacting a new wealth tax on capital gains profits, funding tax credits for people struggling to make ends meet, and taking other actions to rebalance Washington’s inequitable tax code would ensure Washington’s recovery from the COVID-19 pandemic is broadly shared. Passing these policies will also ensure sustainable revenue after federal rescue funding runs out.

Here are 3 reasons why lawmakers can’t stall any longer on bold investments & equitable revenue:

1. State investments were not keeping up with community need long before the pandemic.

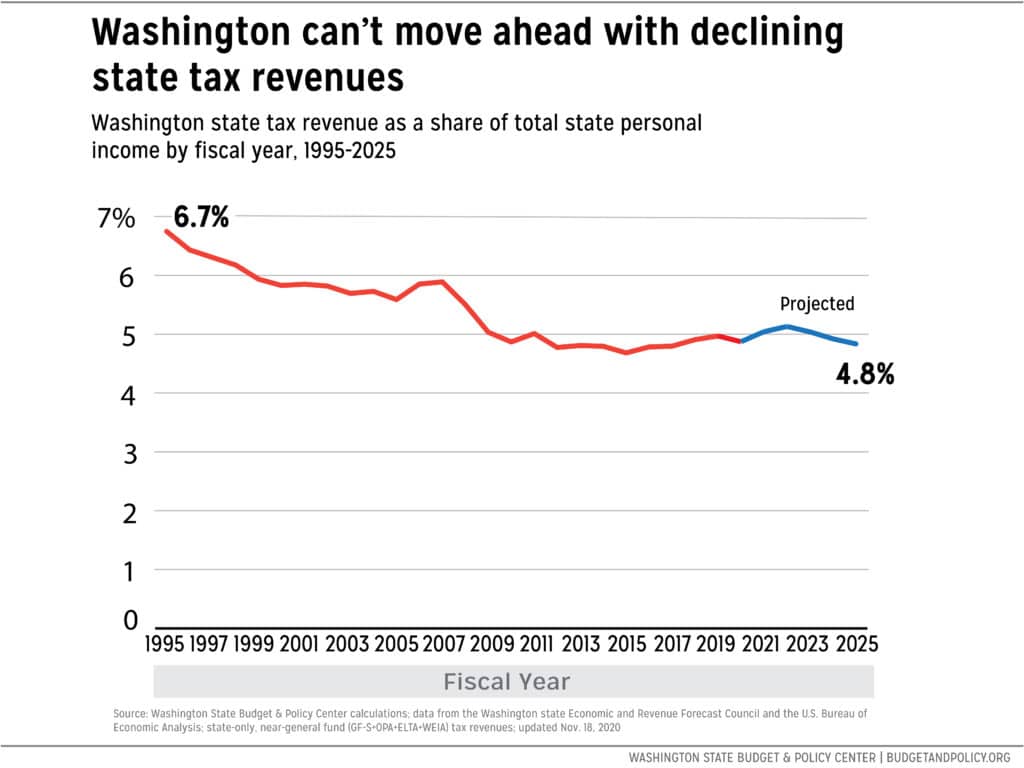

Projected revenues to fund a status-quo budget that wasn’t meeting the needs of – and in fact created inequities for – communities is nothing to celebrate. Revenue as a share of the economy is still below pre-Great Recession levels (see chart below). Long before the pandemic, communities had been calling for more funding for child care, schools, infrastructure, and other investments, since too many people faced food insecurity, were unhoused or unstably housed, and lacked access to other essentials that enable a healthy life.

Click on image to enlarge.

2. The revenue forecast does not reflect reality for Washington communities still struggling as a result of the pandemic.

Our state’s improved revenue projections are a stark contrast to the lived experiences of hundreds of thousands of people across the state most impacted by the pandemic. For example:

- More than one-quarter of households in Washington state are having trouble paying for basics.

- One in ten households and one in three small businesses are behind on rent.

- One third of Washingtonians are going hungry; 60% of those households include children, and four in 10 are families of color.

- Fifteen thousand Washingtonians with developmental disabilities are still on a waitlist to receive basic supports.

Lawmakers cannot ignore voices across the state calling on them to act boldly and unapologetically to support communities in this time of need.

3. The state cannot rely on one-time federal aid to bolster recovery in years to come.

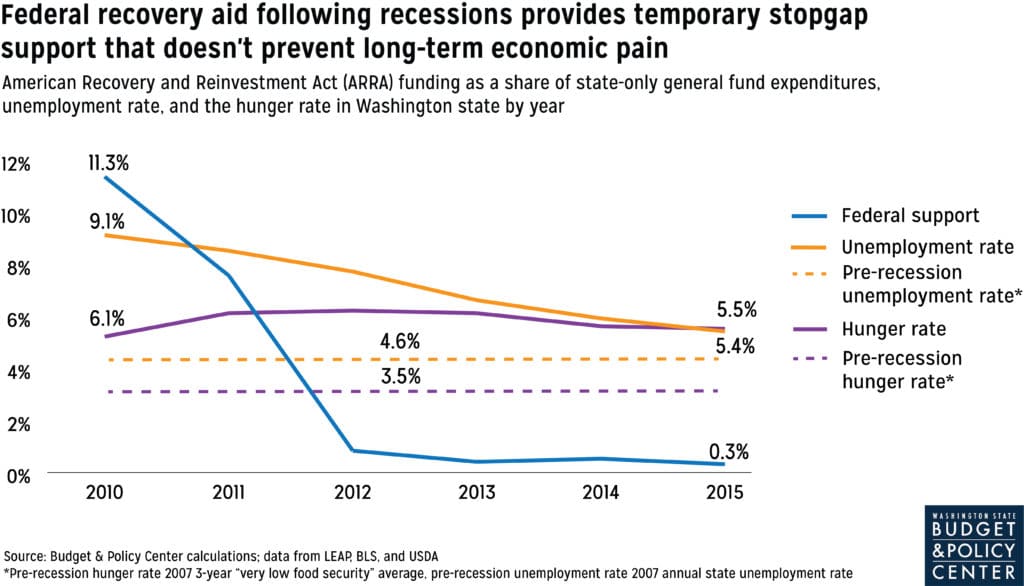

Equitable sources of new tax revenues will be needed to sustain Washington state’s economic recovery in the long run. The state will receive much-needed stimulus funding through the American Rescue Plan Act, but those funds will be exhausted by the end of 2024 even though ERFC projects the unemployment rate in Washington state will remain above pre-pandemic levels through at least 2025. Lawmakers have already learned the hard way that they can’t rely solely on the federal government to supply the funding needed to ensure a broadly shared, equitable recovery that can be sustained.

During the Great Recession, lawmakers made cuts to critical human services that contributed to increased economic hardship for almost a decade. What’s more, federal aid from the American Recovery and Reinvestment Act (ARRA) phased out too soon to support communities (see chart below). Lawmakers have an opportunity to do things differently this time around. By passing equitable revenue now, we can use federal funds as a bridge and avoid a pending crisis when federal funds dry up.

Click on image to enlarge.

We’re counting on lawmakers to make the right choice

We’ve seen community members rise up to take care of one another during this crisis. But it should be the role of our state government to support communities and start to undo our racist and inequitable tax code. Lawmakers must meet this moment with budget proposals that reflect the lived experiences of people across the state, not the numbers on a balance sheet. This session, they must enact a capital gains tax on the sale of high-end assets, pass a Recovery Rebate/updated Working Families Tax Credit, make investments to support immigrant communities, and take action on other important policies.