All members of our communities deserve to have a safe, warm home and to be able to care for their loved ones. Yet, COVID-19’s economic fallout has pushed more families into deeper economic hardship.

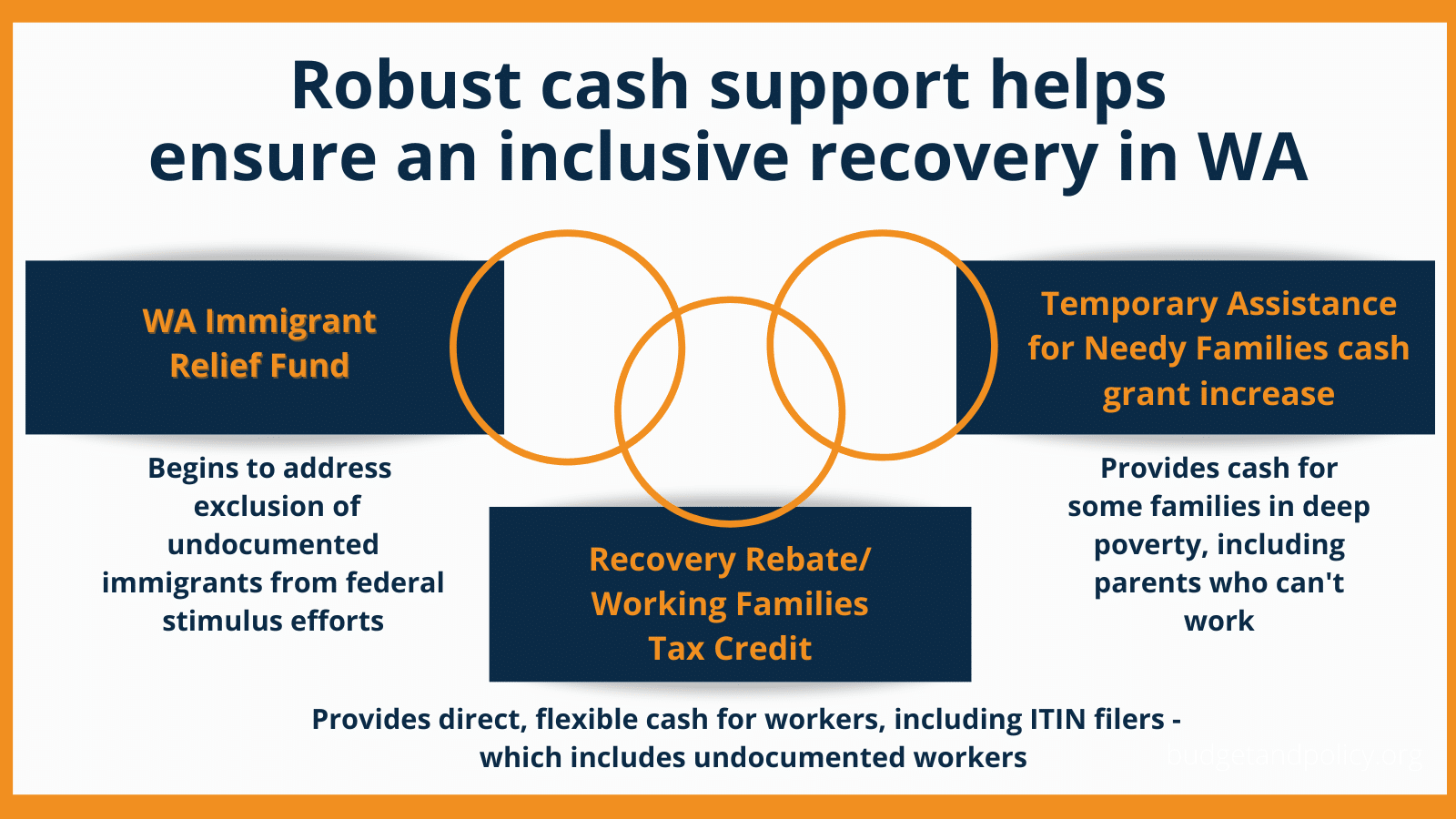

To ensure everyone in our state – regardless of employment or immigration status – can get through this pandemic and beyond, lawmakers must take a multi-pronged approach to providing complementary cash assistance policies, including:

- A Recovery Rebate/updated Working Families Tax Credit: This far-reaching policy would provide one in six households in Washington state with an annual base credit of $500 (plus more for kids), which phases down as incomes rise. Importantly, the policy includes people who file taxes with an Individual Tax Identification Number (ITIN), which includes undocumented immigrants, survivors of intimate partner violence, and others.

- Increased investment in the Washington Immigrant Relief Fund: Undocumented immigrants are members of our communities and workplaces and pay taxes yet are they excluded from federal recovery efforts, like stimulus checks and expanded unemployment insurance. Increased investment in this fund would begin to address this systemic exclusion by ensuring Washington state provides pandemic wage relief to undocumented workers who are, in many cases, shouldering the worst impacts of the crisis.

- A significant increase to the Temporary Assistance for Needy Families (TANF) cash grant: TANF serves families with kids facing extreme poverty and barriers to work (like domestic violence and disabilities) with monthly cash assistance. Washington state’s TANF grant has remained largely unchanged since 1996, meaning its purchasing power has plummeted and more families on the program are houseless or unstably housed. Lawmakers must significantly raise the cash grant to come into alignment with families’ real living costs.

Investing in these complementary policies is essential to ensure no one is left behind. Many of our traditional safety net systems of support, like unemployment insurance and TANF, focus narrowly on providing support to citizens or enact strict eligibility requirements. These systems, rooted in anti-Black racism and in sexism, fail to provide adequate levels of support to Black, Indigenous, and people of color, families headed by women, and immigrants. Policies that universally distribute benefits to all taxpayers regardless of immigration status, like the Working Families Tax Credit, or that seek to address systemic exclusion, like the Washington Immigrant Relief Fund, fill critical gaps.

These programs ultimately should be designed to work together to build a better system where no one is excluded from economic opportunity.

Washington state is strongest and healthiest when all members of our state can meet their essential needs, care for their loved ones, and weather unexpected emergencies. By investing in a multi-pronged system of cash support, state lawmakers can reject the notion that only some members of our communities deserve support and build a stronger economic recovery for all of us.