Final budget data from the Washington state Legislative Evaluation & Accountability Committee confirm that investments lawmakers made in the 2021 legislative session will help our state recover in meaningful ways. Communities across Washington state will receive a large infusion of new resources to bolster a range of public priorities under the two-year state spending plan signed into law by Governor Inslee. Combined with critical federal stimulus dollars, our state is starting to move in the right direction to secure a brighter economic future for Washington’s people and communities.

Thanks to more than a decade of advocacy from people across Washington, the legislature prioritized heightened funding for community needs – like early learning and child care – over greedy calls to keep taxes inequitably low for the wealthiest households who aren’t paying what they owe. This marked an encouraging shift in how lawmakers approach state investments. Important priorities such as an expanded Working Families Tax Credit and more robust cash assistance for families are included in the new budget. And a bold new investment in schools, early learning, and child care will be sustained by an equitable new tax on high-end capital gains wealth.

In the coming years, lawmakers must take further action to fix Washington’s worst-in-the-nation, racist tax code in order to build a state in which people of all races and ethnicities, zip codes, genders, and abilities benefit from the economic growth they create. Legislators must also continue to heed advocates’ calls for reparative new investments in communities long denied access to the kind of wealth-building opportunities enjoyed by households at the very top of the economic ladder.

Communities get a funding boost after years of disinvestment

Emergency federal funding for states played a pivotal role helping Washington state lawmakers sustain and expand vital community investments. Federal actions in 2020 and early 2021 – which include the Coronavirus Aid, Relief, and Economic Security (CARES) Act, Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act , and American Rescue Plan Act (ARPA) – enabled state lawmakers to quickly respond to the public health and economic crises caused by the COVID-19 pandemic. These federal stimulus dollars funded emergency measures to keep people housed, fed, and healthy. And while immigrant communities were unjustly excluded from many emergency supports provided by the federal government, Washington state lawmakers responded to community advocacy to use federal stimulus funds to provide at least some financial assistance to undocumented communities during the crisis.

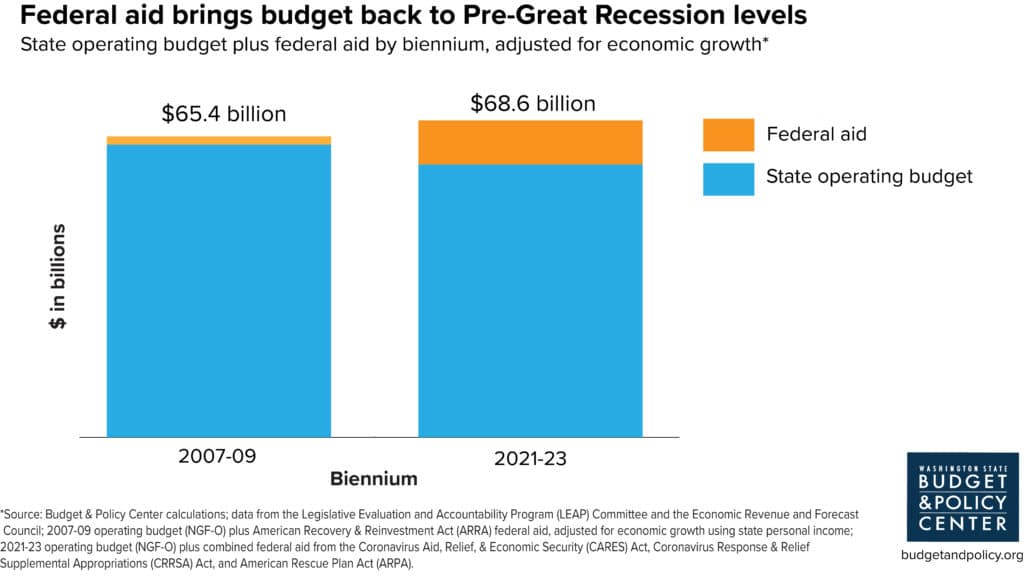

When combined with the funding created by Washington state taxes, fees, and other revenue sources – including the excise tax on capital gains wealth – the infusion of emergency resources from the federal government means investments in communities will finally reach pre-Great Recession-era (2007 – 2009) funding levels, after adjustment for growth in the state economy (see Chart 1 below). Long overdue, this level of investment is a wise way to promote the state’s overall economic recovery. It will also start to reduce longstanding inequities that were only made worse by the pandemic.

Chart 1. Click on image to enlarge.

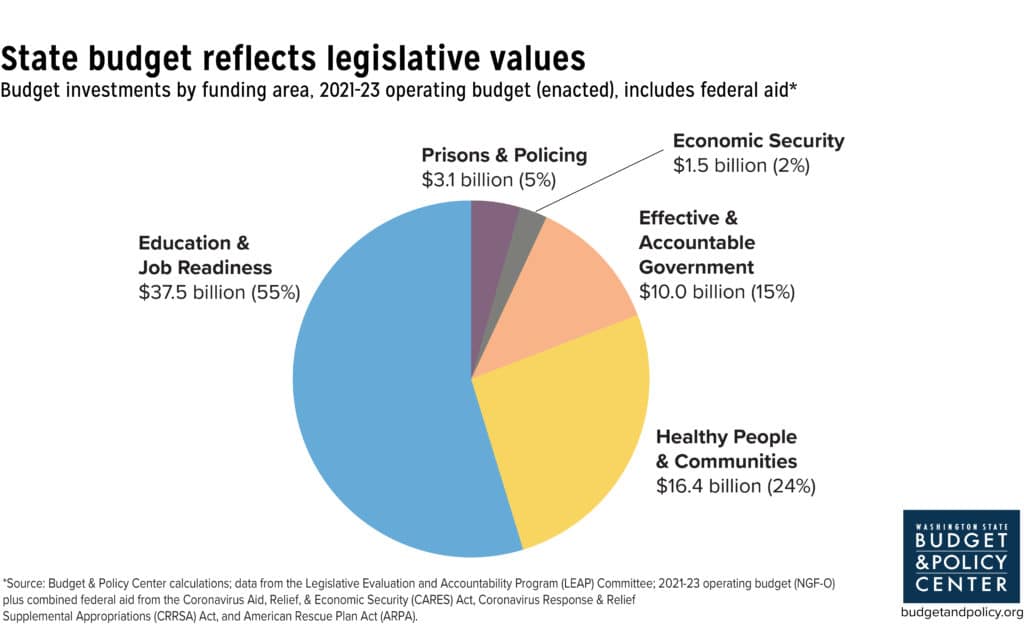

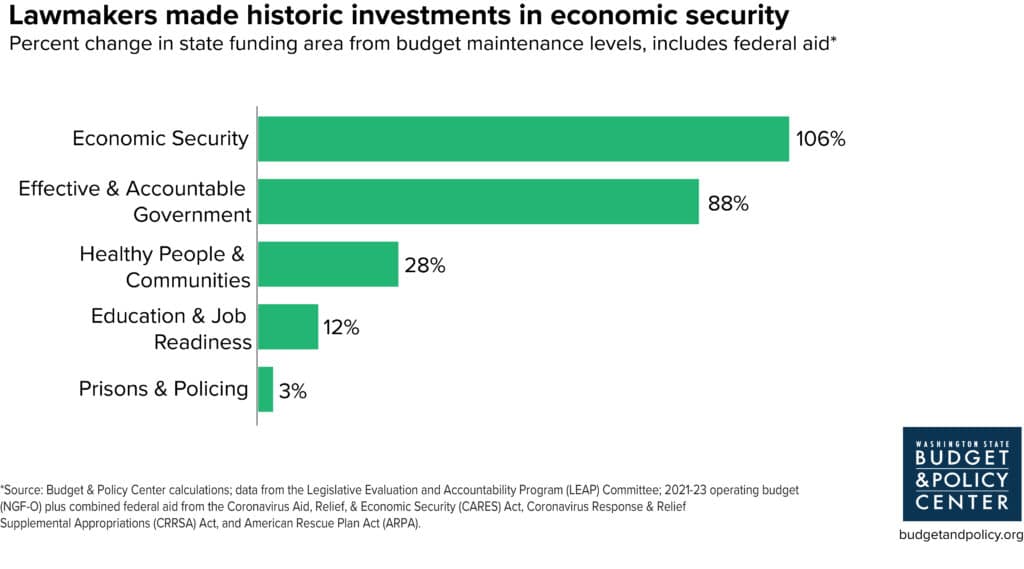

Although the new budget continues longstanding trends in how it allocates funding to specific areas of the budget – from Economic Security to Healthy People & Communities – all investment areas will receive a boost in funding relative to the amounts needed to sustain existing levels of community services. To help kids in preschool, K-12 schools, and colleges and universities recover and prosper in the years ahead, investments in Education & Job Readiness, the largest overall area of the state budget (Chart 2) will grow by 12% (Chart 3) in the new budget. Similarly, investments in Healthy People & Communities, which represents over one-quarter of the budget, will rise by 26%, to ensure communities, public health agencies, and health care providers have adequate tools to fight the ongoing COVID-19 pandemic. Funding that supports Economic Security investments for things like direct financial assistance will increase by 106%, the largest percentage increase of any value area. That bold investment will help people across the state weather the fallout from the deepest recession of the post-World War II era. However, it is worth emphasizing that despite this growth, Economic Security still remains the smallest area of the budget (2%), behind spending on Prisons & Policing (5%) – an area of our budget that we know perpetuates mass incarceration and militarization of police, disproportionately harming Black, Indigenous, and People of Color (BIPOC) communities.

Chart 2. Click on image to enlarge.

The state budget reflects our collective values, but state investments are not uniformly good and can cause significant harm to communities, especially BIPOC communities. For example, continuing longstanding trends, only 2% of our state-funded operating budget will be devoted to promoting economic security for people with low incomes, while 5% of state funds ($1.6 billion more) will fund prisons & policing. To advance racial equity, state lawmakers must interrogate how they choose to spend funds by listening to community leaders for a path forward.

Chart 3. Click on image to enlarge.

All in all, the legislature’s shift in policymaking combined with unprecedented action on the part of federal lawmakers will still mean tangible, long-overdue improvements in the lives of people across the state by ensuring:

- People living on low incomes are better able to meet their basic needs: The legislature took notable action to expand WorkFirst – Washington state’s Temporary Assistance for Needy Families (TANF) program that provides a critical lifeline to people facing a financial emergency – by increasing participants’ monthly benefit amount by 15%. Lawmakers also made changes to the program that will result in fewer families losing their support during times of economic hardship because of unjust time limits in the current law. While in need of deeper, structural changes to address inequities embedded in TANF policy, these long-overdue changes will help some families better afford basics. Combined with increased funding for food assistance, affordable housing, and other investments, these policies will help more people access essentials that support their well-being.

- Children and families in Washington have a stronger foundation: The pandemic made clear just how vital quality child care and early learning are for the well-being of families across the state. Federal recovery funds allowed policymakers to pass and begin implementing the Fair Start for Kids Act, which expands access to high-quality early learning and child care while reducing the costs of these foundational services for young children and parents. Early learning teachers and child care providers – disproportionately positions held by women and women of color – will also have better access to affordable health insurance, ensuring day care centers are healthy and safe. These investments represent a meaningful move toward recognizing the true value of caretaking work for our communities, economy, and quality of life. Much of the new funding will be sustained by revenues from the capital gains wealth tax, which will be implemented as federal recovery act funds begin to phase down.

- Immigrant communities, including people who are undocumented, have access to support: Recognizing the lack of supports for undocumented communities, the legislature acted add an additional $340 million to the Washington Immigrant Relief Fund using federal aid in this budget cycle. This necessary investment will allow thousands more households to receive up to $1,000 in one-time emergency assistance. And once it goes into effect in 2023, the Working Families Tax Credit will also extend a critical tax benefit to more than 30,000 immigrant taxpayers and their families who file taxes using an Individual Tax Identification Number (ITIN) instead of a Social Security Number and who are excluded from many federal tax credits as a result.

Federal Recovery Funds are a crucial bridge to a more equitable future

Since early 2020, more than $10.9 billion in federal aid has been allocated to Washington state to help communities stay afloat through the worst of the pandemic and recession. The largest share ($3.96 billion) of these funds has been dedicated to economic support. Health care and COVID-19 response ($1.94 billion) and schools ($1.76 billion) have also been sustained as a result of federal lawmakers’ bold actions during the crisis. While these funds helped support community investments in Washington state during both the previous and current state budget cycles, lawmakers allocated the vast majority ($9.5 billion) for the current, 2021 – 2023 state budget. Over the next two years, these funds will continue to support the public health response to COVID-19, schools, early learning, transportation, and aid to small businesses.

An estimated $1 billion of state-level funding from the American Rescue Plan Act is still on the table to continue recovery efforts in the coming 2023-25 budget cycle. Ensuring these funds will be a bridge in the next biennium was a fiscally wise decision on the part of lawmakers, as we know it will take many years for communities and local economies – especially those harmed most by the pandemic – to recover. At the same time, lawmakers must remain nimble to use the remaining federal funds to respond to emerging community needs before the next budget cycle as the pandemic enters a new phase.

In either case, the state will need equitable revenue to sustain investments beyond the next biennium. Passing a capital gains wealth tax was a good start. Now, lawmakers must explore other equitable revenue options like a wealth tax, payroll tax on high-end earners, and an updated estate and inheritance tax to ensure communities can thrive long term.

We must continue to dismantle harmful systems

To be clear, although the final budget signals a hopeful shift toward more equitable policymaking, state dollars continue to fund systems and programs that harm communities. As noted previously, the state spends $1.6 billion more on Prisons & Policing than on investments in Economic Security – perpetuating a long history of spending significantly more on the carceral system than on promoting financial stability for families across the state. To halt and reverse this damaging trend, lawmakers must work with community members to identify and divest from harmful systems while prioritizing investments that truly support the well-being and dignity of all in our state.

Yet by not fully funding Communities of Concern Commission,1 an initiative that aims to grow financial capital assets in communities of color across our state, lawmakers missed an opportunity to invest in the self-determination of communities of color and rural communities. Moving forward, they must prioritize funding for these kinds of efforts to support historically under-resourced communities.

As lawmakers interrogate the types of investments in our budget, they must also continue to reform how we raise revenue for our shared priorities. Our tax code will still be the most upside-down in the nation, even after the Working Families Tax Credit and capital gains wealth tax are implemented.2 And as a result of historical and ongoing racist policies designed to exclude BIPOC from wealth and opportunity, BIPOC communities will continue to shoulder the impact of our regressive tax code most heavily while the wealthiest, largely white households continue to enjoy a special deal at the expense of everyone else.

Worse yet, saddled with mostly regressive, inadequate tools for raising revenues like the sales tax, the state and local governments in Washington have increasingly turned to even more regressive criminal legal fines and fees to fund courts and other broadly shared public investments. Disproportionately levied against BIPOC and people living on low incomes, these kinds of monetary sanctions serve to further tilt the playing field against communities already facing economic injustice. When people facing economic insecurity are unable to pay fines and fees, they are unjustly penalized with additional punitive measures, like having their driver’s license suspended or being forced to serve jail time – punishments that initiate or exacerbate a downward spiral into debt, poverty, incarceration, and deteriorating health.

By contrast, a more equitable tax code – one that doesn’t rely on extracting wealth from those with the least – would allow Washingtonians to adequately fund investments that help people build wealth, opportunity, and healthy communities.

Lawmakers must follow through with a blueprint to a brighter future

Investments made in the 2021 legislative session show what is possible when we advocate for a more just state. Federal funds will serve as an important bridge over the next few years, but lawmakers must continue to act boldly to steward an equitable, reparative future. Expansions to the Working Families Tax Credit and anti-displacement property tax exemption paired with a renter’s credit can help balance our tax code and help more people live with dignity. Repealing damaging limits on local authorities to raise much-needed revenue can help reduce the reliance on fines and fees. And policies like a wealth tax, taxes on payroll from highly paid CEOs and other corporate executives, and an updated estate and inheritance tax will ensure that the wealthiest finally pay their share.