Across the U.S. and here in Washington state, millions of households have begun to receive monthly Child Tax Credit payments – providing a regular infusion of cash to support families in raising their children.

These new monthly payments of the Child Tax Credit mean that for the remainder of 2021, qualifying families – which account for nearly 90% of kids in the U.S. – will be able to rely on these stabilizing checks. This reliable financial support will be especially vital as we continue to navigate the COVID pandemic and its economic impact. This is especially true for Black, Indigenous, and People of Color households; immigrant families; households headed by women, transgender and nonbinary people, and other gender diverse people; people with disabilities; and those earning low incomes for whom the pandemic has had a disproportionately damaging impact.

The expanded, fully refundable Child Tax Credit is an abrupt departure of decades of U.S. cash assistance policy. Historical and present day policies have been built upon racist and sexist mistrust of Black mothers. These policies have prioritized the surveillance and control of Black mothers’ bodies, labor, time, and relationships at the expense of the economic and social well-being of themselves and their kids. And they have resulted in shockingly low levels of contemporary cash support here in Washington state and across the country. In stark contrast, the expanded Child Tax Credit payments are provided regularly and unconditionally, and recipients can use the support as they see fit.

The expanded Child Tax Credit payments are provided regularly and unconditionally, and recipients can use the support as they see fit.

These are realities policymakers and advocates, including the Washington State Budget & Policy Center, have been slow to name and have thereby upheld for too long. The expanded Child Tax Credit offers a framework for beginning to turn the page on decades of cash assistance policies rooted in white supremacy and anti-Blackness toward one of economic inclusion, trust, and dignity.

The Child Tax Credit’s dramatic – but temporary – changes will support greater economic inclusion

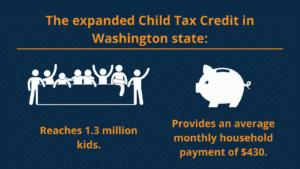

Across the U.S. the expanded Child Tax Credit will reach nearly 9 in ten children. Here in Washington state, 1.3 million kids are estimated to benefit from the policy’s expansion, meaning monthly payments of up to $250 to $300 per child for qualifying households (about $430 on average per household1).

The far-reaching credit is provided to households with a single earner that makes up to $75,000, married earners that make up to $150,000, and heads of household that make up to $112,500.2 Unlike the previous credit which provide a $2,000 annual maximum, the expanded version provides an annual maximum credit of $3,000 for kids ages 6 to 17 and $3,600 for those 5 and under.3 In the current structure, households are receiving half this amount as monthly payments between July and December 2021, and they will receive the other half as a lump sum when they complete their 2021 taxes.

Most critically, the credit is fully refundable, meaning households with the lowest incomes – including households earning no income – can still qualify for the full amount. This is true even if households make too little money to pay taxes. This is an especially important feature for ensuring those most in need of economic support receive a full payment. It also offers a powerful counter to longstanding cash assistance policy in which support is directly tied to the ability to work. By ignoring the reality of structural barriers to education and employment, employment discrimination, the value of unpaid caregiving, and reasons people may be unable to work, that previous approach was rooted in racist, sexist, and ableist assumptions.

What is refundability and why does it matter?

When tax credits are fully refundable, it means households earning low or no incomes can receive them in full without owing federal income taxes. This critical – but temporary – element of the expanded Child Tax Credit is key to promoting economic dignity by making the Child Tax Credit accessible to those with low incomes. Previously, the Child Tax Credit was only partially refundable, meaning families with the lowest incomes couldn’t qualify for the full credit. The good news is that Congress has an opportunity to make the Child Tax Credit fully refundable permanently as part of the Build Back Better plan. Doing so would dramatically reduce child poverty – more than anything else in the plan – even as a relatively small part of the overall budget blueprint.

Let your members of Congress know that a fully refundable version of the expanded Child Tax Credit that includes children with ITINs must be made permanent.

The Child Tax Credit must be expanded to support all federal tax filers, including immigrant families

While this expanded version of the Child Tax Credit has a far-reaching impact, unfortunately, not all federal tax filers can receive it. People who file their taxes with an Individual Tax Identification Number (ITIN), which includes immigrants who are undocumented, are able to claim the credit only if their dependents have Social Security Numbers. Prior to 2017, children with ITINs could qualify as dependents for the credit. However, this provision was revoked by the 2017 Tax Cuts and Jobs Act signed into law by President Trump, stripping an estimated 1 million children and their families from critical access to cash.

It is paramount that lawmakers in Congress provide full inclusion of ITIN filers in future legislation to make the expanded Child Tax Credit permanent.

The U.S. Congress failed to restore this essential provision to the Child Tax Credit when it passed the 2020 American Rescue Plan – despite momentum in several states to include ITIN filers in programs they’ve been excluded from. It is paramount that lawmakers in Congress provide full inclusion of ITIN filers in future legislation to make the expanded Child Tax Credit permanent.

State and local outreach will be required to ensure benefits reach kids with the most need

Most tax filers will receive monthly Child Tax Credit payments in the same way they receive their annual tax rebates – as direct bank deposits or checks in the mail. However, non-tax filers – including those who owe no money in taxes – need to take action by signing up for their payments through the IRS. In order to ensure those with the greatest need receive the payments, resources must be directed toward outreach to families without a permanent address – including those experiencing homelessness or housing instability – and those who do not have bank accounts, do not have internet access, or speak a language other than English.

You may be eligible for the Child Tax Credit even if you did not file a federal tax return. Update your information through the IRS Child Tax Credit non-filer sign-up tool. You can learn more at ChildTaxCredit.Gov or through our Child Tax Credit fact sheet (available in Spanish, Russian, and simplified Chinese).

A more inclusive, fully refundable Child Tax Credit must be made permanent

Long before the pandemic, many households headed by BIPOC, immigrants, and women, transgender and nonbinary people, and other gender diverse people faced barriers to meeting their essential needs in an economic system that was set up to – and continues to – channel wealth, land, resources, and opportunity largely to households headed by white, cisgender men. As families across the U.S. and Washington state feel the impacts of the Child Tax Credit’s monthly payments, federal lawmakers must act to make this baseline economic support permanent – and to take additional actions to enact policies that promote economic inclusion and reduce inequality.

A permanent, more inclusive version of the expanded Child Tax Credit can lay a foundation for further investments in ensuring a more equitable economic system in which all people can live with dignity.

Let your members of Congress know that a fully refundable version of the expanded Child Tax Credit that includes children with ITINs must be made permanent.