The Economic Revenue Forecast Council (ERFC) has released its first revenue forecast for the new year. The forecast provides anticipated revenue levels, which will inform lawmakers in Olympia as they craft their 2024 supplemental budget proposals, to be released next week. The supplemental budget is an opportunity for decision makers to ensure the state budget remains responsive to the economy and community needs by tweaking the previously enacted biennial budget.

According to the February forecast from ERFC, over the next three years, state policymakers will have $337 million more in revenue from existing sources than previously estimated – $121.8 million more (0.2%) in revenue in the 2023-2025 biennium and $215.4 million for the 2025-2027 biennium.

This is a modest increase from previous forecasts. The projected growth in state revenue is encouraging, but people continue to struggle to make ends meet. This is the time for lawmakers to do more to fund the programs and services vital to communities across Washington.

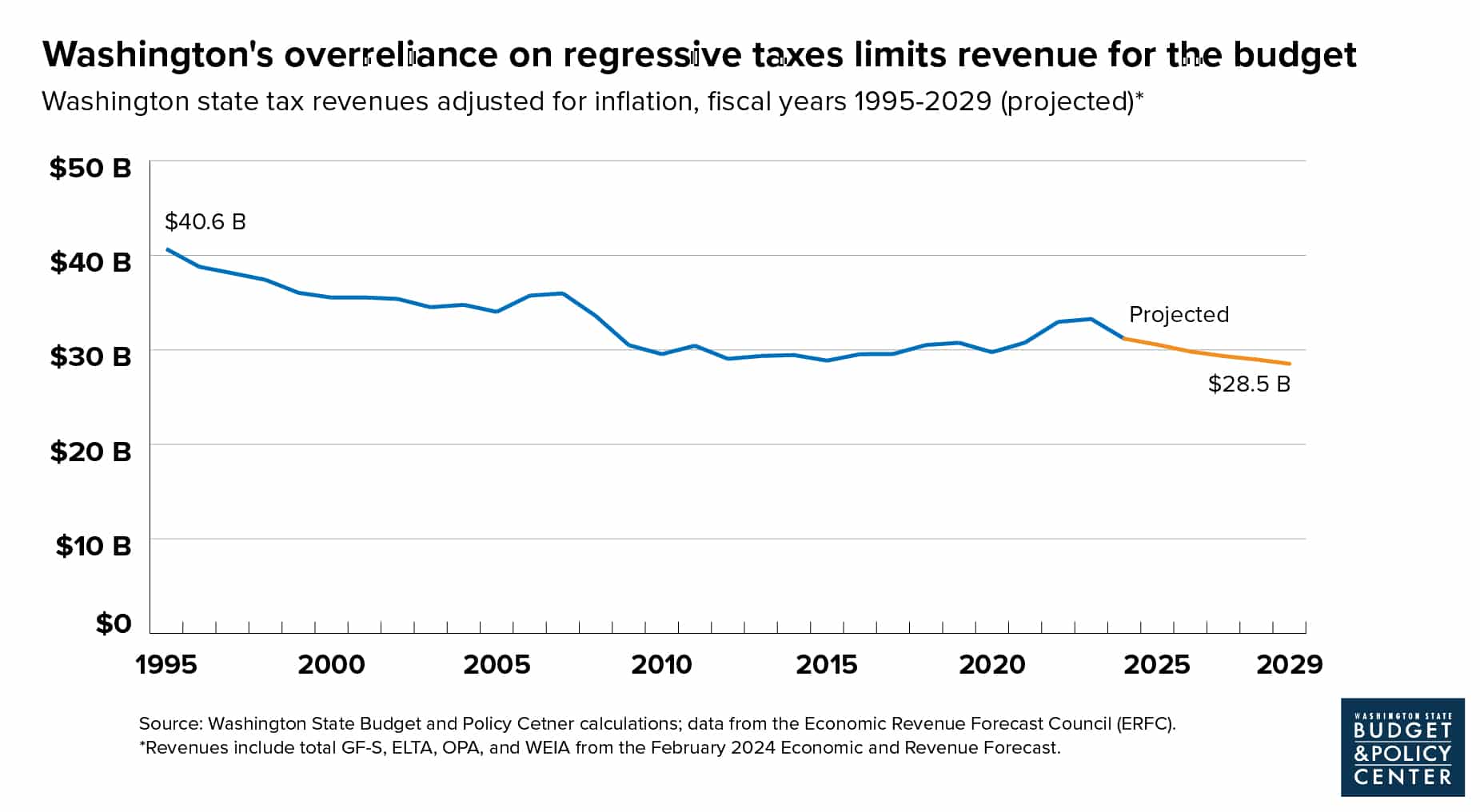

Click on graphic to enlarge.

Indicators predict slow economic growth

During this legislative session, lawmakers must craft a budget that works for everyone in Washington. Legislators can anticipate roughly $67 billion in total revenue for the 2023-2025 biennium and $71.7 billion for the 2025-2027 biennium. The modest increase in the forecast is due to increasing total employment levels and slowed growth of the state’s personal income in the short term.

Common indicators ERFC uses to predict economic strength are unemployment rates and changes in total personal income. However, these statistics merely capture a snapshot of Washington’s economy and fail to paint a complete picture. Washington’s unemployment rate remains low, at 4.2%, after reaching a historic low in September 2023. Total state personal income is projected to grow by an average of 5.4% in 2024-2025, 5.8% in 2026-2027, and 5.1% in 2028-2029, reaching an estimated $848.6 billion in 2029. Even though total state personal income is growing slowly, contributing to a modest bump in the revenue forecast, 1 in 3 people in Washington struggle to make ends meet.

Progressive revenue measures bolster revenue forecast

Washington’s new capital gains excise tax had a strong showing in its first year, helping to bolster state revenues. The revenue collected from the tax totaled $889.3 million last year, more than double its anticipated revenue. Findings from the February forecast suggest that progressive revenue sources, like the estate tax and capital gains tax, will provide $2.17 billion in revenue across the 2023-2025 biennium and $2.38 billion in the 2025-2027 biennium. These funds flow to the Education Legacy Trust Account to support funding schools, child care, and early learning initiatives.

The real estate excise tax (REET) revenue collections slowed during 2023 due to decreased property values and property sale transactions. According to the February forecast, January REET collections were stronger. While overall REET revenue remains significantly lower than in 2022, ERFC forecasts slightly higher revenues from REET in coming years due to declining interest rates and increasing construction.

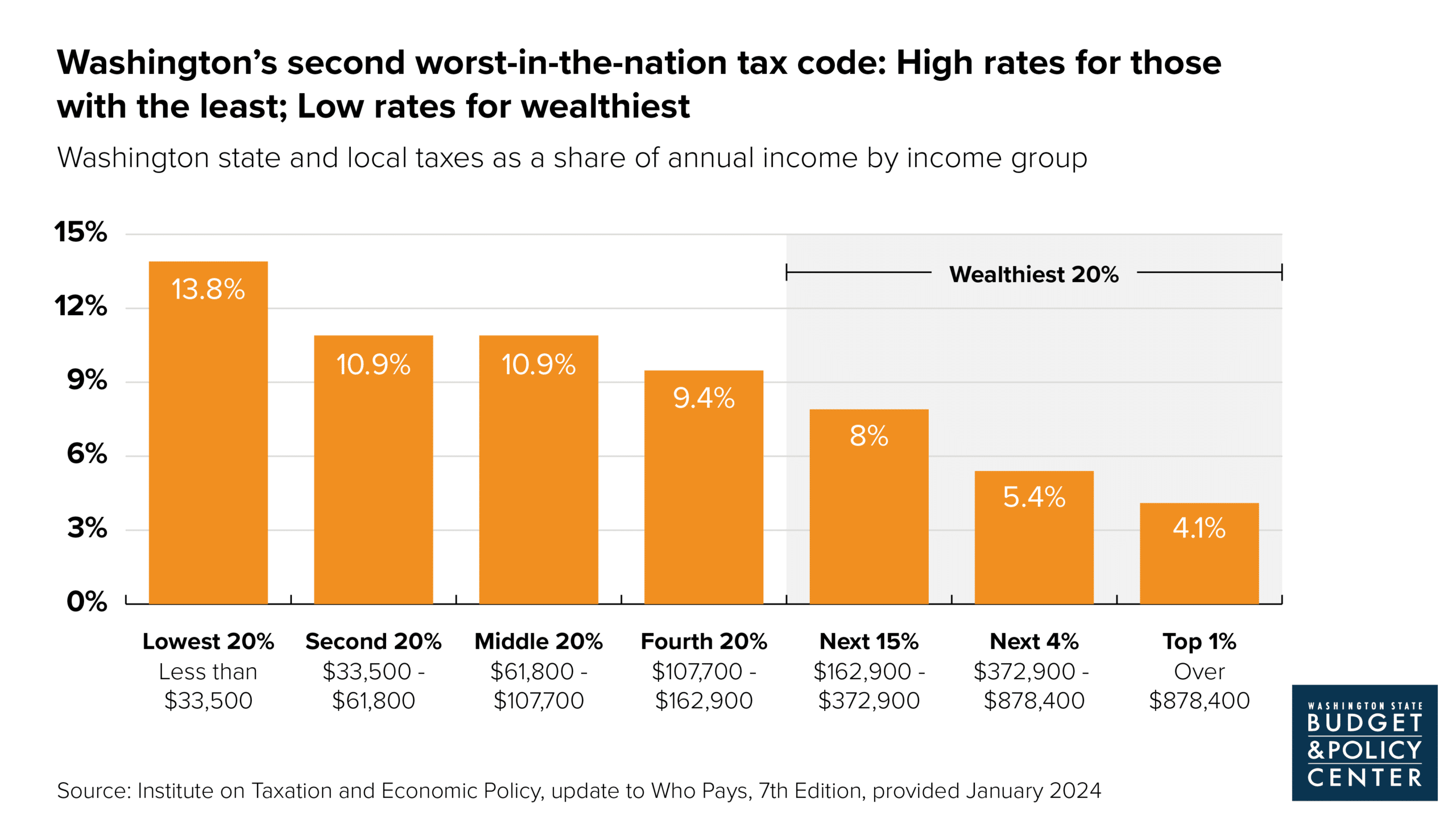

Progressive revenue measures provide much-needed funding for vital state services, and according to the Institute on Taxation and Economic Policy (ITEP), they help to make our tax code more equitable. In January, ITEP released an update to its “Who Pays” report analyzing the regressivity of tax codes around the nation. Since the report’s first release in 1996, Washington has ranked as having the most regressive tax code in the country, where people with low incomes pay a greater proportion of their income toward taxes than people with high incomes. According to ITEP’s recent report, Washington’s tax code is now the second most regressive in the nation. The shift in ranking is due to the success of progressive revenue measures, like the capital gains tax, and the implementation of tax credit programs supporting low-income families, like the Working Families Tax Credit.

Click on graphic to enlarge.

Lawmakers should build upon past successes when crafting the budget

While the latest revenue forecast predicts a modest increase in revenue through 2027, lawmakers should enact new progressive revenue measures to generate funding streams for proven and successful programs like an expanded Working Families Tax Credit, a guaranteed basic income pilot, and a state unemployment insurance system to include undocumented workers. Lawmakers have the power to ensure that everyone in our state has access to healthy foods, safe housing, reliable transportation, and a quality education.

This session, lawmakers can build upon the success of other progressive revenue measures – like the capital gains tax – by passing the Affordable Homes Act. House Bill 2276 and Senate Bill 6191 will make our real estate excise tax (REET) more progressive. These bills amend the graduated rate structure of the REET so the ceiling of the first tax tier is $750,000. The bills also propose a transfer tax of 1% on properties sold above $3.025 million. The revenue generated from the new transfer tax would be dedicated to several affordable housing accounts.

Advocates are rallying behind a second progressive revenue measure to generate much-needed revenue for our state. Washington is home to hundreds of households with extreme wealth. HB 1473 and SB 5486 introduce a property tax of 1% on financial assets, like stocks and bonds. The tax does not apply to households with fewer than $250 million in financial assets. If enacted, the current wealth tax proposal would generate an additional $3 billion in revenue annually.

Pursuing new progressive revenue sources will allow state lawmakers to invest in people and families to strengthen the infrastructure and public supports we all rely on.