To create a pathway for income equality, lawmakers must not repeat the mistakes of the past

In a state with so many hugely profitable corporations, millionaires, and billionaires, it stands to reason that the workers, communities, and public agencies that helped create the foundation for such wealth would also be thriving. But that is not how things have played out in our state. Instead, lawmakers in Washington are facing a $12-$16 billion budget shortfall, largely because of our state’s broken tax code, where the ultra-wealthy and corporations aren’t paying their share in taxes. This has led Governor Bob Ferguson to propose $7 billion in cuts, which include program delays, reductions in services, and state employee furloughs to address the budget shortfall.

During the last comparable revenue shortfall – caused by the Great Recession in the late 2000s – lawmakers chose to cut over $10 billion from the budget instead of reforming our tax code to generate progressive revenue from corporations and the wealthiest. By relying on cuts as the primary tool to overcome the budget shortfall, lawmakers caused harmful economic and health impacts to Washington communities and delayed recovery.

Now, Washington is at risk again. Massive budget cuts to programs that support all our communities, like schools, food banks, and public health will be devastating to the well-being of people throughout the state.

What’s more, these kinds of cuts exacerbate income inequality, which is already rapidly increasing in Washington. If lawmakers truly want to build a state in which everyone has the chance to thrive, across-the-board cuts are not a solution. Rather, they are a pathway to a future in which the rich get wildly richer, the middle class gets squeezed, and people who are already struggling fall further behind. Given the ongoing legacy of policies that exclude BIPOC, women, and people with disabilities from wealth and opportunity, we know this will also exacerbate inequities.

There is a better option: Lawmakers should fix the tax code to ensure the wealthiest among us and highly profitable corporations pay what they owe.

Budget cuts will put hardship on everyday families while the rich keep amassing wealth

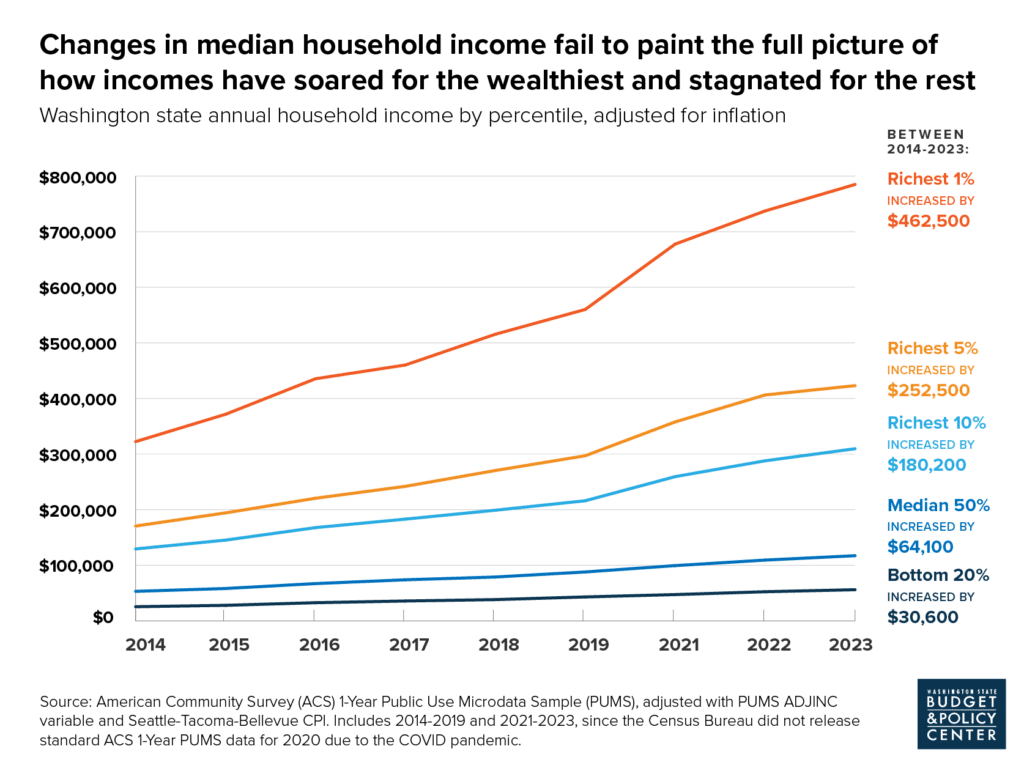

Corporate profits are booming. For example, Microsoft’s net income rose by 22% between fiscal years 2023 and 2024. Washington state has more concentrated wealth than ever, at the same time that lower- and moderate-income families are grappling with an affordability crisis as their wages fail to keep pace with the costs of necessities. For households earning the state median income and lower (roughly $111,000 for a family of three), annual earnings have mostly stagnated over the past decade. Meanwhile, the richest 10% of people have seen extraordinary increases in their wealth (see graph below).

Click on graphic to enlarge.

When considering this widening gap between the ultra-wealthy and people with low incomes, it is disappointing that the governor is pushing back on commonsense policy proposals put forth by House and Senate Democrats, like the proposals to tax extreme Wall Street wealth and remove arbitrary caps on payroll taxes for employers of high earners. These proposals would help address this massive inequity while helping fund essential programs and services. As everyday people struggle with the cost of living and we’re facing serious threats in cuts to federal funding, the governor and lawmakers in Olympia should be doing everything they can to prioritize making investments so they can prevent harmful, across-the-board cuts (regardless of the pressure being put on them by corporate special interests).

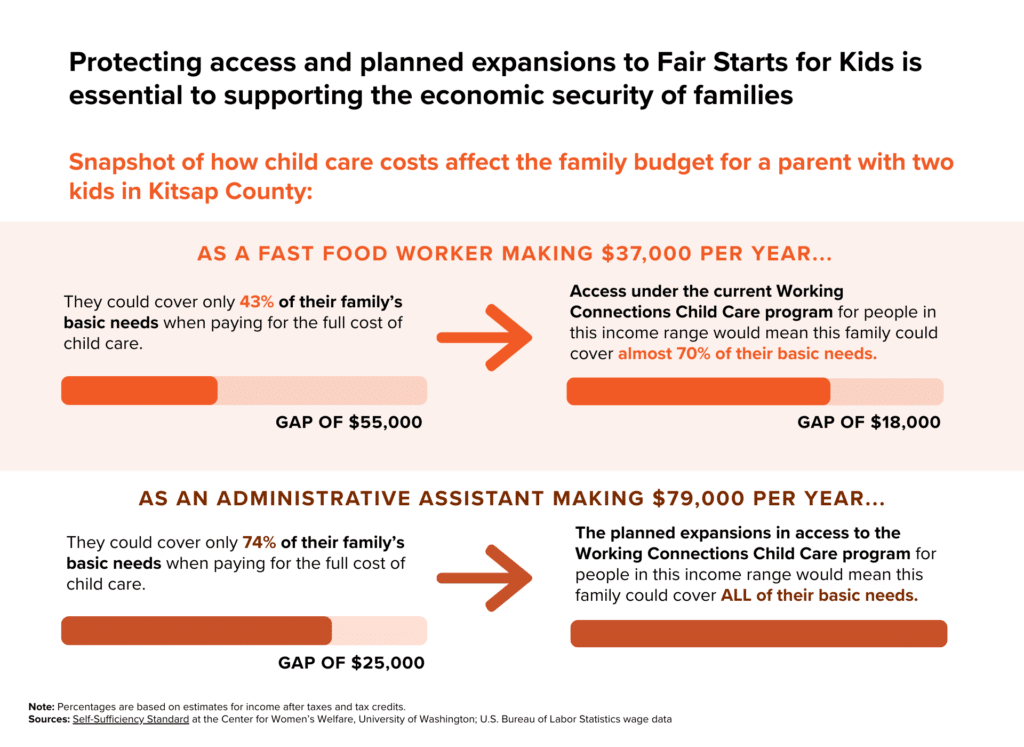

Yet, the largest budget cuts that the governor and lawmakers have proposed are to state child care and early learning programs, ranging from around $700 million to $1 billion in total cuts over the next four years. This is a huge blow to families and kids in our state – and to the many people and organizations that worked for years to pass the Fair Start for Kids Act to create a brighter future for all of us.

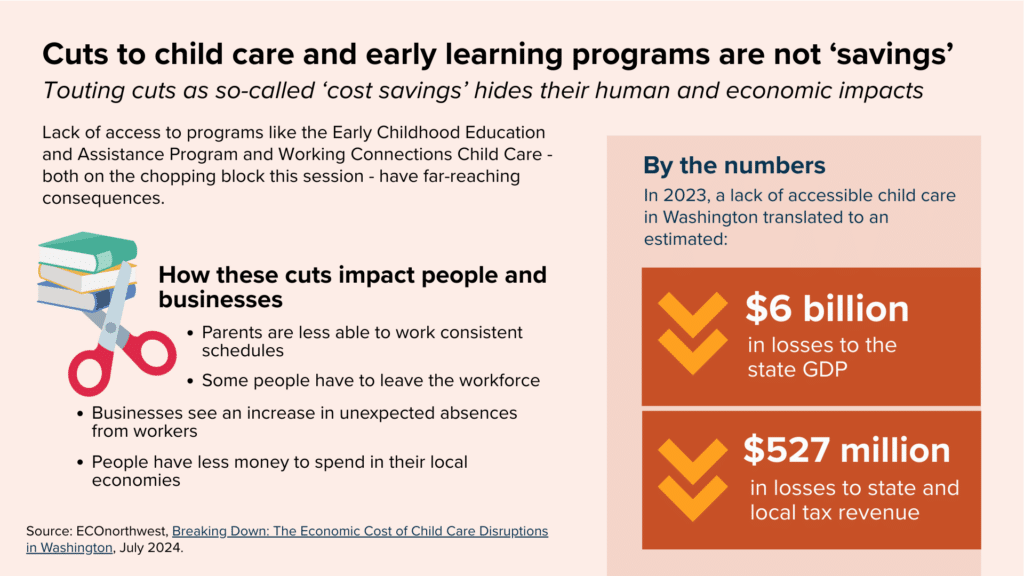

Passed alongside the capital gains tax in 2021, Fair Start increased funding commitments for subsidized child care through Working Connections Child Care (WCCC) and for public preschools through the Early Childhood Education and Assistance Program (ECEAP).1 Some of the proposed cuts on the table would postpone approved expansions in eligibility and guaranteed access to WCCC and ECEAP by another four years. Not only do these kinds of cuts cause serious hardship for families already struggling to make ends meet, but they also harm businesses and the economy. In fact, these cuts likely cost the state more than they “save”: The lack of accessible child care in Washington caused an estimated loss of $527 million in state and local tax revenue in 2023 (see graphics below).

Click on graphic to enlarge.

Click on graphic to enlarge.

We need a solution that actually works

Washington state has an abundance of wealth and resources. Budget cuts hit working-class households the hardest, only making Washington’s income inequality and cost-of-living challenges much worse.

In the final weeks of this legislative session, lawmakers have a choice between two very different paths for Washington. The short-sighted approach of budget cuts will lead to a worsening affordability crisis for lower- and middle-income families, weakened statewide infrastructure, and an uneven economy that harms people and businesses alike. This strategy will widen the income and wealth inequality gaps by sticking with a tax code that overly relies on those with low incomes and does little to avoid repeated future budget deficits.

The other path strengthens investments in our communities through progressive revenue by ensuring the wealthiest people and corporations pay their share. Washington voters have already demonstrated their support for revenue and strong public investments – most recently in the 2024 elections when they upheld the capital gains tax on the ultra-wealthy, the tax to pay for long-term care, and the fee on large polluters. Now, lawmakers must listen to the voters and make choices that build a resilient, inclusive economy – one that supports families, strengthens communities, and ensures every Washingtonian can succeed.

A note about cuts:

While massive, across-the-board budget cuts will be bad for our communities, there are nevertheless places where targeted savings in the state budget do make sense. For example, lawmakers could stop courts from spending exorbitant amounts of money trying to collect fines and fees from people who are unable to pay. And they could work with community members to identify and divest from policing and carceral systems that we know perpetuate harmful and expensive mass incarceration, disproportionately hurting BIPOC communities.

As they work in these final days of legislative session to write the budget, the governor and legislators must resist the pressure from powerful special interests who are lobbying them to put the demands of the ultra-wealthy and corporate executives over the needs of everyday Washingtonians. They must:

1. Ensure those who profit most contribute their share:

Our economy has grown tremendously, but our tax code hasn’t kept pace. Those who have profited the most from Washington’s prosperity should pay their share to keep our communities strong.

Policy Solutions:

- Remove arbitrary caps on payroll taxes for employers of high earners.

- Create a more progressive rate structure for the capital gains tax and estate tax.

2. Modernize the tax code:

Our outdated system relies heavily on revenue sources that don’t reflect today’s economy. We need a tax structure that grows and adapts to our state’s wealth and population.

Policy Solutions:

- Enact a tax on intangible assets for the wealthiest people in our state.

- Reform property taxes to increase sustainable funding for schools while taking into account ability to pay.

3. Reduce the overreliance on working families

Right now, those with the least pay the highest share of their income in state and local taxes. A more balanced approach ensures lower- and middle-income families aren’t carrying so much of the load.

Policy Solutions:

- Expand the Working Families Tax Credit to include young adults aged 18+ as well as seniors.

- Reject any proposals to raise the current sales tax, a highly regressive form of taxation that will disproportionately harm BIPOC, people with low incomes, and people with disabilities.

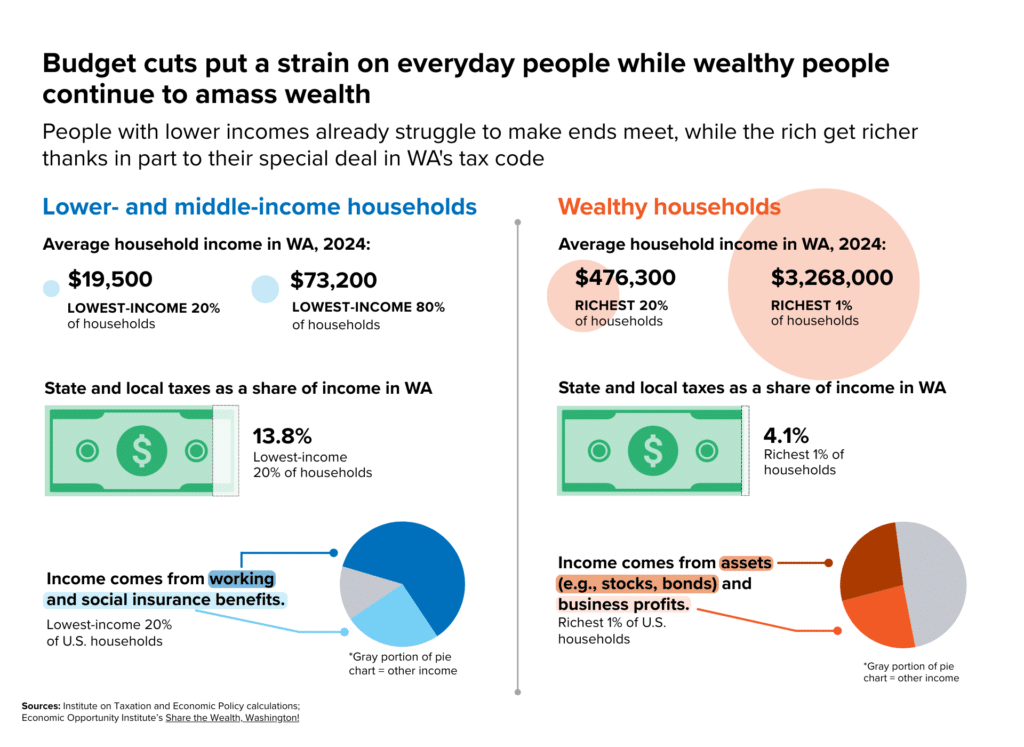

To put an even finer point on the need to enact these kinds of commonsense proposals to fix our tax code, take a look at the contrasting pictures of economic well-being of people with low incomes versus people with extreme wealth in Washington state.

Click on graphic to enlarge.

This session, lawmakers have the opportunity to make history by enacting a slate of proposals that would address the revenue shortfall and make our tax code more equitable and sustainable in the long term. They must think big and move forward with the above policy solutions to ensure the ultra-wealthy and profitable corporations actually finally pay their share. It is the right path to choose for our state. It also happens to be popular with voters.

Annie Kucklick, MSW, Budget and Policy Center consulting analyst, contributed to data and graphics in this post.

Footnote

1Currently, families with household incomes below 60% of state median income (for 2025, $66,000 for a family of three) are eligible for Working Connections Child Care. The eligibility threshold is increasing to 75% of state median income in 2025, and to 85% of state median income in 2027. Proposed cuts would delay planned expansions to 2029 and 2031.