The new Washington state revenue forecast is once again showing a decline in much-needed projected revenue to support the programs that help our communities thrive. The Washington State Economic and Revenue Forecast Council announced today a $900 million decrease in projected revenue over the next two biennial budgets, through 2029. This is largely a result of decreased revenue from the sales tax – as so many people are cutting back on buying non-essentials, and even some essential items, because of inflation and serious affordability issues.

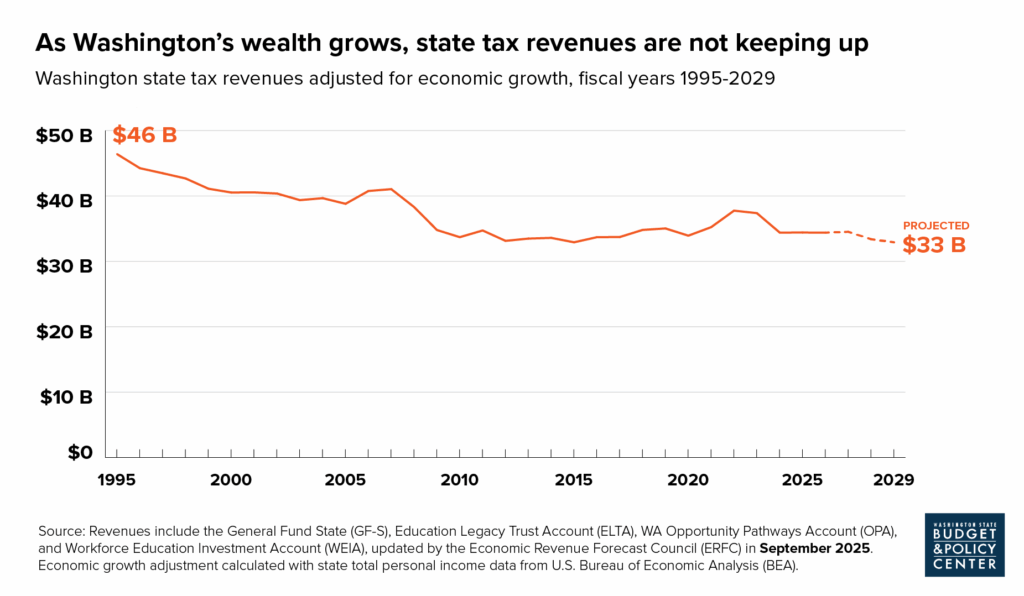

Even with new revenue policies that lawmakers enacted this past session, funding is still on the decline when adjusted for economic growth. Meanwhile, ultra-wealthy people and massively profitable corporations in our state continue to get a special deal in the tax code.

This declining state revenue, combined with budget cuts from this past session and a disastrous decline in federal funding, highlights the need for relief and support for people in Washington. As our state continues to face its own revenue shortfall, this is all the more reason for lawmakers to explore all possible progressive revenue options in the 2026 legislative session.

They have the opportunity to protect the wellbeing of the people in our state most impacted by Congressional cuts to health care, food assistance, and other important programs. Our governor and legislators must prioritize providing relief to the people being hardest hit by the federal budget cuts. All our communities do better when our neighbors who face barriers to opportunity, like veterans, seniors, people with disabilities, and immigrants, have the tools they need to live safe and healthy lives.

Voters have made it abundantly clear they want the wealthiest and hugely profitable corporations to finally pay their share in taxes to support essential programs in our state budget. As those same voters now grapple with the impending loss of critical public supports, our governor and legislators have a moral imperative to finally pass progressive tax proposals that will help mitigate the harm of federal cuts. This next session, they must move forward the proposals that should have made it to the finish line during in 2025 – including a financial intangibles tax on extreme Wall Street wealth and a high-salary payroll tax on employers.