The economy in Washington state is structured to channel much of the total wealth, which all residents help to create, to a small number of very wealthy shareholders – often in the form of capital gains, or profits from the sale of corporate stocks, bonds, and other financial assets. Taxing these profits, as Governor Jay Inslee recently proposed, would generate billions of dollars in much-needed resources for schools, health care, and other investments that benefit all our communities. It would also help rebalance our inequitable state tax code and rein in rising wealth inequality.

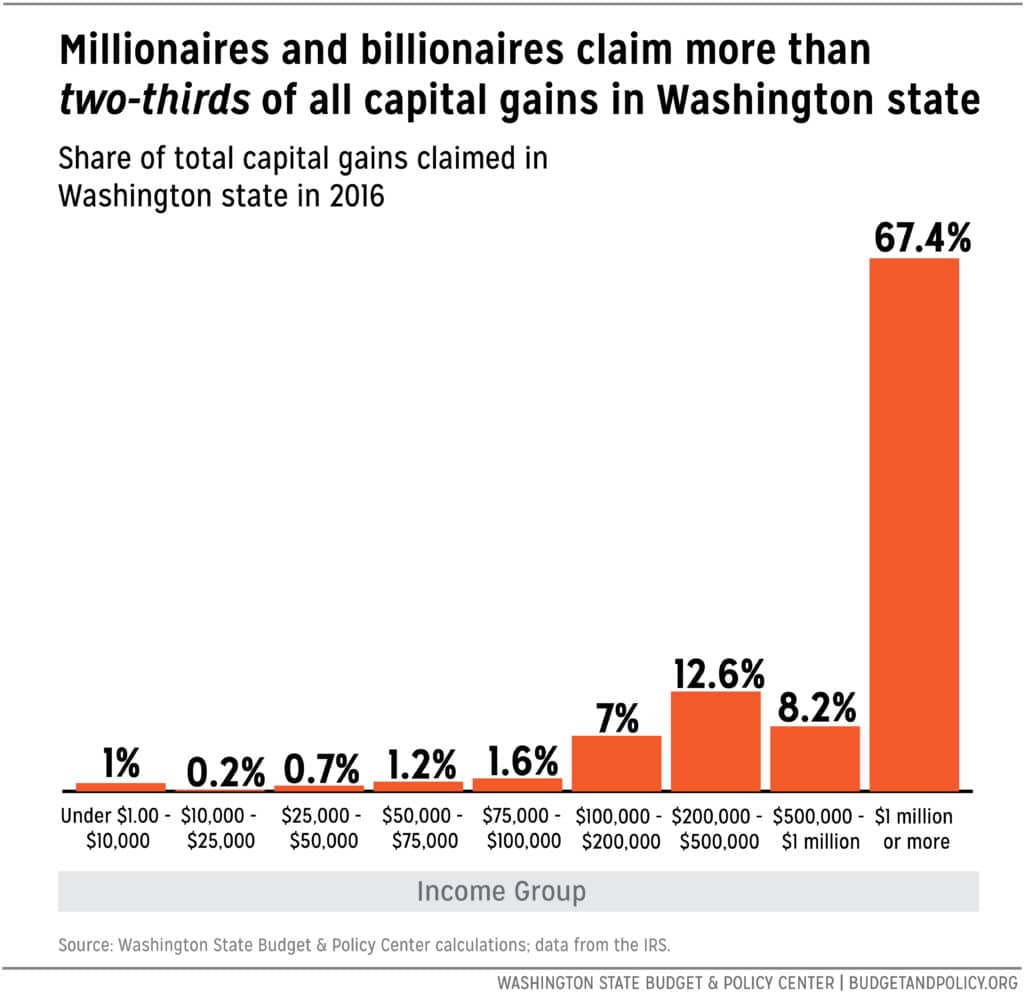

Given the extreme concentration of capital gains among the wealthiest households in Washington (see graph below), the recent proposal from Gov. Inslee to tax high-end capital gains is long overdue. Approximately $1 billion per year in new revenue would be generated for community investments by merely 1.2 percent of households in Washington state – who are almost exclusively those at the very top.1

Under Washington’s current tax code the wealthiest 1 percent pay only 3 percent of their incomes in state and local taxes on average. By contrast, the poorest 20 percent of Washingtonians pay an average of nearly 18 percent – the highest effective state and local tax rate in the nation.

Extending the tax code to include untaxed capital gains would begin to right this extreme imbalance. Under the new proposal, capital gains above $25,000, or $50,000 for a married couple, would be taxed at rate of 9 percent. The proposal is completely reasonable. To build a more just and prosperous future for all of us, a small number of Washingtonians – those who hold most of the state’s wealth – can afford to pay a modest tax on their capital gains.