Governor Inslee’s proposed 2021-23 budget puts Washington on the path to recovery from COVID-19 by raising progressive revenue, prioritizing racial equity, and investing in public services that keep us all well, like public health. But to truly support communities, Washington state lawmakers will need to be even bolder this upcoming legislative session.

Inslee’s proposal smartly avoids knee-jerk cuts that would have harmed communities facing extreme economic hardship by raising new revenue and drawing from the state’s Rainy Day Fund (if this is not a rainy day, we do not know what is).

This is a wise choice: states that invest in their communities by raising revenue during hard economic times fare better. During and in the years following the Great Recession, Washington lawmakers responded to revenue shortfalls by cutting more than $10 billion from the state’s operating budget. These cuts meant that tens of thousands of Washingtonians lost essential services like health care coverage, child care assistance, and income support for people with disabilities when they needed them most. And economists agree that lawmakers’ decision to cut spending contributed to a slower economic recovery for the state.

Click on graphic to enlarge.

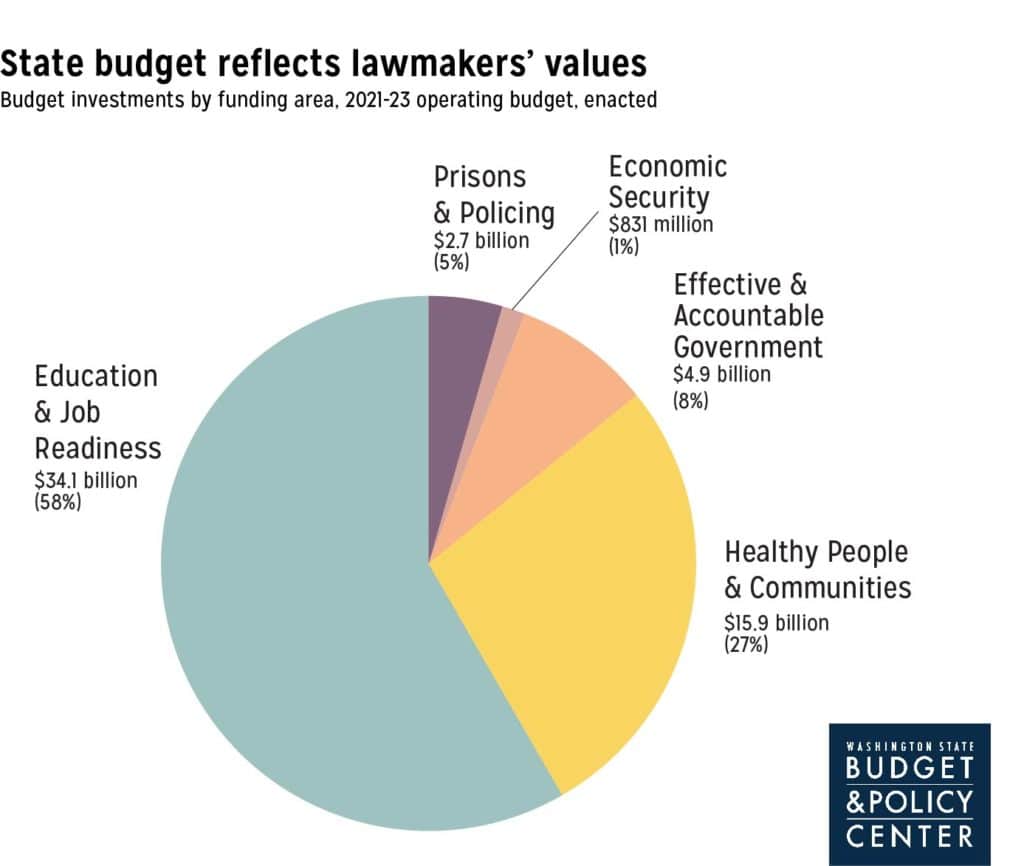

The state budget is a reflection of our collective values, but state investments are not uniformly good and can cause significant harm to communities, especially Black, Indigenous, and People of Color (BIPOC) communities. For example, continuing longstanding trends, under the Governor’s proposal less than 2% of our state-funded operating budget would be devoted to promoting economic security for people with low incomes, while 5% of state funds would go to prisons & policing. To advance racial equity, state lawmakers must interrogate how they choose to spend funds and listen to community leaders for a path forward.

What’s included in the proposal?

The Governor’s budget makes important investments that align with the Budget & Policy Center’s legislative priorities for 2021:

Direct cash support to people most impacted by the ongoing health and economic crises

Direct, flexible cash assistance is key to ensuring people can meet their basic needs, while also promoting a faster economic recovery from COVID-19 by stimulating local economic activity. The governor’s proposal expands access to cash assistance by:

- Undoing strict time limits in WorkFirst/Temporary Assistance for Needy Families (TANF): Strict time limits for receiving TANF cash assistance were introduced during the Great Recession to reduce state spending. Those changes drastically limited access to critical support for families facing deep poverty. The Governor’s budget restores the less restrictive TANF time limit policy in effect in Washington state prior to 2011, and will provide more equitable and robust support for families with the deepest economic need in our state.

- Partially funding a Working Families Tax Credit: The Working Families Tax Credit is a Washington state tax rebate for lower income residents that was enacted in 2008, but never implemented. Funding the credit now would mean direct cash assistance for hundreds of thousands of lower-income Washingtonians who have been disproportionately harmed by the recession and the pandemic. While it’s great that the Governor’s budget partially funds the credit, it doesn’t do so until mid-2023 at the earliest. That’s too late. Lawmakers should work to fund and implement an updated Working Families Tax Credit/Recovery Rebate that would provide a tax credit of at least $500 to people with low incomes with more expediency. The credit should also be extended to include undocumented immigrant workers who are unjustly excluded from receiving federal tax credits, despite paying local, state, and federal taxes.

- Continuing to fund the Immigrant Worker Relief Fund: Earlier this year, advocates organized to secure a $40 million investment to provide one-time emergency cash assistance to undocumented workers excluded from most state and federal supports. Inslee’s proposal adds $10 million to the fund to reach more people, but still falls short and leaves tens of thousands of households without aid. While important, this one-time investment does not replace sustained support. Lawmakers should invest in a permanent income support program for unemployed workers who are wrongly left out of unemployment insurance protections.

Investments in goods and services that bolster well-being

Investments in public services and infrastructure like healthcare, education, and housing support our collective well-being. Inslee’s proposal sustains and expands critical services notably in the following areas, and lawmakers must expand on these proposals:

- Food assistance: Expansions to food assistance are critical as more people across the state face hunger and food insecurity. The Governor’s budget invests $23 million to support food banks across the state responding to dramatic increases in need. An additional $3 million investment in the state’s Supplemental Nutrition Assistance Program (SNAP) match programs also ensures fruit and vegetable incentives can continue. The incentives have been proven effective at reducing food insecurity for 72% of participants, but were at risk of cuts as federal funding dried up. Lawmakers must protect and expand these investments to ensure households can stay fed through the state’s economic recovery from COVID-19.

- Housing and houselessness prevention: Safe and stable housing has always been life-saving; it’s even more critical in this moment to prevent excess deaths from COVID-19. Inslee’s proposal includes an additional $164 million for rental assistance to support nearly 28,000 households struggling to pay rent across the state, but renters will need even more protections. The Governor must extend the state’s current eviction moratorium to protect community well-being. Lawmakers must also do more to house individuals currently facing houselessness by increasing investments in programs like Housing and Essential Needs, which have been chronically underfunded for decades.

- Childcare and early learning: Access to high-quality childcare promotes healthy development in young children and enables families to build economic security. More than $63 million in state funds are dedicated to childcare in Inslee’s proposal. This investment expands healthcare access to the childcare workforce and ensures thousands more children in families with low incomes can access care through the Working Connections Child Care Program.

An equitable capital gains tax to sustain important investments

Lawmakers can address the state’s economic crisis with new taxes on Washington’s wealthiest residents and large, profitable corporations. For too long, the state’s wealthiest (and disproportionately white) households have enjoyed some of the lowest tax rates in the country at the expense of communities of people with low incomes.

The Governor’s proposal aims to begin correcting this injustice with a new, 9% tax on high-end capital gains, which would raise more than $1 billion for community investment in the coming budget cycle and more than $2 billion in following budget cycles. Because the first $25,000 ($50,000 for joint filers) in taxable gains would be exempt, less than 2% of residents – almost exclusively those at the top of the income and wealth ladders – would pay any additional taxes under the proposal. The tax would not apply to gains from the sale of assets held in retirement accounts, small businesses, residential real estate, farmland, timber, or livestock.

Lawmakers should work quickly to enact this equitable new source of revenue. However, to truly meet the needs of this moment, they should generate considerably more funding for communities. This can be done by imposing new excise or payroll taxes on the largest and most profitable corporations operating in Washington state, and by raising taxes on multi-million-dollar estates, inheritances, and real estate transactions.

Investments in public services still lagging

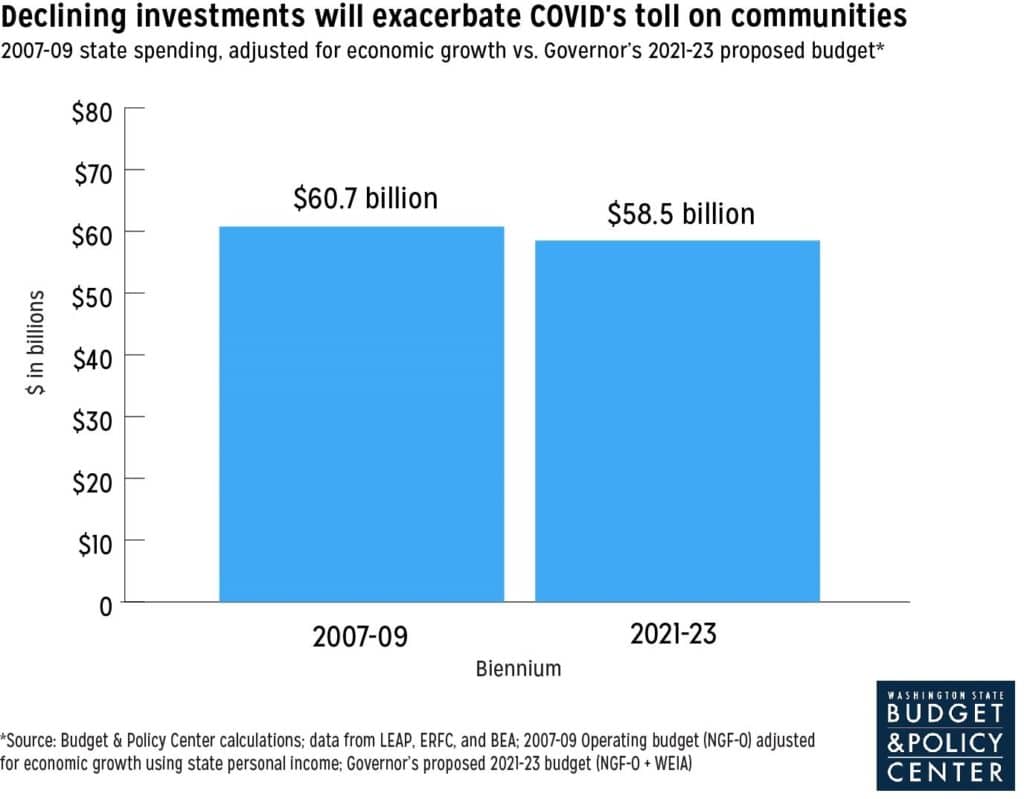

While significant, Inslee’s proposal still does not meet the level of need facing communities at this moment. In fact, the Governor’s proposed budget falls below pre-Great Recession spending levels once adjusted for economic growth (see chart below). This is unacceptable as communities face unprecedented losses in income and employment, rising costs of living, and growing racial and economic inequities as a result of COVID-19.

Click to enlarge.

There is enough wealth in the state to fund a just recovery from COVID-19

Lawmakers can leverage taxes on those with the most in our state who have benefited from wasteful tax breaks for too long. Lawmakers must also listen to BIPOC leaders on how to invest resources in community-driven solutions like: investing in the Communities of Concern Commission, redirecting funds from policing to community well-being, and expanding broadband access – among many other proposals that would move Washington toward becoming an antiracist state.