Some highlights of the governor’s proposal

The governor’s proposed budget contains some promising investments. In the area of education, he proposes raising teacher salaries during the next school year. The legislature’s failure to fund adequate salaries for educators in the current state budget prompted the state Supreme Court to intervene and require salaries to be boosted by September 2018. Under the governor’s proposal, total funding for schools would increase by about $950 million compared to current funding levels. Around $600 million of that additional investment is generated by a one-time accounting trick – reducing the amount of funds that will be allocated to school districts in the coming school year with an offsetting funding increase in the following, 2019-20 school year, which falls just outside the current state budget period.

To support healthy people and communities, the governor proposes to inject more than $100 million in additional resources to help ensure Washingtonians can access effective mental health treatment. Most of the funding would be used to improve care at state psychiatric hospitals, which have been under the scrutiny of the courts and the federal government after years of chronic underfunding led to inhumane conditions at those facilities. The legislature added funding for psychiatric hospitals in the current budget, but not enough to comply with federal standards. The governor’s proposed supplemental budget is a reasonable step toward meeting our state’s mental health needs, but significantly more funding will be needed in the years ahead to build a reliable and adequate mental health system.

The foreseeable shortfalls from the legislature’s budget

In late June, after multiple special legislative sessions and months of stalemates, lawmakers hastily enacted the current 2017-19 budget. That budget penciled out with the use of short-sighted fixes and temporary accounting gimmicks. For example, the legislature assumed they’d see about $100 million in unrealistic savings from efforts to reduce the costs of prescription drugs and provide health care to Washingtonians with low incomes. In addition, lawmakers underestimated the cost of efforts to fight wildfires by at least $40 million. The governor addresses all of these flaws in his 2018 supplemental budget, mostly by tapping budget reserves.

Most important, legislators failed to enact any long-term reforms to equip our tax code to meet the changing needs of our communities. Until it is reformed, our inadequate tax code will continue hampering efforts to build thriving communities in every corner of Washington state. While the state economy and the capacity to fund important investments has grown enormously since the Great Recession, the tax code has made it impossible to do so.

The truth about school funding and community investments

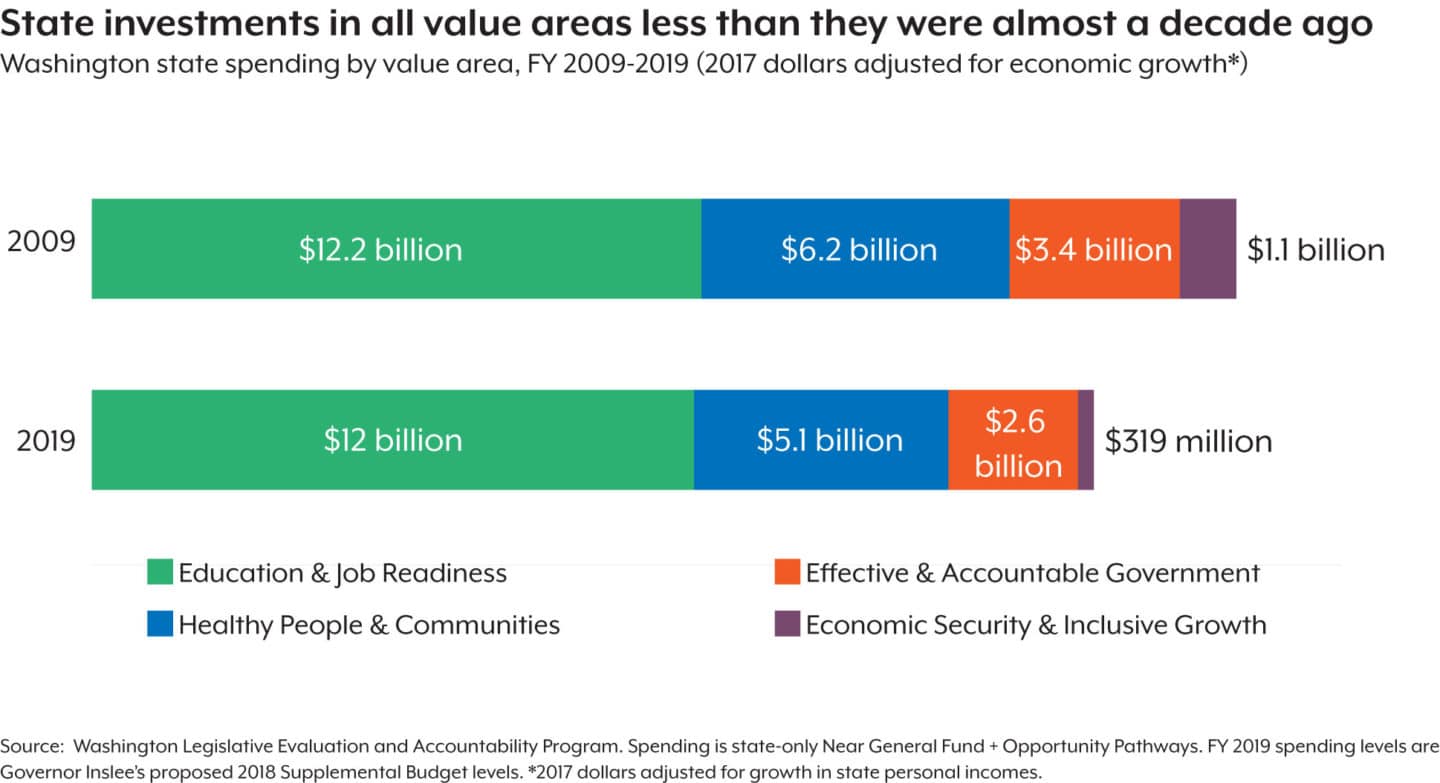

In the last several years, lawmakers made significant investments in public schools, but the reality is that those boosts don’t represent actual increases relative to economic growth. And even with the additional investments included in the governor’s proposal, state spending remains near historic lows. In today’s dollars, the proposed levels of overall community investments in our state are actually lower than Recession-level spending. As the chart below shows, education spending in the governor’s proposed budget for the 2017-19 budget cycle will not even reach the level it was at a decade ago. And investments in every other value area have dropped significantly since then. This is the big picture that lawmakers must focus on when they meet again in January.

[Click on image to enlarge.]

The governor’s proposal is a measured step forward given the limited good choices available to meet our state’s pressing needs. But the need to resort to drastic measures like tapping the rainy day fund could – and should – have been avoided. Had lawmakers come together and used their many chances to enact long-term reforms to the tax code, the budget picture would be much brighter. To his credit, the governor announced that he will unveil a revised proposal to tax damaging carbon emissions in January 2018. That proposal could help create a more sustainable state budget in the short term while reducing air pollution in the long run. The governor’s previous calls to close the tax break on high-end capital gains would also help bring more balance to our inequitable tax code while generating billions of dollars in additional resources for schools and other priorities in the years ahead.

Cleaning up the tax code now – including forward-thinking proposals like closing the tax break on capital gains and enacting a carbon tax – would preserve and bolster funding for investments that benefit all Washingtonians. If lawmakers start taking steps to fix the tax code this coming session, it could also save future legislatures from having to drain reserves in order fund the needs of our schools and communities.