The Senate Democrats’ “Fix Our Tax Code” proposal, which pairs a Working Families Tax Credit with a capital gains tax, would be a big step to start making things more fair. It’s good for Washingtonians, and is consistent with a national movement to fix state and federal tax codes with commonsense policies that lift up working people.

High earners in the United States, like the two of us, should be paying our share in taxes. We recognize that taxes help us pay for resources that build strong communities for everyone – like great schools, emergency services, and public transportation. Washington’s capital gains proposal is a smart idea to ensure that the people who can most afford it are chipping in and not getting an unnecessary tax break.

Washington is one of only nine states that doesn’t have a state capital gains tax. It’s time to change that. A capital gains tax for the top earners – 0.4% of them – is smart policy. And on the other end of the tax code scale, households with lower and moderate incomes could see a meaningful cost-of-living boost through the Working Families Tax Credit. Washington’s version of the successful federal Earned Income Tax Credit, this state credit would offer a targeted sales tax rebate to hundreds of thousands of Washingtonians who work hard for low wages. The average income boost would be $500, with a maximum credit of about $1,300. That kind of money would make a difference for families struggling to put food on the table or to pay bills, and will infuse growth in local economies.

“Taxes help us pay for resources that build strong communities for everyone – like great schools, emergency services, and public transportation. Washington’s capital gains proposal is a smart idea to ensure that the people who can most afford it are chipping in and not getting an unnecessary tax break.”

This boost in income will further help rebalance the tax code. And it will help address the fact that the building blocks of a stable life – child care, health care, a college education – are becoming out-of-reach luxuries for many families. In addition, it will have an outsized positive impact on people of color who have long been excluded from economic opportunity because of historically racist policies.

We also call on the legislature to build on Washington’s recent economic policy wins – like the minimum wage and paid family leave policies – and ensure any Working Families Tax Credit proposal includes workers without kids, caregivers, low-income students, and immigrant workers.

The Senate Democrats are making the right call in asking the wealthiest to pay their fair share with a capital gains tax and giving hardworking Washingtonians a cost-of-living refund with the Working Families Tax Credit. It’s the least we can do.

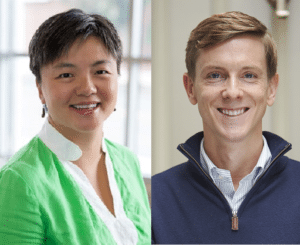

Sharon Chen is a former Microsoft employee and serves on the boards of Progress Alliance of Washington and Washington Conservation Voters.

Chris Hughes is the co-chair of the Economic Security Project and author of Fair Shot: Rethinking Inequality and How We Earn. He co-founded Facebook in 2004.