Communities are stronger, healthier, and more secure when needs are funded equitably. Lawmakers in our state are rightly listening to communities and following the lead of the U.S. Congress by investing in a just economic recovery and sustaining federal investments through a tax on extraordinary profits.

The House’s $58.4 billion two-year operating budget proposal and the Senate’s $59.2 billion proposal1 both take action to balance our state’s worst-in-the-nation tax code, advance cash assistance policies for those trying hard to make ends meet, and make other important investments in shared priorities like child care, housing and homelessness prevention, and public health. These bold investments are a direct result of years of organizing from community members, advocates, and community leaders who called on lawmakers to fix our upside-down tax code and invest adequately in communities that were struggling even before the pandemic hit.

For too long, Washington’s budget – and the tax code that funds it – has benefited ultra-wealthy (and disproportionately white) households at the expense of everyone else, especially people with low incomes and Black, Indigenous, and People of color (BIPOC) communities. While COVID-19 exacerabated these existing inequities, the budget proposals just released by House and Senate Democrats signal a hopeful shift in how our lawmakers think about and fund community investments for the better. Budget writers must keep this mindset as they move forward to finalize the budget this session and in years to come to reduce inequities and build a brighter future for all Washington communities.

The House & Senate budget proposals rightfully invest in Washington communities and economic recovery

Lawmakers made progress on key areas of the Budget & Policy Center’s legislative priorities by:

1. Balancing the tax code with equitable revenue and tax credits

Budgets are moral documents. Lawmakers can’t continue to balance them on the backs of people with low and moderate incomes. That’s why a capital gains tax on extraordinary profits (Senate Bill 5096) and Recovery Rebate/updated Working Families Tax Credit (House Bill 1297) in both budget proposals is an important move forward. Together, these policies help make the tax code more equitable by providing tax credits to people with low and moderate incomes – like custodians and frontline healthcare workers – while modestly increasing taxes for the wealthiest in our state, like Jeff Bezos, who have enjoyed a special deal under our state’s tax code.

2. Advancing direct, flexible cash assistance

Cash support enables more people to afford the basics, improves well-being, and supports local economies. The House’s $340 million and Senate’s $300 million proposed investment in the community-driven Washington Immigrant Worker Relief Fund expands critical cash support to undocumented workers. The one-time fund starts to remedy the longstanding and xenophobic exclusion of undocumented immigrants from state and federal aid. Policymakers should continue to remove exclusions for people who are undocumented in other state policies and explore ways to provide unemployment insurance to everyone who needs it, regardless of immigration status.

Both budgets also propose increases to the state’s Temporary Assistance for Needy Families (TANF)/WorkFirst cash grant (15% in the Senate and 10% in the House) to families experiencing deep poverty. The House proposal would also fund an $80 per month diaper benefit for families with young children. Both budgets take action to prevent struggling families from having their benefits eliminated as a result of overly strict time limits built into the current law. The House budget’s approach will provide more certainty for families in the coming biennium and should be paired with funding for Senate Bill 5214 (as proposed by the Senate) in order to support families with more time during future periods of recession. Ultimately, the final budget should include these complementary changes to the TANF time limit policy and overdue increases to cash benefit levels (funding both the 15% grant increase proposed by the Senate and diaper stipend proposed by the House). Such an approach would ensure families can meet basic needs while the economy recovers.

3. Investing in public goods and services that benefit us all

Both House and Senate Democrats proposed recovery budgets that robustly invest in public health and vaccine distribution (more than $1 billion), rental assistance and foreclosure prevention (more than $850 million), reopening schools ($1.7 billion), child care ($450 million), emergency food assistance (more than $23 million), and more. The House makes a particularly strong investment in housing by allocating more than $1 billion to rental assistance, which will help avert a tsunami of evictions as the state’s eviction moratorium is lifted.

Federal action is a bridge to long-term recovery, but not a long-term solution

Robust state investments in both budget proposals would not have been possible without bold and necessary action on the part of federal lawmakers. In the current 2019-21 budget cycle, federal stimulus efforts, such as expanded unemployment insurance, heightened funding for health care, and direct payments to households, helped keep state revenue collections near pre-pandemic levels by bolstering consumer spending during the deepest part of the recession. These federal actions would have been even more impactful had they included undocumented immigrants and mixed status families, who were unjustly excluded despite their large contributions to the economy and our quality of life. Community investments funded via the state budget were bolstered by about $7 billion in the current budget cycle due to federal stimulus dollars approved by Congress in the past year.

Going forward, the state Senate budget proposal, for example,2 for the next two-year budget cycle includes another $7.5 billion in federal aid from the recently enacted American Rescue Plan Act. These resources will allow state lawmakers to continue to appropriate funds for direct pandemic response, rental assistance, funding for schools, and other investments that will undoubtedly support the well-being of millions across the state.

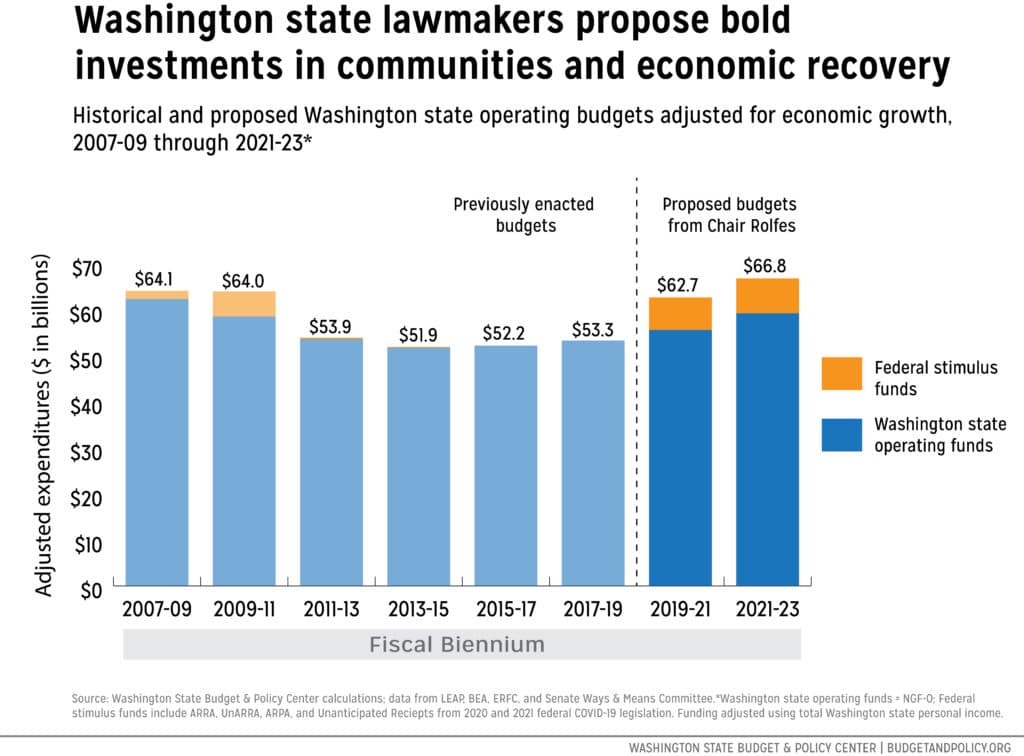

But it’s important to note that federal funding is merely a stop-gap measure. State funding is just now returning to pre-Great Recession levels after adjusting for economic growth and accounting for federal aid – 13 years after the start of that recession (see chart below). That’s because after the Great Recession, lawmakers cut more than $10 billion from the state budget, rather than replace time-limited federal stimulus funds with equitable new taxes on the wealthiest households. That decision inflicted great pain on communities across Washington state.

Click on image to enlarge.

The current budget proposals from Democratic leaders in the House and Senate show lawmakers don’t intend to repeat that mistake. The budgets assume long-term revenues from an equitable wealth tax on capital gains over $250,000 per year. They should work quickly to approve other new equitable sources of revenue, such as the billionaire wealth tax proposal, to sustain Washington’s economic recovery in the long run.

The current $59.2 billion Senate proposal, along with $7.5 billion in additional federal funds to the state, would put us back to where we were before the Great Recession took its worst toll on communities. In short, state lawmakers are taking the right approach by avoiding harmful budget cuts and ensuring we have adequate short-term and long-term investments to support the needs of the people, businesses, and communities that are struggling during this pandemic. If sustained, this proposed level of investment will finally put Washington on a path to recovery and greater equity.

Lawmakers still have time to improve these already impressive proposals with a stronger commitment to equity

Funding for a Missing and Murdered Indigenous Women and People (MMIWP) taskforce and the Healthy Environments for All (HEAL) Act (Senate Bill 5141) show lawmakers are finally listening to BIPOC leaders who, for years, have been calling for targeted investments to help reverse inequities. Still, lawmakers have an opportunity to advance an even stronger final budget proposal that further invests in the self-determination of BIPOC communities. They can do this by appropriating an additional $5 million in the capital budget and $1 million in the operating budget toward the Communities of Concern Commission, a statewide coalition of 23 community-based organizations of color and under-resourced rural areas seeking public investment to build and preserve self-determined capital assets in their respective communities to reduce poverty.

Lawmakers should take the Senate’s approach on creating a pandemic safety net in K-12 education. Both proposals would boost overall funding for all public schools across the state. However, the House’s approach would reduce state resources provided to schools in high-poverty areas. While these resources would be replaced with federal aid, this approach would violate federal requirements to sustain pre-pandemic levels of state resources for schools, especially schools in high-poverty areas. Now is the time to reduce inequities between schools in low-income and high-income neighborhoods, and the Senate’s approach does a better job of moving toward that important goal.

Finally, lawmakers must also interrogate and divest from areas of the budget that actively harm communities – like prisons and policing. Passing House Bill 1090, which bans private, for-profit detention facilities in the state, is an important first step. Policymakers must continue to divest from harmful systems.

Returning to the status-quo is not an option

This year’s legislative session is showing us what is possible when lawmakers listen to community demands for more inclusive and equitable policies, a fairer tax code, and a budget that adequately invests in community need. Budget writers must take this momentum to the negotiating table in preparing a final budget.