As they work to build a new two-year state budget, lawmakers should heed calls from advocates to infuse substantial new resources into schools, health care, infrastructure, and the many other vital structures that support the common good across Washington. While Governor Inslee’s proposed budget would sustain much of the funding advances achieved in recent years, it still leaves too many community needs unmet. Lawmakers should correct his omissions and free up the funding needed to fund all community priorities by enacting equitable new taxes on highly concentrated millionaire wealth, multimillion-dollar estates, and upper-end corporate payrolls.

More revenue needed to build a strong, healthy state

As we wrote previously, Governor Inslee’s proposed funding plan for the upcoming biennium – the period spanning July 2023 through June 2025 – maintains much of the new funding for schools, health care, housing, tax credits for people living on lower and moderate incomes, and other priorities approved during the COVID-19 pandemic. He proposes a bold bond measure that would fund some 27,000 new affordable housing units over the next eight years. Given the rapid growth in housing costs in recent years, and the havoc those costs continue to wreak, lawmakers should pass this proposal and send it to voters for approval on the November ballot.

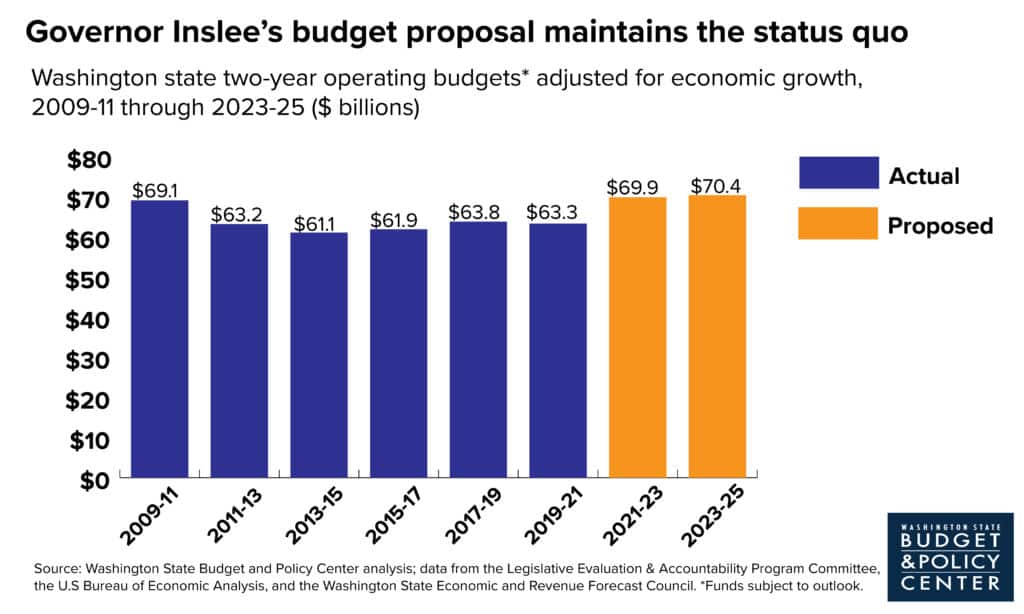

Overall, his proposal is far too modest, however. Under Inslee’s plan, state funding in the 2023-2025 operating budget would amount to $70.4 billion – nearly the same as it was in the 2009-2011 budget, after adjustment for economic growth (see chart below). And lawmakers channeled considerably more state resources to communities back in the mid-1990s than they do today. Simply put, there is ample capacity in Washington’s vibrant economy to boost funding for many critical programs and services in the next two-year budget.

Simply put, there is ample capacity in Washington’s vibrant economy to boost funding for many critical programs and services in the next two-year budget. Share on XGovernor omits many of our legislative priorities, drains reserves

Advancing the governor’s largely status quo budget without making any improvements would mean many bold and impactful funding proposals would not reach people in Washington. In our legislative agenda, the Washington State Budget and Policy Center calls on lawmakers to implement the following important policies:

- A Guaranteed Basic Income would reduce poverty and improve the long-term well-being of people and communities across the state by providing direct cash assistance to eligible Washingtonians.

- The Washington Future Fund, or Baby Bond savings program, would help families with lower or moderate incomes begin to build generational wealth by providing a small but meaningful nest egg for their children to access in adulthood.

- Equitably expand the Working Families Tax Credit (WFTC) to all low-income, working seniors and young adults. The WFTC is a new policy that is putting cash back in the pockets of approximately 400,000 Washingtonians struggling to make ends meet.

- Reforming harmful fines and fees, or Legal Financial Obligations, – with the end goal of eliminating them – would stop the government from wrongly and unnecessarily extracting wealth and resources from people involved in the criminal legal system. This year, lawmakers should create a reliable structure and process for compensating crime victims without putting youth and families into juvenile LFO debt. They should also grant relief to people who qualify as indigent by removing the burden of paying mandatory LFOs and more reliably fund victims’ and witness services through the state budget.

Governor Inslee’s 2023-2025 state budget proposal fails to include the above proposals, as well as many other proposals and requests from organizations and community leaders across the state. Because he proposes no further actions that would equitably increase state tax revenues, the governor would substantially reduce budget reserve funds to maintain current funding levels. These are resources lawmakers set aside to address unanticipated costs or events. Tapping budget reserves now is a much better option than cutting funding for communities. But doing so is also risky, as those funds would be needed to shore up schools, health care, and other priorities in the event of an economic downturn, a new pandemic, or other state emergency.

Equitable new taxes will benefit us all

The good news is that lawmakers can build a robust and equitable state budget that repairs much of the damage caused by generations of racism, classism, gender discrimination, and other forms of oppression that degrade our quality of life.

#WaLeg can build a robust and equitable state budget that repairs much of the damage caused by generations of racism, classism, gender discrimination, and other forms of oppression that degrade our quality of life. Share on XThey can do so by correcting an inequitable imbalance in the state and local tax code. Options for doing so include (but are not limited to):

- A new tax on individual financial wealth above $250 million annually (SB 5486/HB 1473) would generate over $3 billion each year in funding to support services for people living with disabilities; schools, early learning, and higher education; affordable housing; and equitable state tax reductions. Only about 700 extremely wealthy households would pay this tax.

- Closing estate tax loopholes and raising tax rates on multimillion-dollar estate transfers, as proposed in HB 1795, would generate some $30 million per year to support efforts to reduce intergenerational poverty. The proposal would narrow a loophole in which wealthy families transfer assets to a family foundation in order to avoid estate taxes. It would also increase tax rates on transfers of estates valued over $3 million, and it would exclude the first $2.6 million in estate value from taxation, up from $2.2 million under current law.

- Increasing Real Estate Excise Tax (REET) rates on sales of mansions and high-value commercial properties, as proposed in HB 1628, would generate over $300 million per year in new funding to expand affordable housing. It would do so by increasing the top REET rate to 4% on property sales above $5 million, up from the 3% top rate currently applied to sales over $3.025 million.

- Enacting a new upper-end payroll compensation tax, similar to the highly successful JumpStart Tax levied in Seattle. A 5% payroll tax applied to wages, salaries, and other forms of compensation over $200,000 annually would generate roughly $1 billion per year in new revenue to support the funding priorities listed in our legislative agenda as well as those of community organizations across the state.1

The bottom line is that lawmakers should aim higher than the status quo when it comes to funding for our schools, health care, infrastructure, and other pillars that support strong and resilient communities. The wealthiest households and large corporations in our state, who pay some of lowest overall state and local tax rates in the nation, reap huge financial benefits from our education, infrastructure, health care, and other publicly funded systems. They can and should pay more to support a high quality of life for everyone in Washington state.