The Legislature concluded its second special session by passing a budget that spares kids and vulnerable populations from deeper cuts, but takes no steps to rebuild our economy.

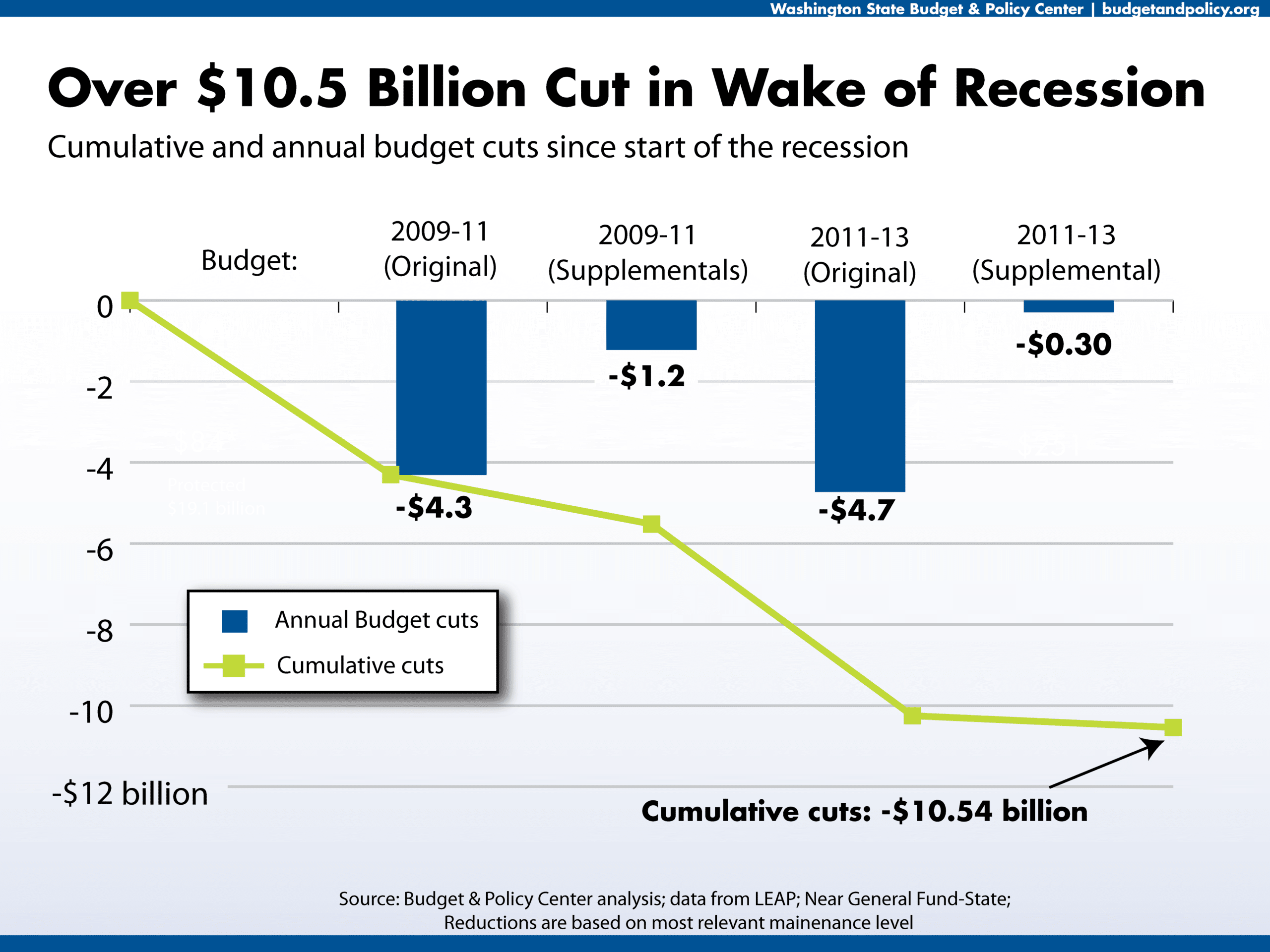

Since 2009, the Legislature has cut over $10.5 billion from investments in health care, education, and resources people need to remain economically secure through a recession (see graph). This is the opposite of what is necessary for our economy to recover. While the worst of the cuts to these investments were avoided this time around, little progress was made to ensure future economic prosperity.

Actions taken by the Legislature at the close of special session include:

Spending cuts:

- $295 million in cuts: Almost half ($127 million) of the reductions came from unspent funds in the Temporary Assistance to Needy Families program, which provides families with child care support and help finding a job. This funding could have been used to help families hardest hit by the recession, but instead it was mostly used to balance the budget.

- Funding preserved: K-12 and higher education, support for people with disabilities, women’s health, and food assistance were spared further cuts.

$238 million shift in payments to local governments:

By waiting

until the end of each month to distribute tax revenues to local

jurisdictions, the state budget gets a one-time $238 million boost.

Miniscule revenue increases:

- Actual tax increases amounted to about $26 million, from closing a tax breaks for out-of-state banks and sellers of roll-your-own cigarettes.

- Policymakers also cut taxes by about $20 million. Tax breaks were renewed or extended for companies that process fruits and vegetables, server farmers, film companies, and shipping businesses.

- Administrative actions — such as selling the state’s liquor distribution center and offering an amnesty program for taxes owed on personal property – amounted to about $27 million in additional resources.

Change to four-year budgeting:

Requiring the Legislature to budget four years out could result in even deeper cuts to public priorities in the future because it fails to address the major reasons why Washington has a hard time meeting growing public needs: spending and revenue are not treated the same in budget decisions, and examining tax breaks is not part of the budget process. Click here to read more on this topic.

The Legislature missed out on the opportunity to enact smart reforms that would help create jobs and put the state on track to compete in the economy.. Key reforms include: extending the sales tax to more consumer services, enacting a tax on capital gains, and systematically reviewing the billions of dollars spent each year on special tax breaks.

More posts to follow.