Lawmakers in Washington should act quickly to adopt Governor Inslee’s proposal to tax high-end capital gains. Doing so would begin to rectify the inequitable concentration of wealth among a small group of very wealthy, and mostly white, households.

Capital gains, or profits from the sale of financial assets, such as corporate stocks and bonds, are a major contributor to rising wealth inequality, especially between whites and many communities of color. As we wrote previously, more than two-thirds of all capital gains in Washington state are claimed by households earning at least $1 million per year.

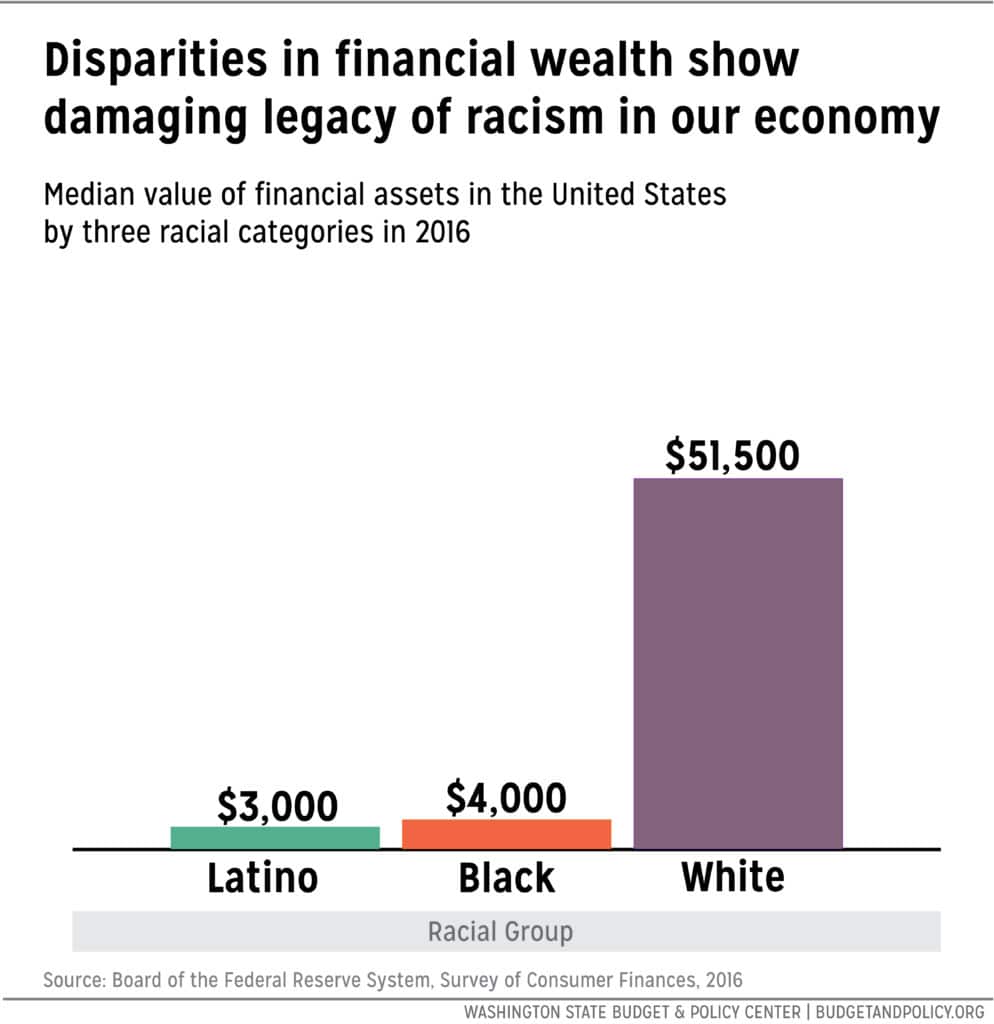

The wide disparities in financial wealth between white households and certain communities of color can no longer be ignored. As the graph below shows, the median value of all financial assets among white households in the United States ($51,500) is more than 17 times that of Latinx households ($3,000), and nearly 13 times that of Black households ($4,000).

Throughout our nation’s history, white households have enjoyed privileged access to multiple forms of wealth, allowing them to accumulate substantial financial resources over many generations. By contrast, many racist policies and laws deliberately prevented communities of color from accumulating any meaningful amount of wealth.

Today, the ongoing result of those historically racist laws and practices in the United States and Washington state is that white households now hold a disproportionately large share of the country’s total wealth – especially wealth in the form of assets like stocks and bonds.

Federal, state, and local tax codes only exacerbate the inequality. At the federal level, the highest tax rate applied to long-term capital gains, profits from the sale of financial assets held longer than one year, is 13.3 percentage points lower than the highest rate applied to wages and salaries.

Meanwhile, Washington state has the most upside-down (or regressive) state and local tax code in the nation. The poorest fifth of residents pay an average of 18 percent of their incomes while the richest one percent pay an average of only 3 percent. It’s a tax code that takes and especially large toll on Washingtonians who are Black, Latinx, and Native American.

By itself, the proposal to tax capital gains won’t end racial wealth disparities in our state. But it would be an important step toward making our tax code more equitable. And the more than $1 billion per year in new resources it would provide for child care, schools, health care, and other investments that promote opportunity would reduce barriers that people of color still face when it comes to building wealth for their families and communities.