The announcement that the new IRS Direct File tool will be a permanent tax filing option is a major win for Washington taxpayers, who will now have permanent access to free, easy, and fast federal tax filing directly from the IRS. With a little bit of work to integrate the Working Families Tax Credit (WFTC) application process, Direct File can be a key tool to make sure that the 180,000 households who haven’t claimed their Working Families Tax Credit this year don’t miss out next year.

Tax credits are a key anti-poverty tool, and work is needed to make sure people don’t miss out

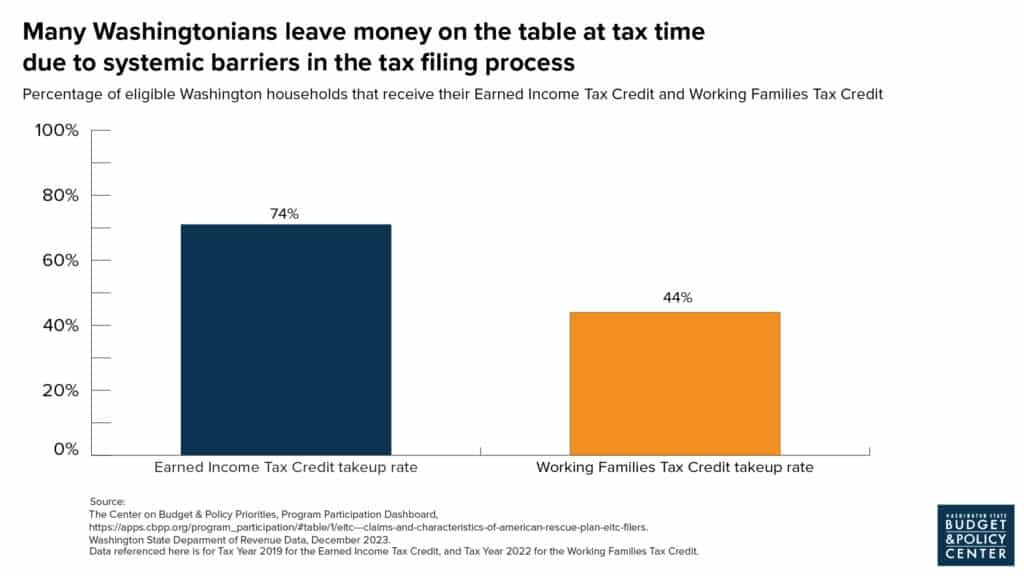

While tax credits for people with lower incomes are one of the most effective ways to make sure people can meet their basic needs, barriers to access mean that not every household claims their credits.

Boosting the number of people who claim their credits would mean more cash in people’s pockets to pay for groceries, save for a rainy day, and catch up on missed rent payments. Tax credits are a powerful tool to strengthen local economies and help increase economic stability across our state.

Click on graphic to enlarge

Other states are leading the way on seamless state and federal tax filing

While Washington was one of the states to offer Direct File as an option in its pilot year, our state tax credit application was not fully integrated. Rather, all applicants were prompted to go separately to the Department of Revenue’s website to check if they were eligible and fill out their tax credit application, adding multiple time intensive steps to the process.

Several states have already taken steps to reduce barriers for people to access their state credits when using the Direct File tool. States like Massachusetts have worked to allow users to pull in data from the Direct File tool and carry over the information from their federal tax return that is duplicated on their state return.

Other states – like New York and Arizona – have taken additional measures to seamlessly integrate their state tax filing with Direct File, working with the organization Code for America to not only pre-populate information from Direct File, but also simplify the state application overall.

Evidence from New York and Arizona showed that 90% of filers who used the Direct File tool continued to the integrated state filing option – suggesting that a similar option in Washington could significantly boost Working Families Tax Credit participation for those who used Direct File.

The landscape for applying to the WFTC is complex and frequently presents barriers to Washingtonians with lower incomes

In Washington, WFTC applicants have limited ways of accessing the credit without having to re-enter significant information from their federal tax return or pay fees to for-profit tax preparation companies.

Some tax filing software have fully integrated the WFTC application into their systems, meaning that after you file your federal return, paid tax software or paid preparers alert applicants of their eligibility for the credit and ask just a few more questions. However, supposedly “free” tax filing systems often charge applicants fees or use sneaky tactics to redirect people to a paid option. In 2022, Washington’s Attorney General won a lawsuit against TurboTax for using these unfair tactics to fool taxpayers into paying for tax filing, even when they were eligible to file for free.

Importantly, there are free tax filing options, such as the Volunteer Income Tax Assistance program (VITA), which offer truly free access to the WFTC across Washington. However, VITA services are not readily available across Washington state. Many areas of the state with the highest rates of eligibility for the WFTC, like Yakima and Grant counties, also have the least access to VITA tax preparation sites. The free online and paper application for the Working Families Tax Credit from the Department of Revenue is a good option to claim the WFTC, but requires applicants file their federal taxes separately, and then re-enter a significant amount of information from the federal tax return.

A simpler application process can help make sure immigrant communities don’t miss out

Communities with lower incomes and harder to reach households including immigrant and non-English speaking applicants, people without at-home internet access, and rural communities are much more likely to miss out on this annual cash rebate.

The Washington Immigrant Solidarity Network (WAISN) Hotline has provided in-language assistance over the phone for immigrant community members since the launch of the credit in 2023. Through their experience, WAISN has found that the biggest barriers to access include:

- Lack of knowledge about the credit

- A too-complicated application process

- Limited availability of trusted, in-language, free tax preparation and Individual Taxpayer Identification Number (ITIN) application services in their area (Learn more about ITIN filers in our fact sheet here).

- A lack of trust in government agencies or fears around public charge and information security

It doesn’t have to be like this. Direct File offers a new and better system, and with full integration with the Working Families Tax Credit application, it would help make sure less people miss out.

Our state and federal government can work together so that eligible individuals and families in Washington don’t miss out on the cash they’re entitled to.