Families working hard to get by shouldn’t have to choose between rent and groceries. But Washington’s current state and local tax code requires those with the least to contribute the most – 18 percent of their incomes – while the wealthiest 1 percent pay significantly less – only 3 percent of their incomes. While the state’s economy has been booming for some, it is leaving many people behind. It has worsened income inequality and is making it hard for too many Washingtonians to keep up with rising costs.

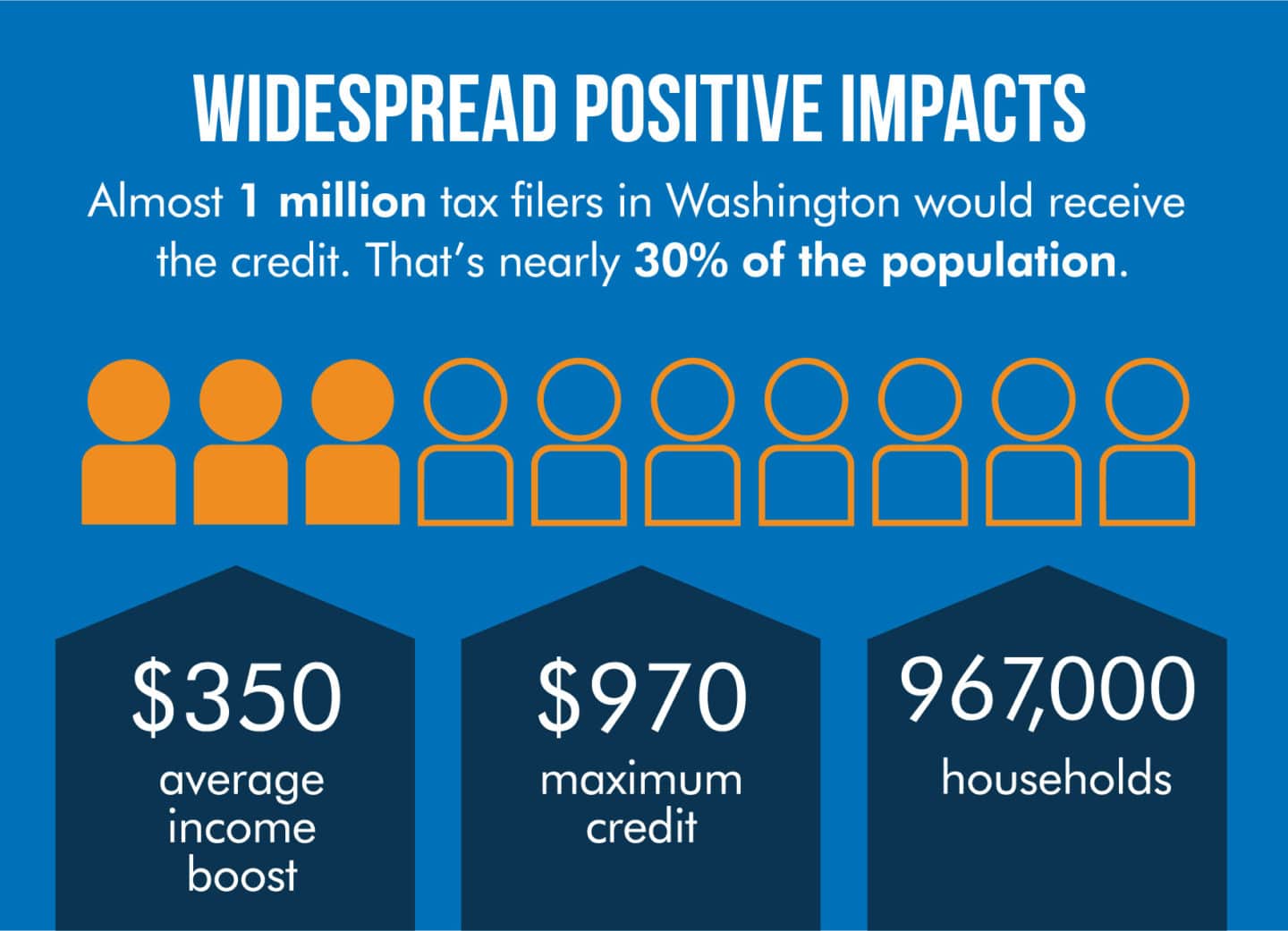

This session, lawmakers have a chance to help lift up hardworking Washingtonians by enacting and funding a modern Working Families Tax Credit. House Bill 1527 would make our tax code more equitable by putting a meaningful amount of money – through a sales tax credit – back into the pockets of working people who need it. The credit would help 967,000 households, offering an average annual income boost of $350. (See our new fact sheet for more details)

The Working Families Tax Credit builds on the federal Earned Income Tax Credit (EITC), which is a proven success at reducing poverty, especially among children. It has been shown to help keep families working and to improve community-wide outcomes related to health and well-being.

The bill would also expand the credit to several key populations to better reflect our modern workforce, most of whom are excluded from the federal EITC, such as: family caregivers who work for little or no pay, college students with low incomes, workers without children, and immigrant workers who are largely excluded from the federal EITC.

This effort is endorsed by the Washington State Budget & Policy Center and a broad coalition of organizations that advocate for anti-poverty, workers’ rights, racial equity and social justice, small business advancement, rural and urban economic and community development, and tax reform.

Check out our new fact sheet, A Modern Working Families Tax Credit, for more details.