For us policy nerds at the Washington State Budget and Policy Center, Tax Day is a big deal. That’s because, as an organization devoted to economic justice, we know that tax dollars pay for the things that make our economy strong and help our communities thrive. Taxes pay for things like parks, schools, libraries, public health, buses, ferries, trains, infrastructure. (We could go on, but you get the point).

This year, Tax Day feels different in Washington state, though, because lawmakers are facing a huge revenue shortfall that is threatening funding to agencies, institutions, and jobs. It doesn’t have to be this way. If lawmakers take critical steps to make our tax code more equitable – by enacting some of the progressive revenue options on the table this session, such as the proposal for a high-earner payroll tax on large employers and a tax on intangible assets for the wealthiest in our state – they can create a more sustainable budget that funds communities.

As so much is swirling in the legislature on Tax Day this year, we thought we’d take a moment to remind you of five key reasons why it’s time to fix Washington state’s tax code:

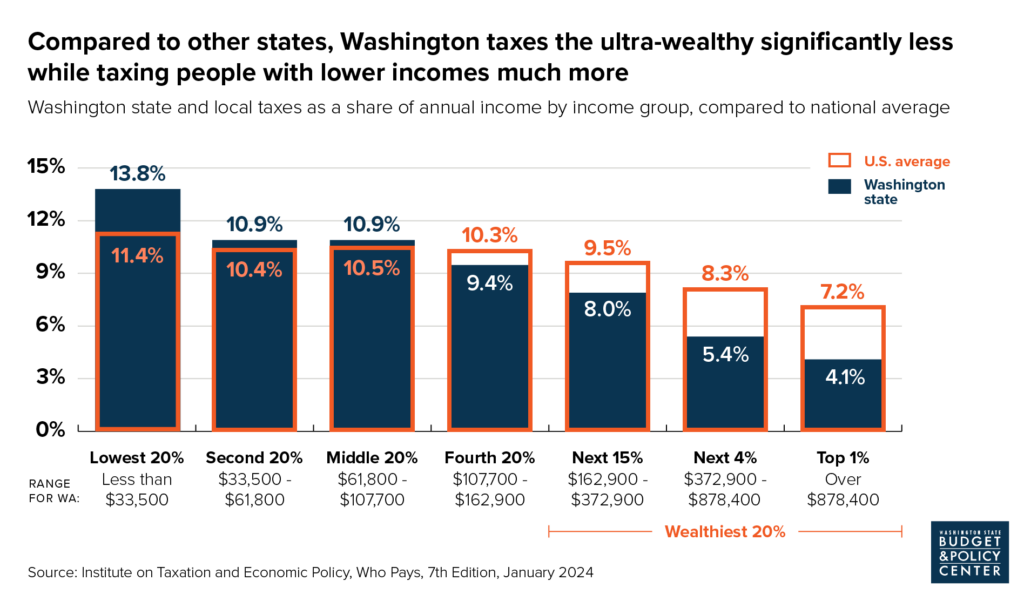

1. It simply doesn’t make sense that the ultra-wealthy and hugely profitable corporations continue to get a special deal in our tax code while people with low and middle incomes end up footing most of the bill. We know we use words like broken and inequitable and upside-down a lot to describe our tax code. But they’re just accurate. Seriously, check this out.

Click on graphic to enlarge.

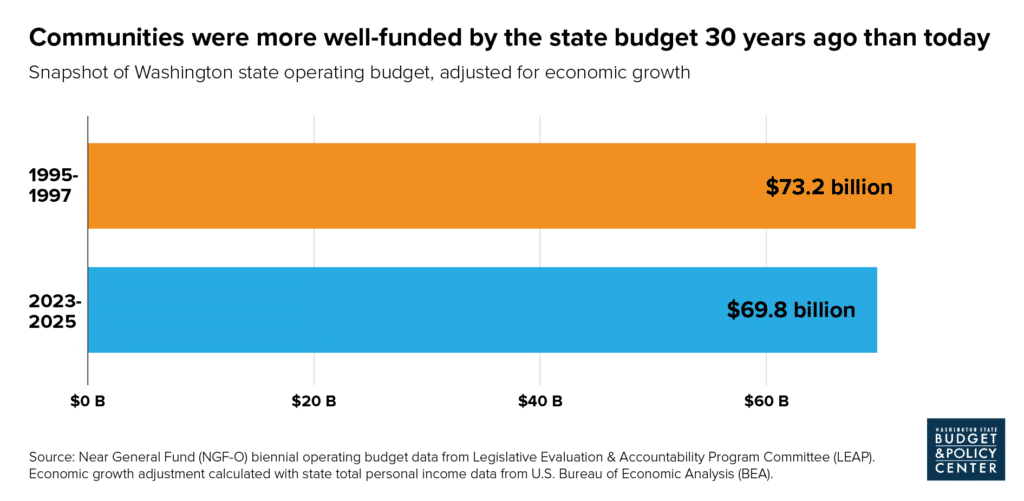

2. In a state that’s known for innovation and big ideas, it’s embarrassing to have an antiquated tax code that fails to meet the current needs of Washington state. Our state still uses a tax code established in the 1930s. This means lawmakers continue to try to balance the budget with taxes that put undue pressure on low- and middle-income households, such as the sales tax and gas tax. Not only are these taxes regressive, they’re unsustainable. Funding for our budget has not kept up with population growth, community needs, and inflation in our state, because that wealth is not taxed. In fact, we’re still living in the 1990s.

Click on graphic to enlarge.

(And, well, while we’re on the topic of things that are embarrassing about our tax code, it’s certainly awkward that Washington falls behind Idaho, Oregon, and Montana when it comes to tax rates on the ultra-wealthy.

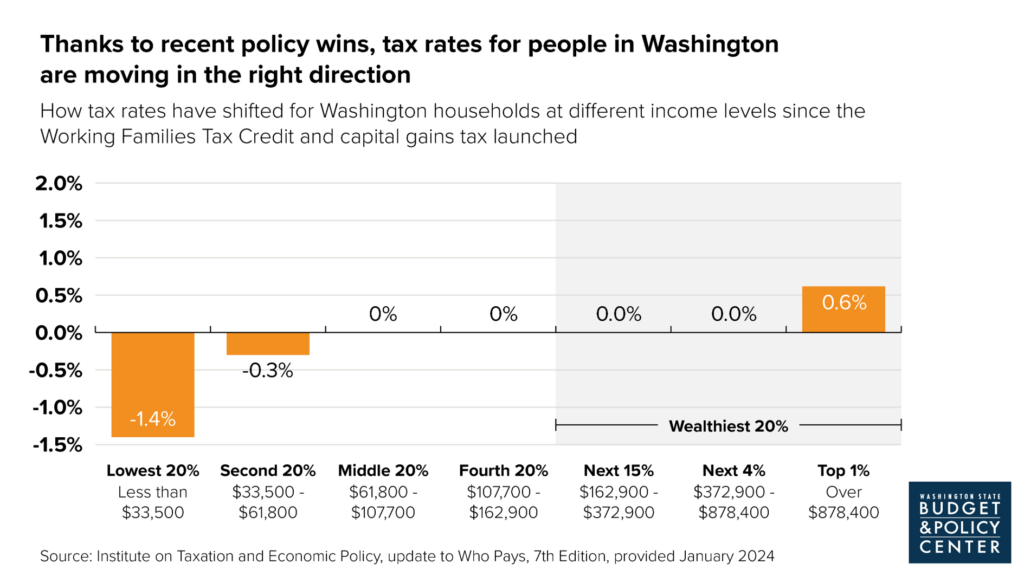

3. We’ve made good progress on fixing our tax code with smarter policies – and more must be done! The capital gains tax on the ultra-wealthy and the Working Families Tax Credit for low-income households went into effect in 2023. Since that time, the capital gains tax has brought in billions in funding for early learning and schools. The Working Families Tax Credit has provided an average cash boost of over $750 to over 200,000 families since it went into effect. The below chart (and this press release!) demonstrate how these policies started to balance our state tax code. This chart will get MUCH better if lawmakers enact progressive revenue and expand the tax credit this session.

Click on graphic to enlarge.

4. Putting people over profits is critical to a more sustainable and equitable tax code. It’s alarming to see massively profitable corporations in Washington state pushing back against commonsense proposals that will help maintain access to vital services for working people and families. Corporations and many of wealthiest people in our state have Washington state workers and state services (like child care, roads, and health care!) to thank for their exorbitant amounts of wealth. Corporate executives who are making a fuss sure seem more interested in their shareholders than in the well-being of their workers and communities. Lawmakers must heed the calls of everyday people who are imploring them to put people over corporate profits to preserve funding for critical services. Voices like:

- Educators in Pierce County: “Puyallup schools are underfunded despite public support. The legislature must act”

- A public health worker in Seattle: “Invest in public health”

- A state employee in Tacoma: “Protect state employee pay, benefits”

- An editorial board in Vancouver: “Budget cuts may make wildfire season riskier”

- A Seattle high school student: “Our schools are in a budget crisis and it’s making them less safe”

- And see more where these came from on our BlueSky thread

5. Fixing our tax code so it has adequate and sustainable revenue will help defend our state from federal threats and protect working-class and low-income people who continue to be most pummeled by losses in services. Lawmakers must act now to strengthen our state budget as the Trump administration and far-right Republicans make cuts to essential federal programs and agencies like Medicaid, Social Security, and the Centers for Disease Control. Budget and Policy Center Executive Director Eli Taylor Goss penned these pieces about how Washington state must stand up to federal threats:

- The Spokesman-Review: “In this Washington, lawmakers must act to protect people’s economic well-being”

- The Stranger: “What Version of Washington Do We Want to Be”

So while taxes are on your mind on this April 15, it’s a good time to write your lawmakers to say “Please help fix the tax code by ensuring the rich and powerful pay their share.”

Want to know more about the state budget and tax code? Visit our Schmudget blog, our Resources and Tools page, and our webpage about the 2025 revenue shortfall! And if you’re fired up to do more, get involved with Balance Our Tax Code!