Washington state continues to have the most upside-down tax code of any U.S. state, according to a new report from the Institute on Taxation and Economic Policy (ITEP). It wrongly requires people with the lowest incomes to pay six times more in taxes as a percent of their income than the state’s wealthiest residents to fund investments that benefit all Washingtonians.

Lawmakers need to create a more just tax code that better fits our vibrant state economy. They can take steps to do this by funding and expanding the Working Families Tax Rebate and closing a tax loophole on capital gains that benefits the very wealthiest households.

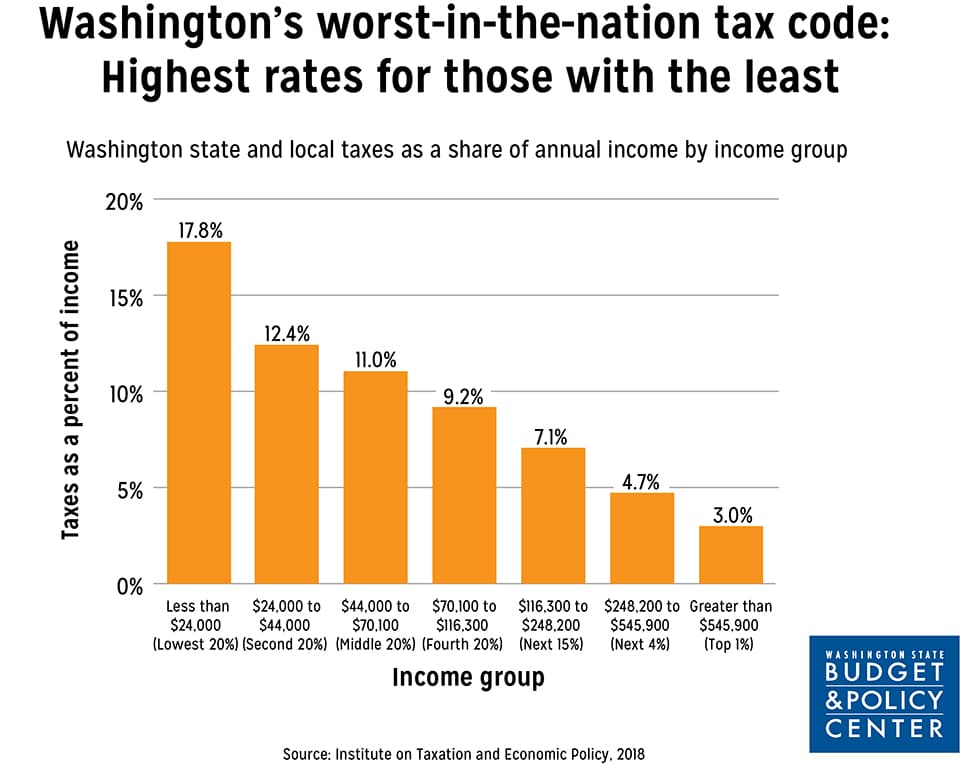

The report, “Who Pays? A Distributional Analysis of the Tax Systems in All 50 States,” finds that the poorest fifth of Washingtonians, those earning less than $24,000 per year, pay an average of 17.8 percent of their incomes in state and local taxes. By contrast, households earning more than $546,000 per year (the top 1 percent) pay only 3 percent of their incomes in taxes (see graph below). This gap in tax responsibility between the wealthiest and poorest families is wider in Washington state than any other state in the nation.

Click on image to enlarge.

The culprit behind this extreme imbalance is our state’s over-reliance on regressive forms of taxes, like sales and other excise taxes, that take an especially large bite out of lower- and middle-income family budgets while asking little of those at the very top of the income scale. Our state’s business and occupation tax is another major contributor to the problem, acting as a hidden sales tax on consumers. (See the Washington state fact sheet from ITEP for more details about our upside-down tax code.)

This is simply unacceptable. A state as cutting-edge and socially advanced as ours should not rely nearly so heavily on those who are least able to afford the taxes that fund state investments that benefit us all. Washington’s regressive tax code is especially hard on communities of color, many of whom, due to the legacy of systemic racism, are more likely to be in the lowest-income, highest-taxed portions of the population than in the highest-income, lowest-taxed portions.

Since 2009, 42 percent of all income generated in Washington state has gone to the wealthiest 1 percent. But our upside-down tax code only exacerbates rising income inequality, making it harder for families to make ends meet in the short run and virtually impossible to save for a house, a child’s college tuition, and retirement in the long run.

And asking so little of those at the very top of the income scale deprives us of resources needed for schools, health care, infrastructure, and other investments that create good jobs and form the foundation of a strong state economy.

It’s time we joined the company of our neighboring states on the West Coast, Oregon and California, which have much more equitable state and local tax codes. In fact, California has the most equitable tax code in the nation, while Oregon ranks tenth best.

When lawmakers convene in Olympia in January, they should take two critical steps toward creating a state and local tax code that fits Washingtonians’ values and the needs of their communities. First, extending our excise tax code to include currently untaxed capital gains would generate billions of dollars in new resources for community investments. Since the tax would almost exclusively be paid by the wealthiest two percent of Washingtonians, doing so would bring greater balance to the tax code at the top end of the income scale.

Second, funding and expanding the Working Families Tax Rebate, our state’s unfunded version of the federal Earned Income Tax Credit, would significantly reduce taxes for the 40 percent of households with the lowest incomes. This would create more opportunity for those who have been denied their just share of our state’s growing prosperity.

While Washington leads the nation in many important ways, our neighboring states have far surpassed us when it comes to creating balanced and equitable systems for funding investments that build thriving communities. This new ITEP report reaffirming our tax code’s worst-in-the-nation status shows we’re long overdue for a tax code overhaul. Now is the time to get started.

For more, see our press release about ITEP’s new “Who Pays?” report. For media inquiries, contact Melinda Young-Flynn, communications director, 206.262.0973, x223.