Wasteful tax breaks are depriving our communities of billions of dollars that are instead being funneled to large corporations and special interests that have manipulated the tax code in their favor. Those special interests are receiving money that our state could be collecting and investing in public priorities that benefit us all, like schools, utilities, and emergency services.

To support the well-being of our state and its people, lawmakers must take long-overdue steps toward cleaning up our tax code so that it serves all Washingtonians and secures revenue to fund important state programs. They can do that by getting rid of budget-busting tax breaks.

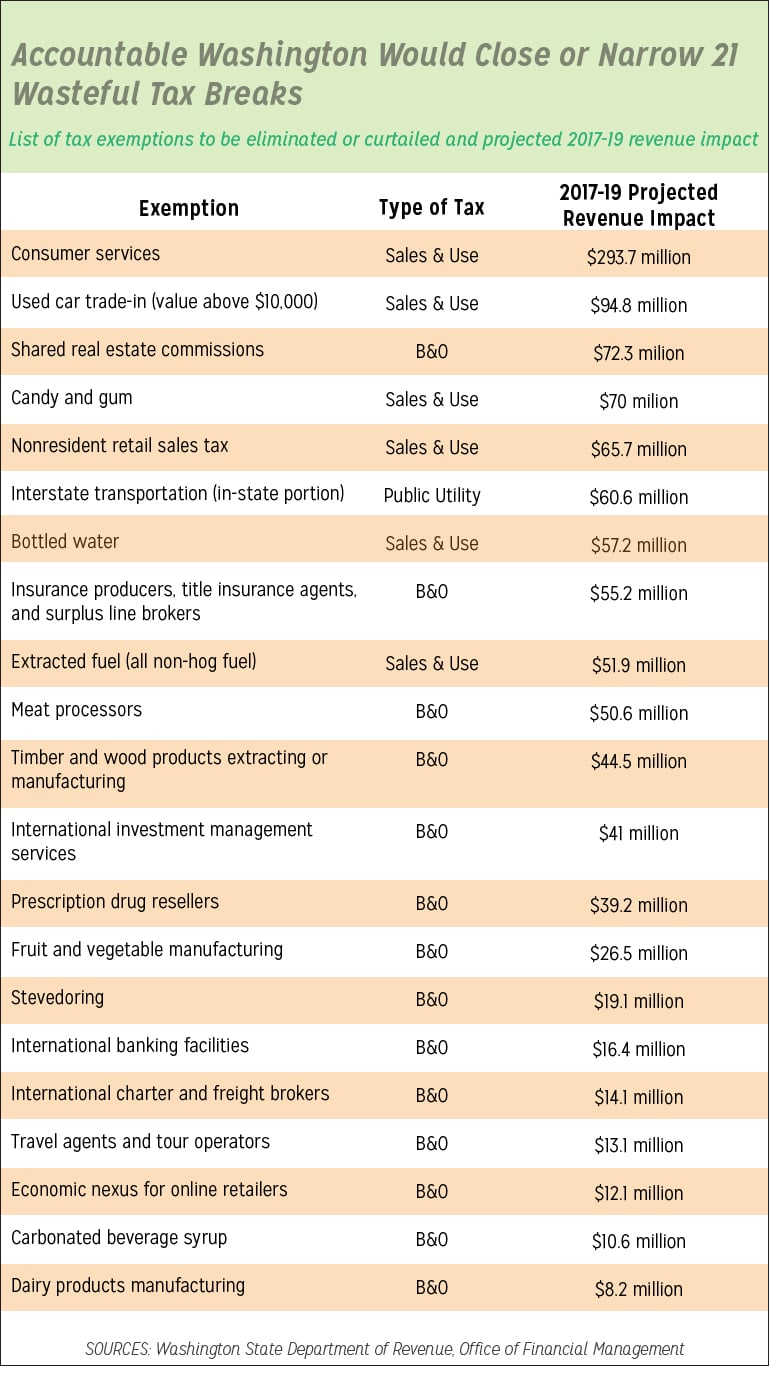

The Budget & Policy Center’s revenue reform plan, Accountable Washington, proposes closing or narrowing 21 of the most wasteful and outdated tax breaks in the code, which would inject $1.1 billion into our communities in the 2017-2019 biennium. They are detailed below.

Narrow the tax break for big oil extractors. Fuel used by manufacturers or extractors in the process of manufacturing or extracting at the same plant is exempt from the use tax. This tax break was originally enacted to benefit the timber industry, but today, it primarily benefits the oil industry. Curtailing this exemption would end the tax break for all fuel extractors, except on fuel from wood byproducts, also known as “hog fuel.”

Repeal the sales tax break for nonresident shoppers. Residents of states where there is no or low sales tax – primarily Oregon, Alaska, Montana, and certain Canadian provinces – may make purchases in Washington without paying the sales tax. This exemption was originally enacted to make Washington’s border businesses competitive with neighboring states. However, the majority of exempt purchases from qualifying nonresidents occur in King County, which isn’t a border county. That suggests this break is wasted on tourists who would shop in Washington with or without it.

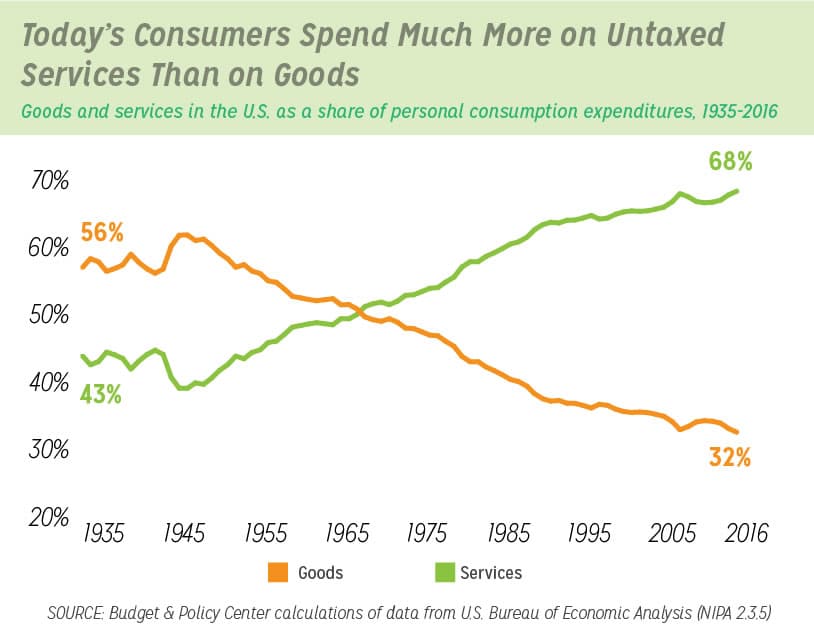

Apply the sales tax to consumer services. Washington’s sales tax mostly applies to tangible retail goods, such as cars and appliances. It also applies to many “nondurable” goods such as toothpaste and other hygiene products. That worked pretty well back in the 1930s when consumers spent most of their incomes on these kinds of products. But, as the chart below shows, consumers today spend the majority of their income on services not covered by the sales tax. It makes sense to modernize our tax code to reflect this economic reality. Applying the sales tax to consumer services, such as spa treatments, financial advice, and cable and satellite TV packages would accomplish that.

Close the sales tax break on bottled water. Our state’s sales tax applied to bottled water until 2008, when Washington joined a multi-state effort to conform to a single set of sales tax standards, which excluded bottled water. Since then, this exemption has left millions of dollars on the table each year. Not to mention the negative effects on the environment: Not only does packaging and transporting bottled water contribute to global warming, but empty plastic bottles are also notorious for filling landfills and clogging waterways. Policymakers can reapply the sales tax to most purchases of bottled water while ensuring it remains untaxed for people who don’t have access to potable water.

Close the sales tax break on candy and gum. Washington state has a broad-based sales tax. While there are valid sales tax exemptions for some consumer goods, including many grocery items, there is no compelling economic reason why candy, gum, and baked confections should have a tax exemption. Applying the sales tax to these items would generate significant new resources and make the sales tax more broad and sustainable in the long run.

Eliminate a business tax break for large online retailers. Retailers that have employees and properties located in Washington state pay business & occupation (B&O) taxes on the goods they sell to Washingtonians. However, large online retailers with no employees or offices located in Washington don’t pay any B&O taxes – even though they sell millions of dollars in goods to customers located here. This loophole can be closed by adopting an “economic nexus” approach for the B&O tax. Under this rule, any business that makes at least one quarter of its total sales to customers in Washington state, or that has at least $267,000 in sales here, would be required to pay B&O taxes on their in-state activities.

Narrow the tax break for trade-in vehicles valued over $10,000. Under current law, the full value of a vehicle trade-in to a dealership is exempted from the state sales tax. We propose limiting this exemption to the first $10,000 of trade-in value. The Citizen Commission for Performance of Tax Preferences notes that this tax break doesn’t stimulate enough additional sales to replace the lost sales tax revenue. Further, the average vehicle traded in at a dealership is valued at $7,500, which means many trade-ins would remain exempt under the proposed $10,000 threshold.

Eliminate the preferential tax rate for prescription drug resellers. Businesses that warehouse and resell prescription drugs pay a B&O rate that is less than a third of the standard rate for wholesaling. Even though this preference was passed to lure prescription drug wholesalers to relocate to our state, the preference is now available to all drug resellers who do business here, including those operating out-of-state warehouses. This preference no longer serves any purpose except to provide giveaways to prescription drug companies.

Close the public utility tax break for interstate trucking and rail hauls. Transportation businesses that begin or end their trip outside of Washington state are not taxed on any of their income generated from activities here. Repealing this exemption would subject such businesses to the public utility tax for income received while in the state.

Eliminate B&O tax breaks that no longer serve us, including for industries such as international investment management services and banking facilities, travel arrangement services like those provided online, and soda sellers. These industries get a break on their B&O taxes even though there’s little evidence that they benefit state or local economies.

The full list of tax breaks we propose to narrow or close can be found in the table below.

When our state gives away money to big oil, international investment banking companies, and prescription drug resellers, it can’t use those dollars to invest in the things that benefit us all. It’s time for lawmakers to clean up these wasteful and outdated tax breaks and invest those resources into the things that provide the foundations for thriving communities – from schools to public health programs, and from parks to walkable sidewalks.