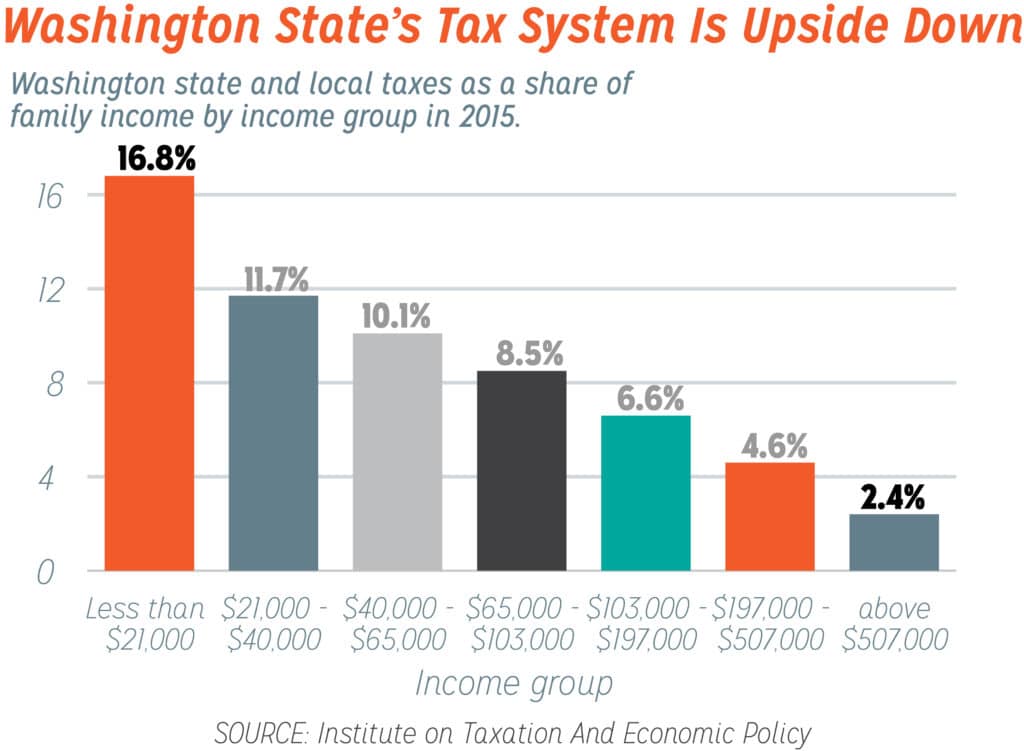

While most Washingtonians agree that everyone has a responsibility to help pay for schools, safe communities, health care, and other broadly shared investments that create jobs and grow the economy, the state continues to have the most upside down state and local tax system of any U.S. state, according to a new report, “Who Pays?”, from the Institute on Taxation and Economic Policy.

People with lower and moderate incomes – a disproportionate share from communities of color – pay a much larger portion of their incomes in Washington’s state and local taxes than those at the very top of the income scale, who are disproportionately white.

As the graph below shows:

- The poorest fifth of Washingtonians, those with incomes below $21,000 per year, pay an average of 16.8 percent of their incomes in state and local taxes.

- The middle fifth of Washingtonians, whose incomes fall between $40,000 and $65,000 per year, pay 10 percent of their incomes in state and local taxes every year on average.

- The richest 1 percent of Washingtonians, who earn a minimum of $507,000 per year, pay on average only 2.4 percent of their incomes in state and local taxes.

Click on graphic to enlarge.

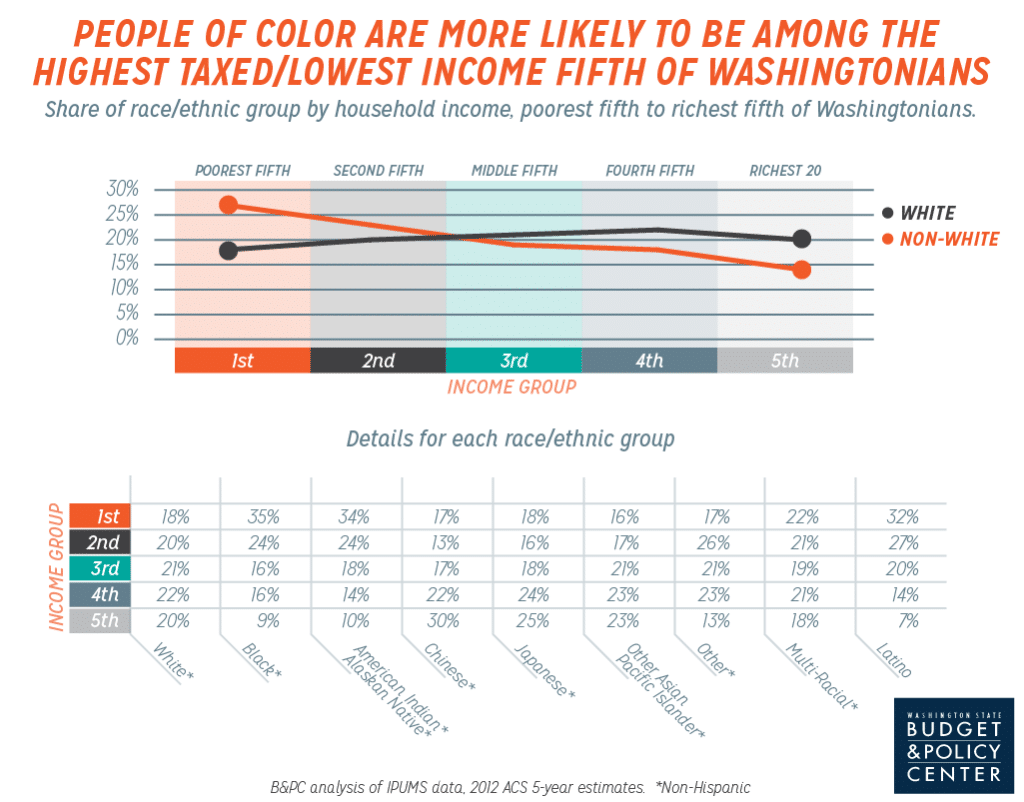

Washington state’s upside down tax system takes an especially heavy toll on people from communities of color. Washingtonians from communities of color are far more likely to be among the poorest fifth of the population, which face the highest effective state and local tax rates, than among the richest fifth of the population that enjoys considerably lower effective tax rates (see graph below). By contrast, white Washingtonians have a roughly equal chance of being in either the poorest fifth of the population or the richest fifth.

Click on graphic to enlarge.

Governor Inslee has called for a reasonable reforms, such as enacting a new capital gains tax on profits from the sale of high-end financial assets and funding a rebate program for hardworking Washingtonians with children, that would help to rebalance the state tax system while generating additional resources for schools and other investments that benefit all Washingtonians. Policymakers should follow his lead by enacting these proposals while looking for other ways to make the tax system more equitable and dependable.