All of Washington’s kids deserve great schools, but the hard truth is that too many of them will remain saddled with under-resourced K-12 schools as long as a damaging law that arbitrarily suppresses state property tax collections remains on the books. This law starves Washington’s schools of adequate funding – and children of color have been disproportionately harmed by the chronic lack of investment in schools that it has created.

That’s why our organization, in partnership with the Equity in Education Coalition and three state legislators, has submitted an amicus brief to the Washington State Supreme Court focused on this damaging law. Our brief demonstrates to the court – as the justices are in the process of ruling whether the legislature has fulfilled its duty to amply fund schools under the McCleary case – that this law should be struck down as an unconstitutional barrier to funding the great schools our kids deserve.

First enacted in 2001 with the passage of Tim Eyman’s Initiative 747 (and later reenacted by the legislature after I-747 was struck down by the state Supreme Court), the restriction significantly weakened the state property tax, which is a major source of funding for Washington schools. The restriction arbitrarily caps annual growth in state property tax revenues to 1 percent (or the rate of inflation, whichever is lower) plus the value of new construction. Given that the annual costs to recruit and keep excellent teachers, purchase up-to-date computers and other classroom technologies, and buy other important resources grow faster than the law allows state property tax revenues to grow, the restriction has effectively drained billions of dollars in resources from our local schools over most of the last two decades. It will continue to do so if it’s not significantly reformed or taken off the books.

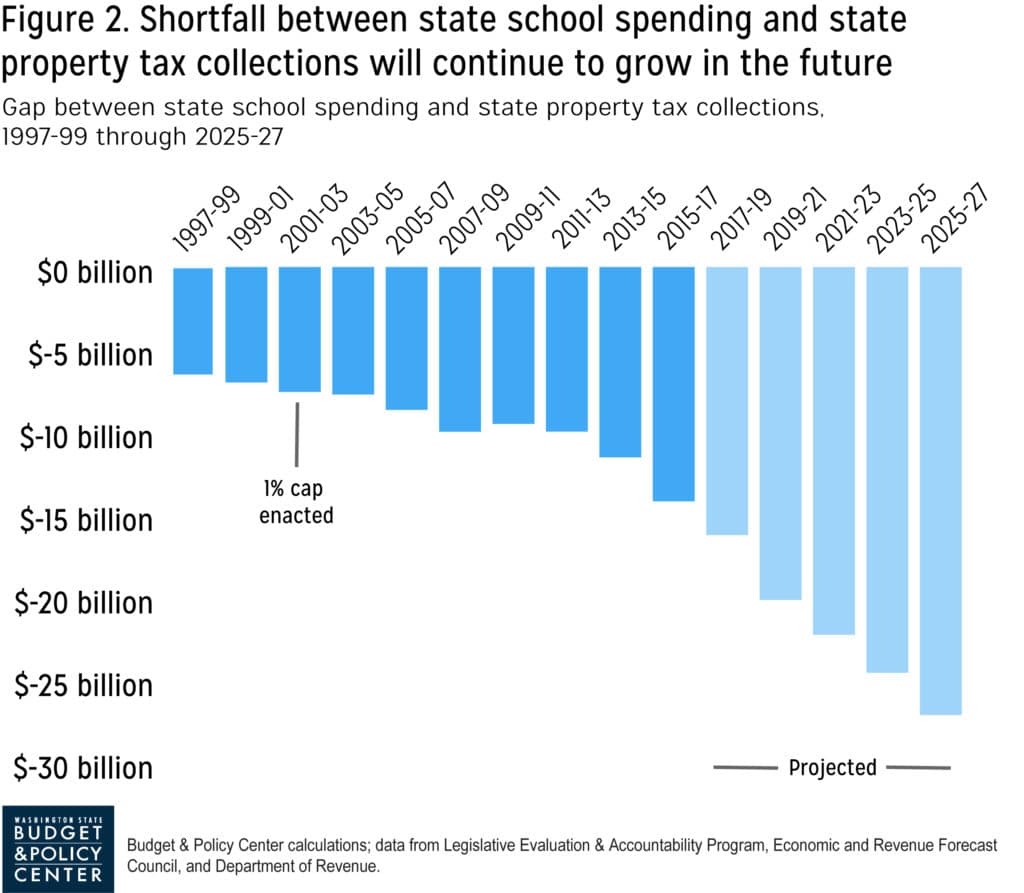

As shown in Figure 1 from the brief, from 1992 to 2000, the period of economic expansion immediately before the restriction was enacted, the state property tax was a robust and stable source of funding for our schools, growing at nearly the same average annual rate as property values. But our property tax revenue foundation grew much weaker after the restriction was enacted in late 2001. While property values grew at an average annual rate of 10 percent between 2002 and 2009, state property tax revenues grew by only 3.4 percent per year on average during this period.

Click on image to enlarge.

The property tax restriction took an especially large toll on school funding in the wake of the Great Recession. Although the Recession nominally ended in early 2009, its lingering effects caused property values to decline for several years afterward, bottoming out in 2013.

The construction boom that followed led to a rapid turnaround, with property values growing by 7 percent per year on average between 2013 and 2016. But again, the restriction did exactly what it was designed to do: it held property tax revenue to an average growth rate of only 2.1 percent during this period, preventing our schools from reaping any meaningful benefit from the booming recovery.

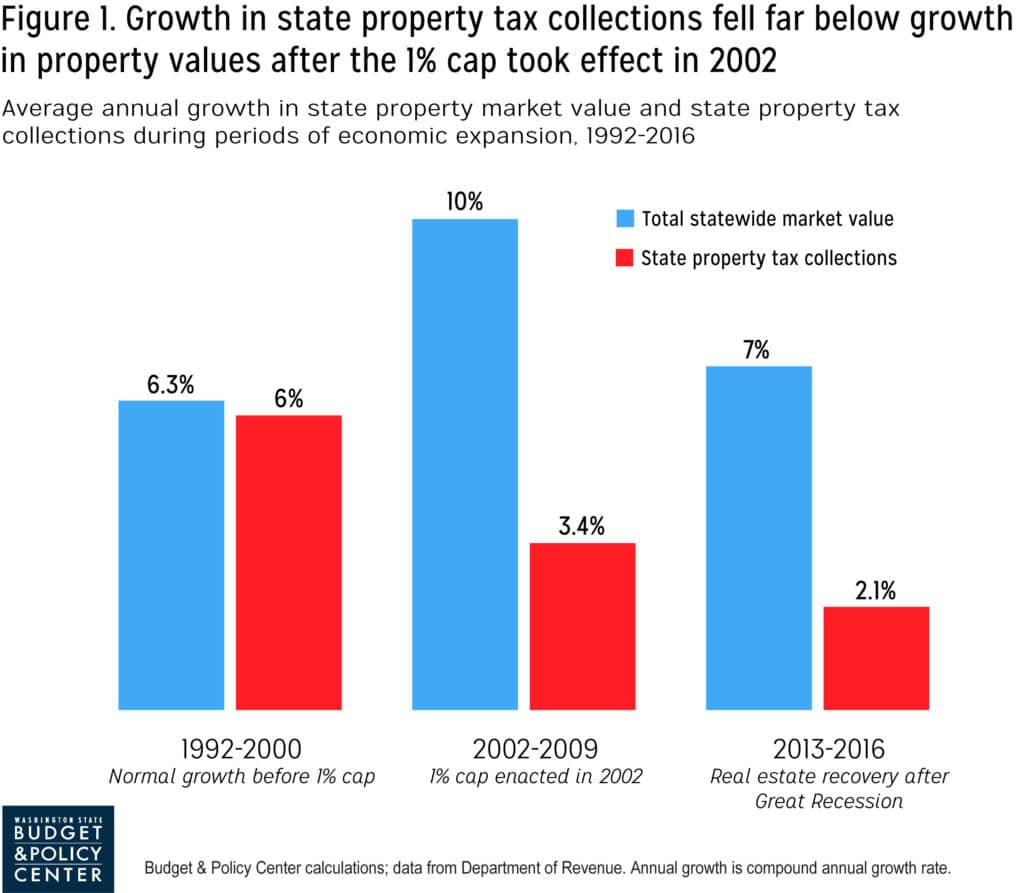

The gap between state property tax collections and school funding has steadily ballooned under the restriction (see Figure 2). As part of their McCleary “fix,” lawmakers this year temporarily suspended the restriction to raise new state property tax resources for schools. However, it is slated to go back into effect in 2022. If this happens, the restriction will quickly erase most of the school funding progress achieved this year. In fact, the gap will rise to $27 billion in the 2025-27 cycle from the current shortfall of $16 billion.

Click on image to enlarge.

The property tax restriction has taken an especially heavy toll on kids of color throughout Washington. As our brief states,

While much more will need to be done to close the opportunity gap, eliminating the property tax restriction would free up resources needed to bolster opportunities for kids of color and kids from families with lower incomes in every corner of our state.

It’s important to note that while eliminating the restriction would allow property taxes to increase, lawmakers can take actions to ensure that lower- and middle-income households don’t wind up saddled with unaffordably high property tax bills. (Information about our safeguard rebate proposal and other equitable reforms to our property tax code, for example, is available here and here.)

The bottom line is the property tax restriction makes it even harder to sustainably fund Washington’s kids’ classrooms, which is particularly detrimental to children of color. All kids should have access to great schools with up-to-date textbooks, learning resources, and facilities – so that they can have the opportunity to thrive. That’s why we urge the Supreme Court to strike down this damaging restriction.

See the entire amicus brief that we submitted in partnership with the Equity in Education Coalition, Sen. Jamie Pedersen, Rep. Laurie Jinkins, and Rep. Gerry Pollet here.

And read the Seattle Times article about all of the amicus briefs submitted to the Supreme Court for the McCleary case here.