The truth about Washington’s revenue shortfall

Two key things to know about the budget shortfall lawmakers faced during the 2025 legislative session are:

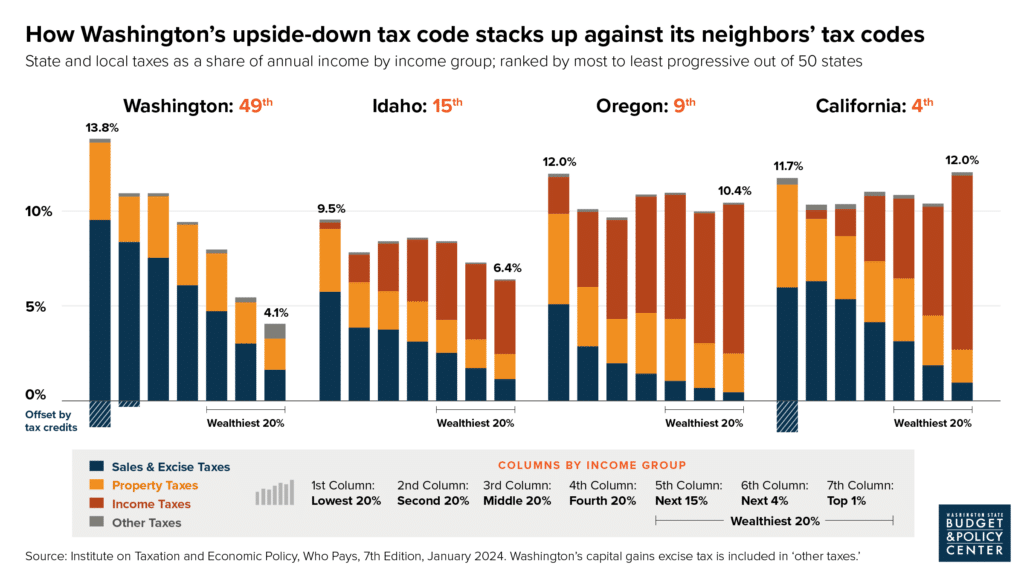

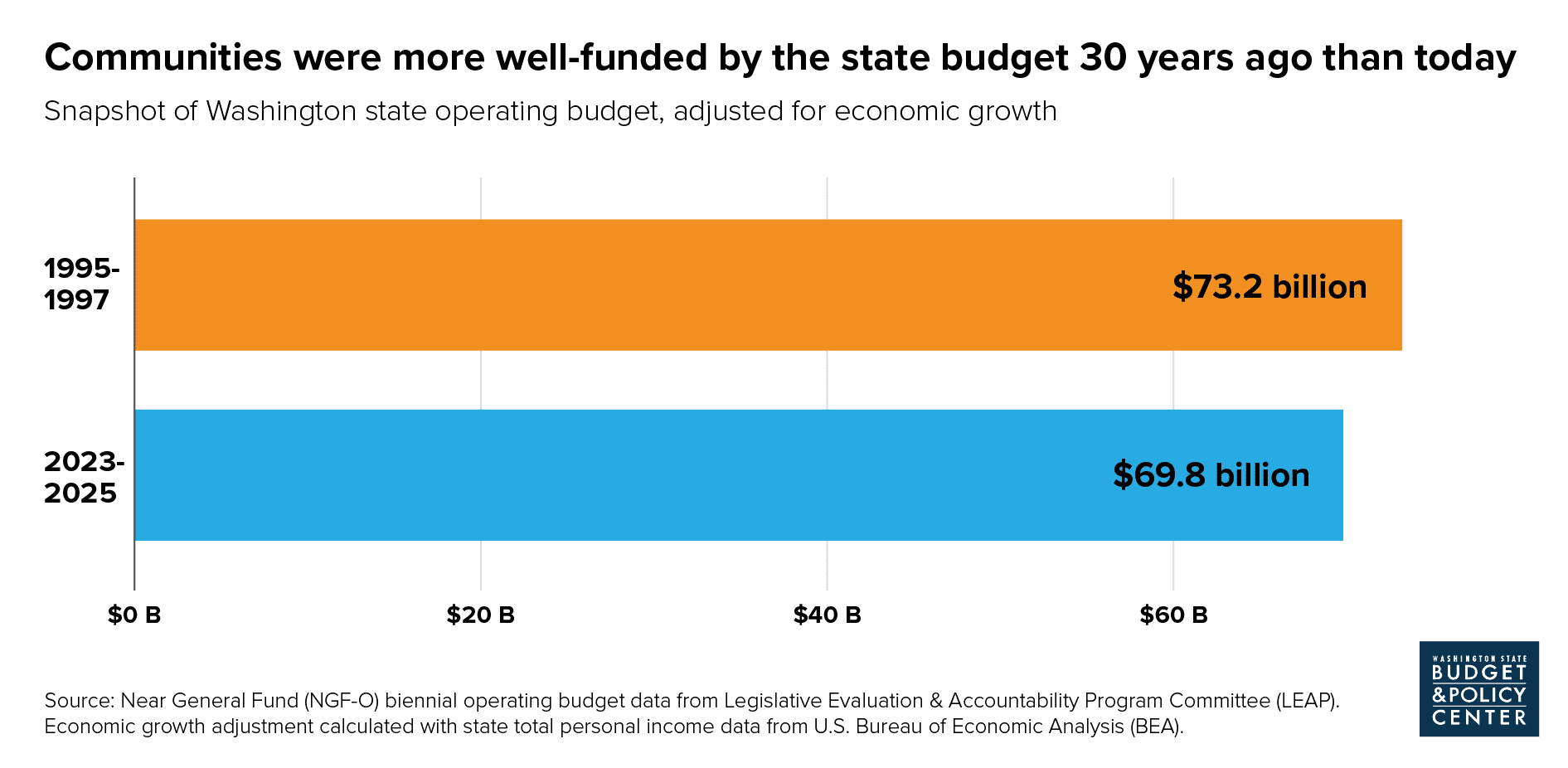

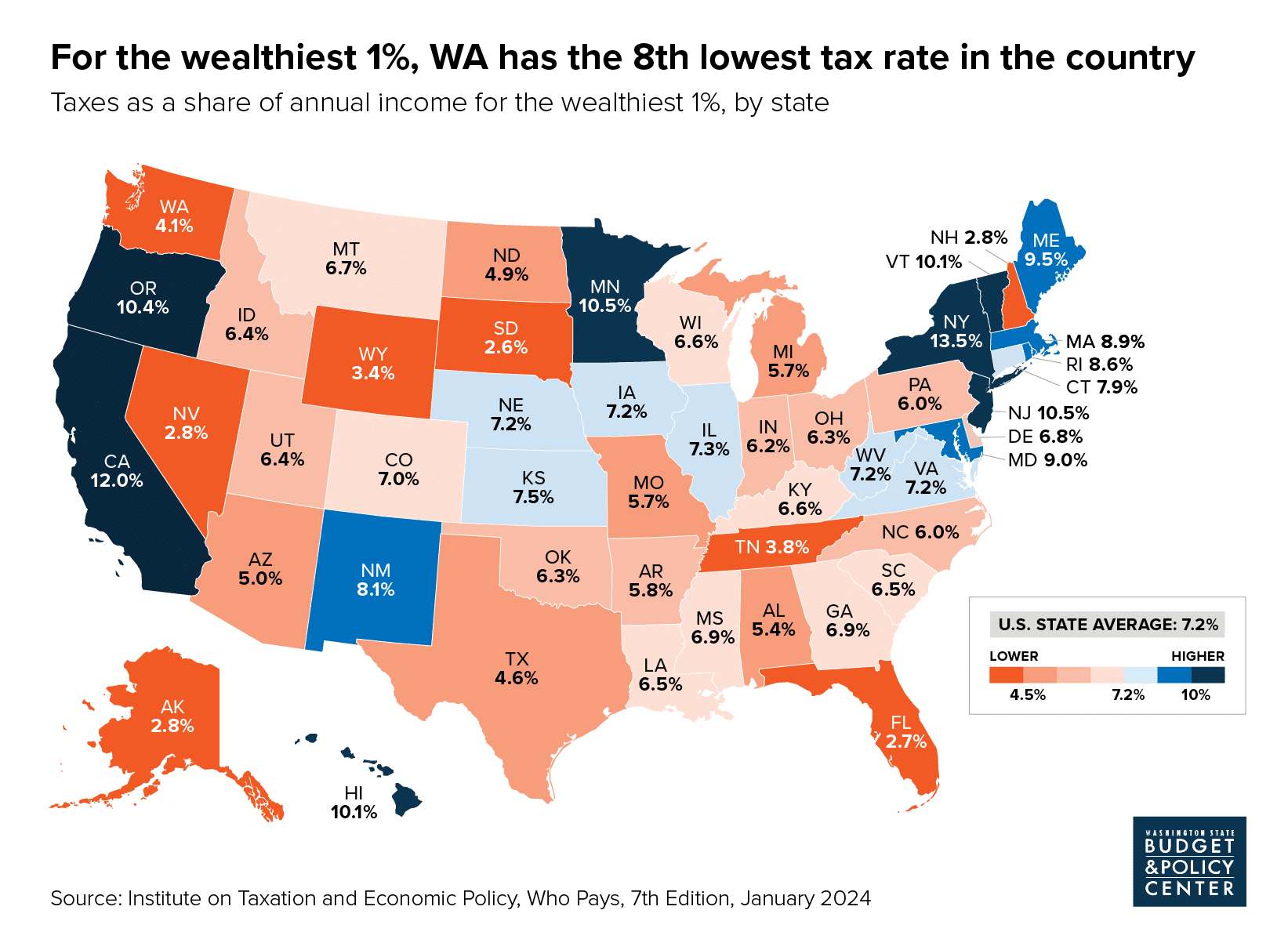

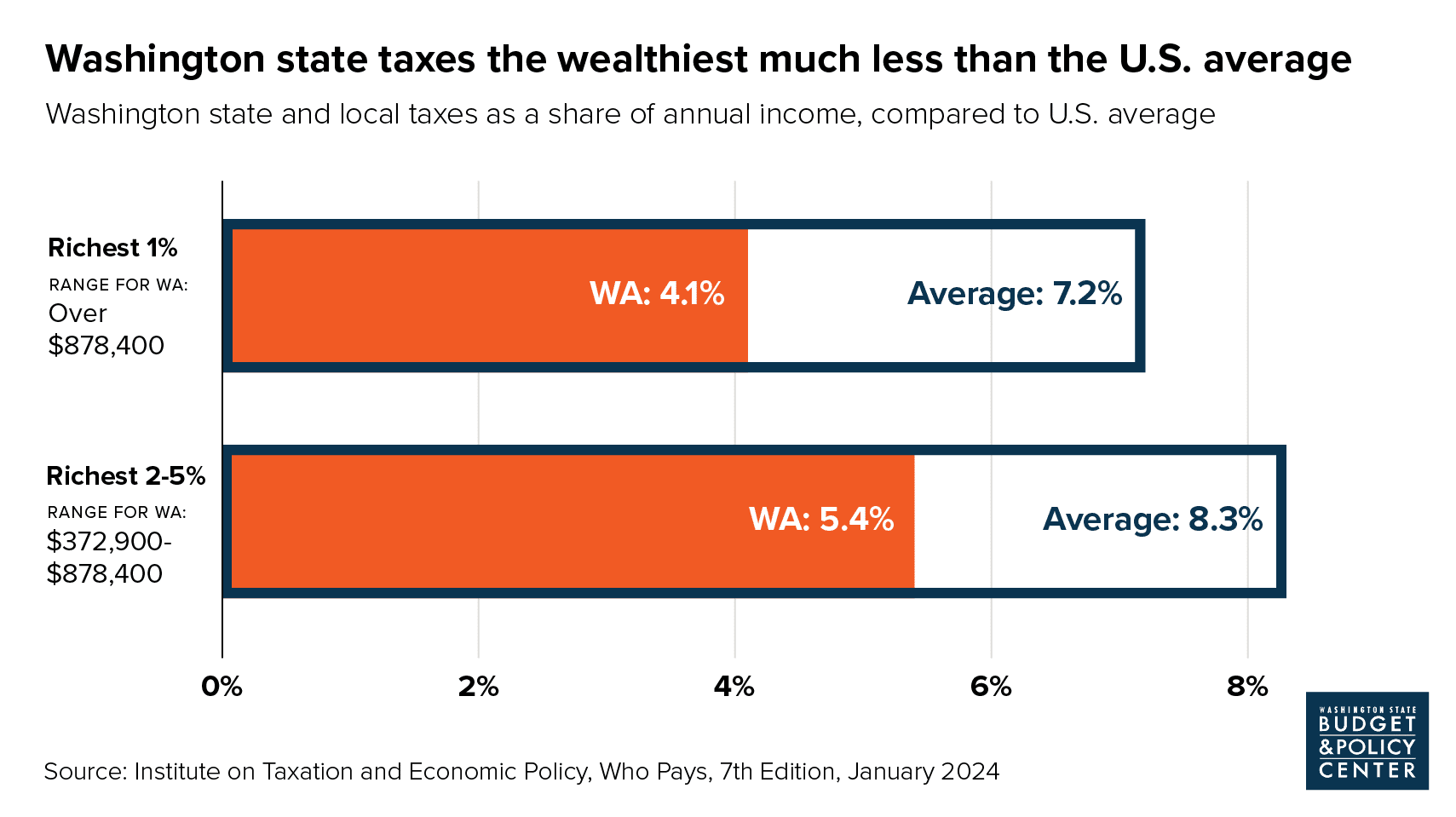

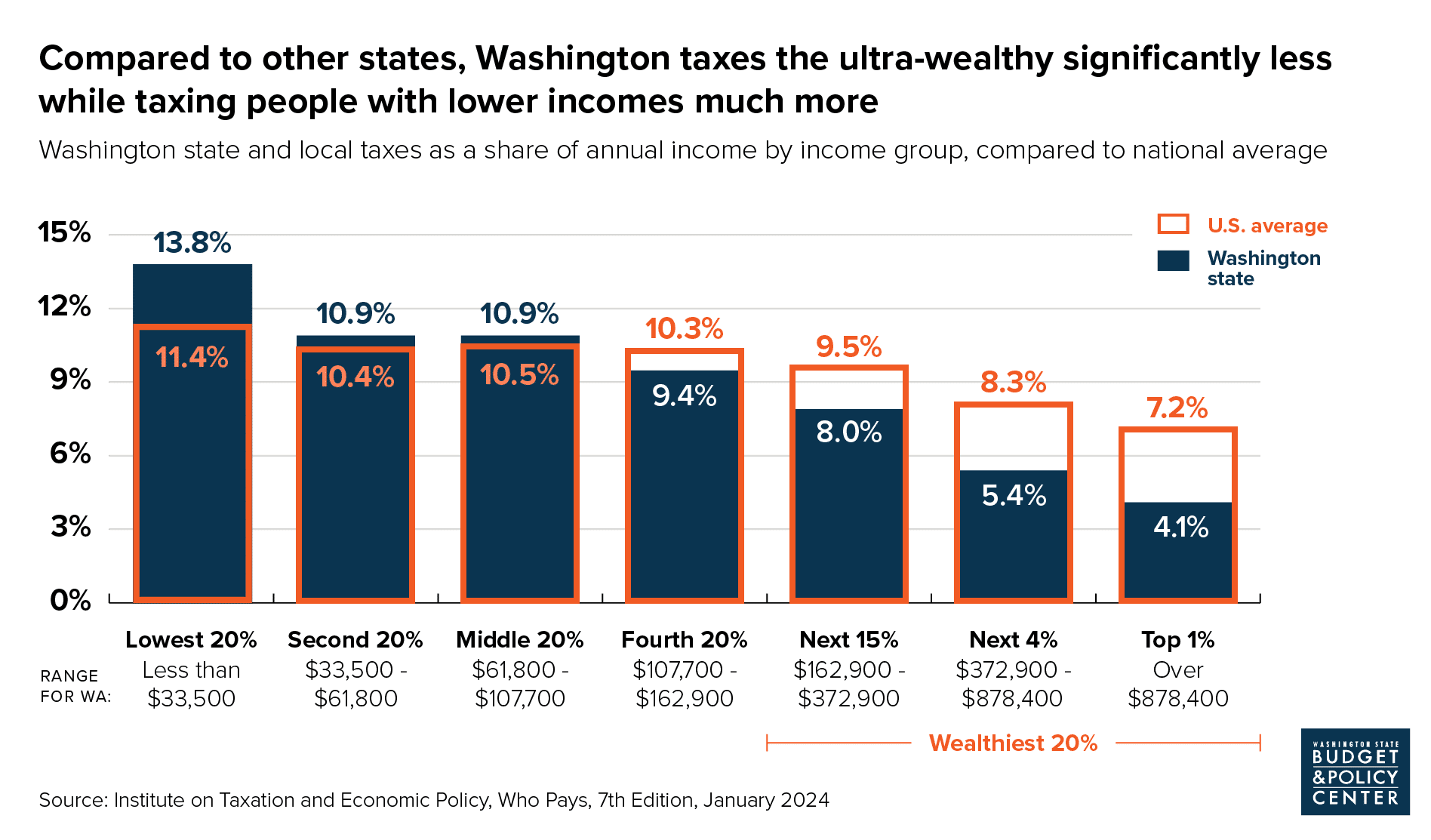

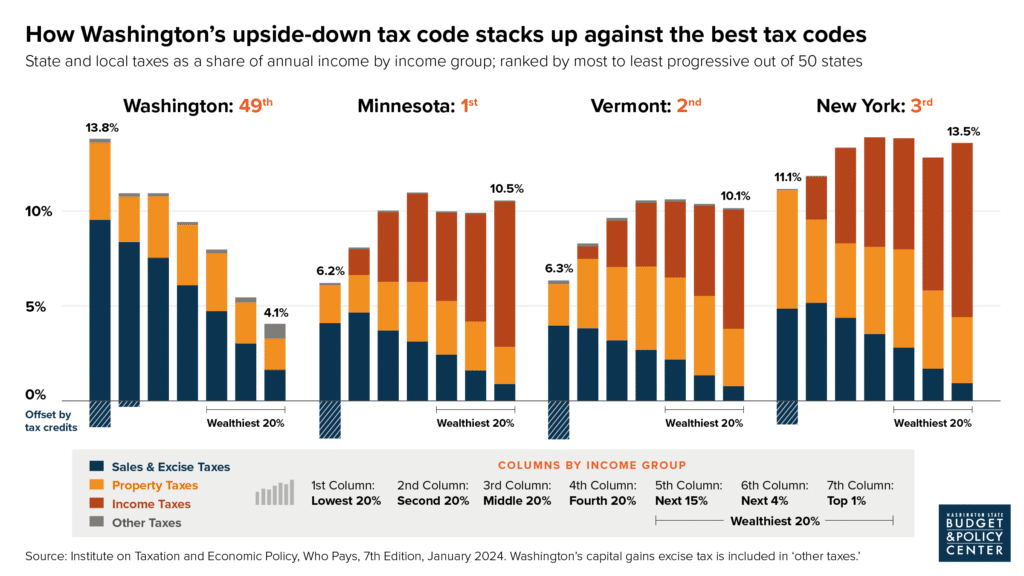

- It is in large part a direct result of our state’s inequitable tax code that relies on those with the least to pay the most. Revenue has failed to meet community needs because lawmakers are not requiring that millionaires, billionaires, and highly profitable corporations pay their share of taxes. As a result, important programs are chronically underfunded, like schools, child care, and mental and behavioral health programs.

- It has a straightforward solution: Lawmakers can generate equitable new forms of revenue.

The people of Washington want equitable, progressive taxes, like the capital gains tax that voters overwhelmingly upheld on the ballot in November 2024.

Post-session update: Although they made some incremental changes to prevent across-the-board budget cuts, lawmakers ultimately failed to pass commonsense progressive proposals during legislative session.

For more information about the continued budget shortfall in our state, take a look at our fact sheet about the revenue crisis and the below analyses that highlight the need for lawmakers to fix our state’s inequitable tax code and avoid harmful budget cuts:

Click on image to enlarge.

Click on image to enlarge.

Click on image to enlarge.

Click on image to enlarge.