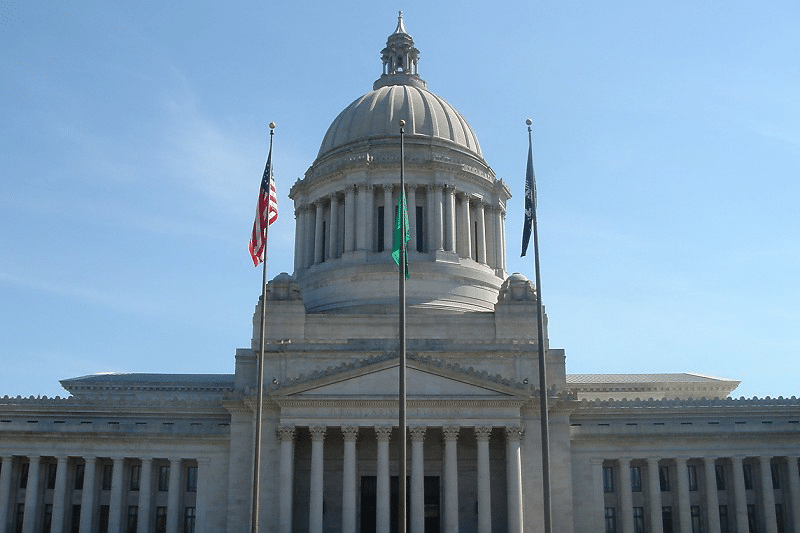

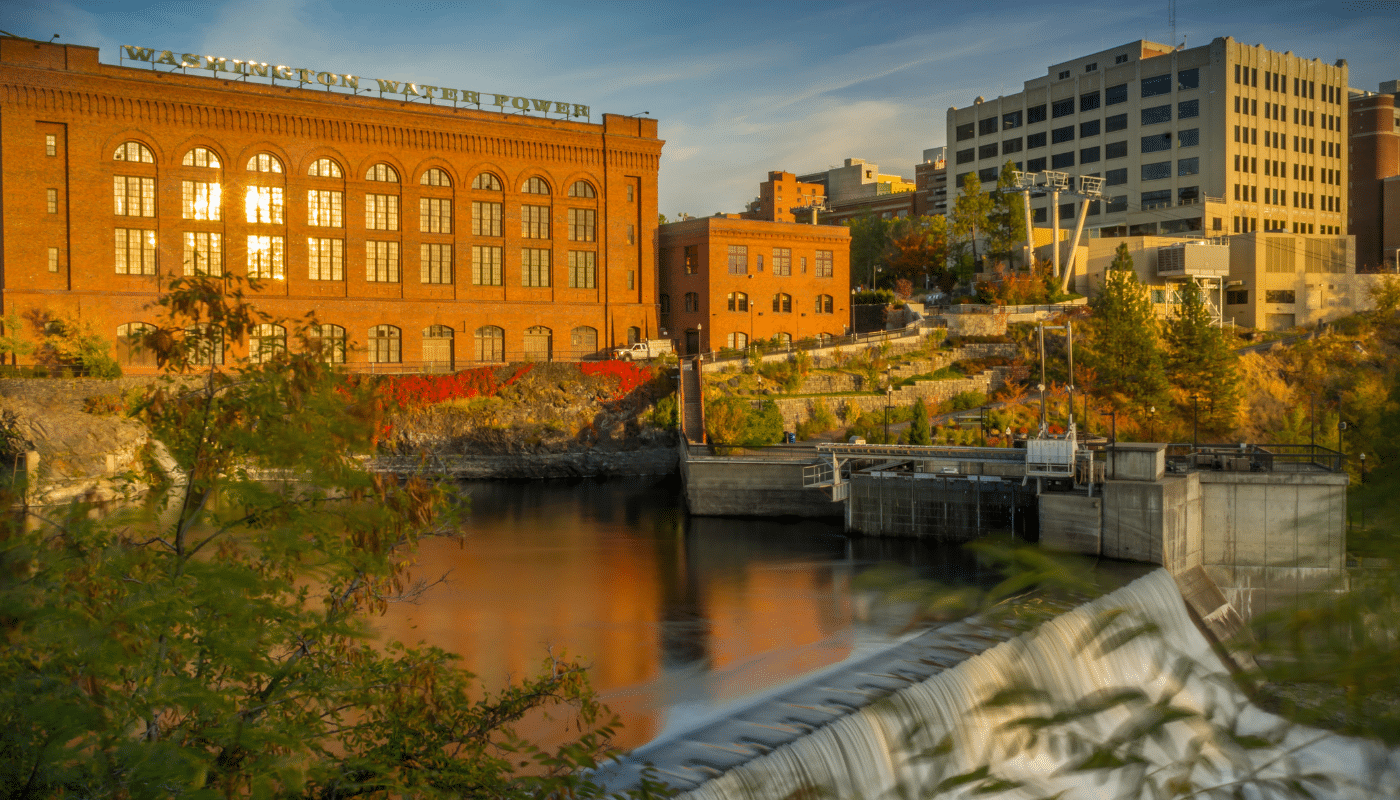

To create thriving communities, state lawmakers must invest in the foundations of a strong economy – things like accessible child care and solid public infrastructure. To do this, they must fix our broken tax code in which people with low and moderate incomes pay much more in state and local taxes as a share of income than corporations and the richest 1%. This is not only inequitable, but it’s also unsustainable. Progressive revenue is essential to creating a healthy state budget.

EXPLORE