Any reform to the Washington state property tax code to help pay for schools must also take steps to make the tax code more equitable. In conjunction with other reforms that the Budget & Policy Center is proposing to the property tax, legislators should consider creating a new property tax rebate – called a safeguard rebate – to reduce property tax payments for homeowners and renters with middle and lower incomes. This new rebate would ensure that our proposed changes to the property tax code do not disproportionately impact these residents.

For eligible households, the safeguard rebate would reduce property tax payments that exceed a certain portion of a household’s annual income. The rebate would be available to homeowners and renters in Washington state with annual household incomes below $75,000. More specifically:

- Households earning less than $25,000 per year would be refunded all of the property taxes they pay, up to a maximum of $1,500.

- Households earning $25,000 to $46,999 would be refunded their property taxes in excess of 1 percent of household income, up to a maximum of $1,250.

- Households earning $47,000 to $74,999 would be refunded their property taxes paid in excess of 2 percent of household income, up to a maximum of $1,000.

The Budget & Policy Center’s property tax reform proposals would increase the state property tax rate and eliminate the law that artificially restricts property tax growth. Adding in this safeguard rebate is an important step to ensure that these reforms don’t most heavily impact the people who can least afford a higher tax.

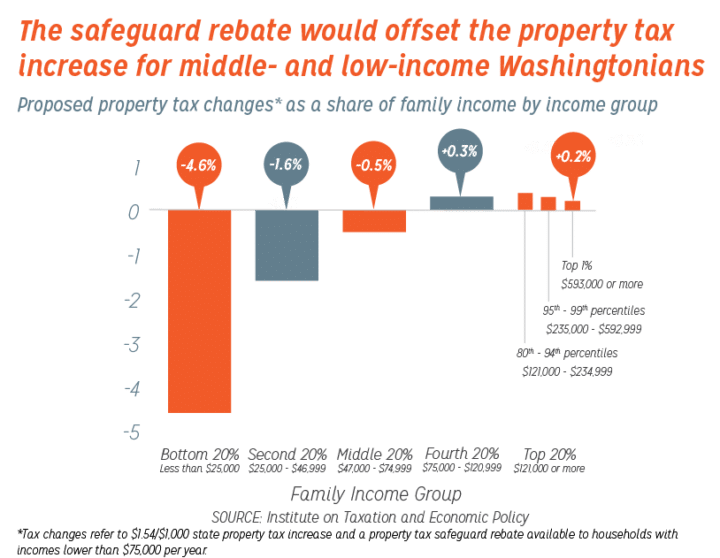

In fact, creating this safeguard rebate would actually result in reduced property taxes for lower- and middle-income households. The chart below shows how safeguard rebates would offset the effect of increasing the state property tax for households bringing in less than $75,000 per year. The households with the lowest incomes would see their overall state and local tax bills shrink by 4.6 percent of their annual incomes.

Click on the graphic below to see an enlarged version.

Importantly, the rebate would be available to renters as well as homeowners. Even though renters do not directly pay property taxes, economists note that most landlords pass some of their property tax bills on to renters, and renters pay property taxes through higher rents. Under this proposal, renters would be able to assume that 15 percent of their rent is property tax, and they would be eligible for the safeguard rebate under the same parameters as homeowners.

Across the nation, 18 states have enacted similar property tax credits or rebates, and 16 of them include renters in the program. This is an approach that has been tested – and works – in other states.

Protecting households with middle and low incomes paves the way for lawmakers to raise property tax revenue in an equitable way – from Washingtonians at the top of the income scale who currently pay seven times less in state taxes as a percentage of their incomes than those with the lowest incomes.

By promoting equity and raising essential revenue, safeguard rebates are a smart path to keeping property taxes affordable for those who already struggle to make ends meet. They would help fix a tax code that for far too long has raised revenue on the backs of those who can least afford it while giving the richest 1 percent a break.