Currently, our state tax code caters to the wealthiest Washingtonians by giving them generous tax breaks on their capital gains – which are the profits they make from the sale of corporate stocks, bonds, gold bars, and other high-end financial assets. Such financial assets are exempt not only from state and local sales taxes, but also from property taxes, and most business & occupation (B&O) taxes. The simplest and most equitable way to effectively close these state tax breaks is to enact a state excise tax on high-end capital gains. Doing so would generate substantial new resources for Washington state’s schools and other investments that foster thriving communities. Eliminating the tax breaks on profits from capital assets in this way would represent a significant step toward turning Washington’s inequitable, upside-down tax code – in which people with low incomes pay seven times as much in state and local taxes as a share of income as the wealthiest 1 percent – right-side-up.

Click on graphic to enlarge.

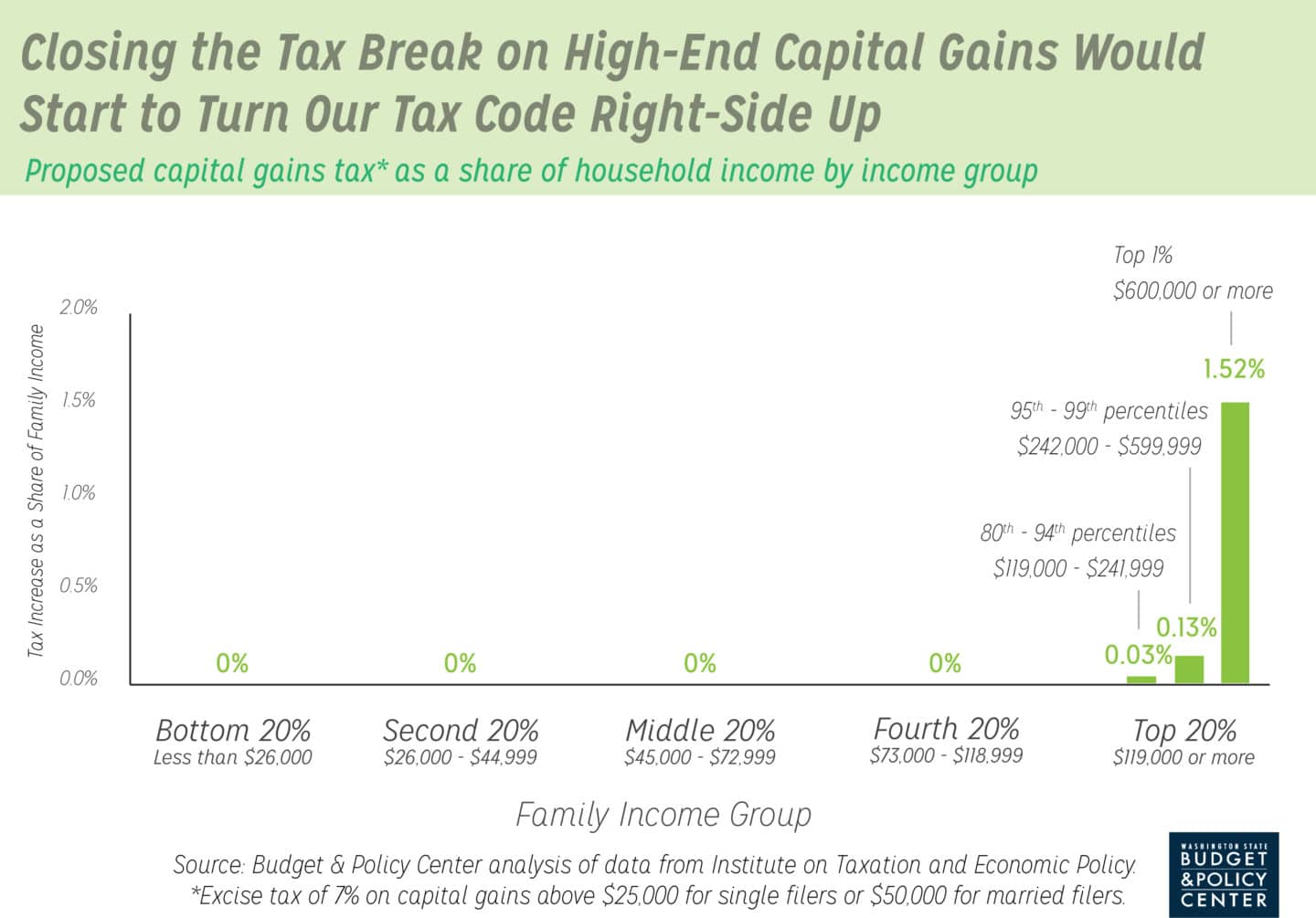

Democratic leaders in the state House of Representatives have sensibly proposed to close the loopholes on most profits from capital assets in Washington state’s tax code with a new 7 percent excise tax on capital gains above $25,000 ($50,000 for a married couple). As the chart above shows, 92 percent of capital gains taxes would be paid by the wealthiest 1 percent of Washington’s families – those with incomes above $600,000 per year. By contrast, virtually none of the additional tax revenue would come from families with incomes below $119,000 per year. Only 0.03 percent of households in that group would pay any additional taxes.

Closing the capital gains tax break would generate more than $700 million per year in new resources for schools, child care, environmental protection, and other priorities that serve Washingtonians. And the additional payments from the few households that would be impacted would be relatively small. As the chart below shows, on average, taxes would increase by only 1.5 percent as a share of annual incomes among the richest 1 percent of households in Washington state. This is a small price to pay for the people who have benefited most from our economy to ensure that all kids have access to great schools and all Washingtonians can have thriving communities.

Click on graphic to enlarge.

The excise tax on capital gains proposed by House Democrats is the most sensible way to address the numerous tax breaks for capital assets on the books in Washington state, which include exemptions and exclusions from the sales tax, property tax, and B&O tax (Washington’s three major revenue sources). When it comes to the sales tax, for example, people don’t have to pay it when they buy or sell stocks, bonds, and other high-end financial assets (or intangible goods). But Washingtonians do pay sales tax when they buy tangible goods, like cars, appliances, soap, and toothpaste. Because stocks and other financial assets are heavily concentrated among the wealthiest households, their exclusion from taxes gives a huge advantage to wealthy Washingtonians.

The capital gains proposal in Washington state would be simple for taxpayers and cost-effective for the state to administer because it would be based on the federal capital gains tax. Further, it would be almost impossible for the few wealthy households subject to the tax to evade it. That’s because liability for the tax would be based on where the taxpayer lives, not where their stock trades occur.

As the regular legislative session comes to an end, the budget writers in Olympia who are seeking to fund schools and other key priorities need to close the capital gains tax break.