In the final 2018 supplemental budget, Democratic leaders in the state House and Senate reached compromises to make several laudable new investments in our schools and communities – including some very worthy investments that advocates for low-income communities and communities of color have promoted for years. But lawmakers also cut next year’s state property tax using accounting gimmicks that may leave the state in financial trouble for years to come. Not only did budget writers choose to pay for these across-the-board property tax cuts with funds that should have gone toward the state’s emergency savings, they also missed opportunities to strengthen our state tax code.

No doubt the investments lawmakers made in our communities – from making breakfast available for students in high-poverty schools to expanding health care access – will put many on a much brighter path forward. But these investments would have been more sustainable and better for the well-being of our state if policymakers hadn’t decided to prioritize short-term tax cuts over maintaining healthy fiscal reserves for the longer term.

Lawmakers should not have compromised the rainy day fund to pay for property tax cuts

In a slight variation on what both the House and Senate put forth in their earlier budget proposals, the final budget diverts funds from the rainy day fund to pay for inequitable and unnecessary property tax cuts next year. As we have written previously, any property tax reform should be targeted to low- and middle-income households that already pay a higher share of their income in taxes than the wealthy do. Higher-income households don’t need any more tax breaks.

When economic times are good, as they are now, our state should be building up reserves – not squandering them on tax cuts. Instead of depositing this year’s unforeseen revenue growth into our state’s rainy day fund, budget writers enacted a legislative maneuver that allowed them to get around their savings requirement and instead put that money toward cutting the recently enacted state property tax levy. In the long term, compromising the state’s emergency savings to pay for tax cuts is fiscally irresponsible, and it will leave our communities vulnerable when real emergencies – like natural disasters or major economic downturns – strike.

Lawmakers missed an opportunity to enact a capital gains tax to bolster community investments and rebalance our tax code

Lawmakers once again had the opportunity this session to make solid investments in schools and other community priorities in addition to ensuring the strength of our state’s long-term fiscal health. They could have done that by closing the tax break on capital gains, which would have generated more than $700 million annually to put toward our most important priorities. This move would have also been a significant step toward rebalancing our worst-in-the-nation tax code, in which people with low and middle incomes pay up to seven times more in taxes as a share of income than the top 1 percent do.

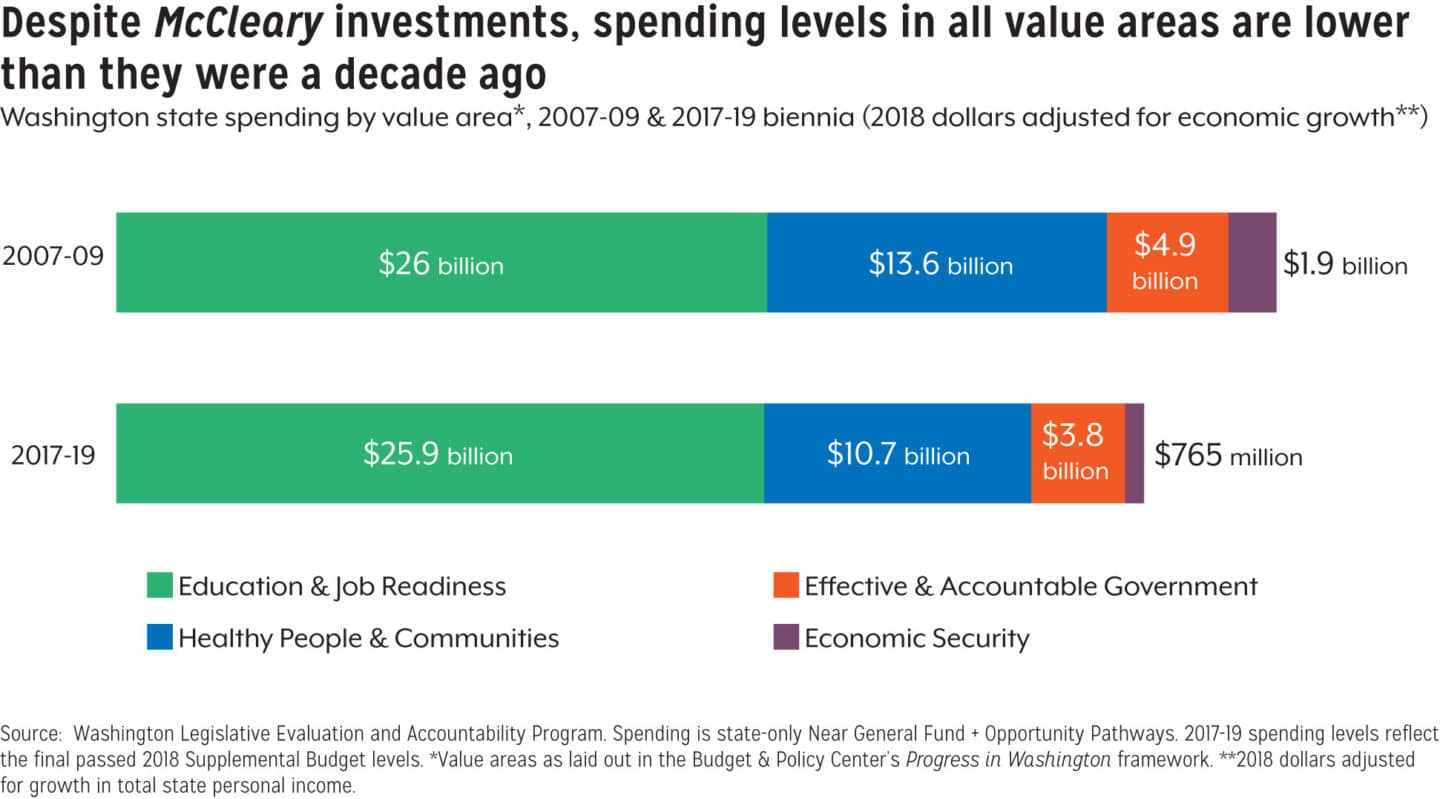

To put the need for this new form of revenue in context: When adjusted for economic growth, our state is still well below the investment levels it had before the Recession (see chart below). That is despite the fact that lawmakers have made significant investments in K-12 schools.

Lawmakers must get serious about making our tax code more equitable, adequate, and sustainable if they want to ensure we have a state where everybody has the chance to thrive. That starts with closing wasteful tax breaks like the one on capital gains.

Click on image to enlarge.

On the bright side, the final budget makes progress on strengthening Washington’s communities

Despite the missed opportunities in some parts of this budget, there is a lot to celebrate in terms of the investments that lawmakers prioritized with the resources they had. Included below are snapshots of how well the final budget promotes the well-being of Washingtonians based on the Budget & Policy Center’s Progress in Washington framework:

Education & job readiness

Our education system must have the resources to prepare all students – from early learning through higher education – for good jobs and jobs of the future. It should prioritize removing barriers to education and employment for communities of color. Investments in education and job readiness make up 60 percent¹ of total community investments in this budget. In the supplemental budget, lawmakers:

- Prioritized funding teacher salaries per the Supreme Court’s McCleary order. After House Democratic leaders initially neglected to propose minimum funding for teacher salaries by next school year per the Supreme Court’s McCleary order, budget writers ultimately settled on providing nearly $800 million in additional K-12 school funding to fulfill the state’s paramount duty to fund education. Even though there is still much work to be done to ensure world-class schools for all students, this is a positive step toward bringing the years-long Supreme Court battle to an end.

- Expanded learning opportunities for K-12 students. The final budget includes much-needed additional funding for special education, which is critical to providing every student with the resources they need to learn. Lawmakers also included modest funding for a bilingual educator pilot initiative and dual-language programs, which are evidence-based strategies to close the opportunity gap for students who are English-language learners.

- Made progress toward ensuring kids have access to a nutritious breakfast each school day. After years of debate and advocacy, lawmakers included funding for Breakfast after the Bell, a program to ensure that more of our state’s lowest-income students have access to a nutritious breakfast each school day. This is a significant step in the right direction toward providing kids with the most basic thing they need to learn: food.

- Took significant steps forward to provide financial aid to college students with low incomes. The final budget invests an additional $18.5 million in the State Need Grant, the state’s chronically underfunded financial aid program for college students. This is a significant boost to funding, which will provide financial aid to an additional 4,600 students who need it and cut the program’s wait list by 25 percent next year. The legislature plans to eliminate the wait list by 2022, but they will need to make additional investments in the coming biennium to accomplish this goal.

- Focused on targeted, proven child care and family support programs. Lawmakers made some modest but impactful investments in these areas. Chief among them was funding to provide 275 additional families with home-visiting services – a proven and targeted program that gives in-home resources to new and expecting parents to help them lay a strong foundation for their child’s development and health.

- Did not make significant progress to improve broad access to early learning for the youngest Washingtonians. Early learning should be one of the legislature’s top priorities in next year’s budget. Lawmakers will need to grapple with how to provide funding for the planned expansion of the state’s Early Childhood Education and Assistance Program, as well as how to strengthen the Working Connections Child Care program to ensure that all families across the state have access to affordable, high-quality early learning and child care.

- Should have done more to provide outside-the-classroom support for K-12 students who need it. Next year, lawmakers should take up strengthening investments in family involvement coordinators, guidance counselors, and other outside-the-classroom resources to help school kids – especially those facing the most significant barriers to opportunity – get the most out of their education.

Healthy people & communities

Our state should support vibrant communities that allow Washingtonians to lead healthy lives and better connect to and participate in the economy. Investments in healthy people and communities make up 25 percent of total community investments in this budget. Lawmakers:

- Expanded health care access for many Washingtonians. Lawmakers improved access to health care for kids from families with low incomes by increasing the reimbursement rate for doctors who care for them. They also rightly included funding to expand access to health care for Washingtonians who are citizens of Compact of Free Association (COFA) nations – the Republic of the Marshall Islands, the Federated States of Micronesia, and the Republic of Palau. Citizens of COFA nations are legal residents of the U.S. who work, pay taxes, and serve in the U.S. military – but are ineligible for Medicaid health care coverage.

- Made necessary additional investments in behavioral health services. The final budget includes funding necessary to bring our state’s mental health hospitals into compliance with federal safety standards, which was a priority in both the House and Senate budgets. Lawmakers also included significant funding to improve community behavioral health services and opioid treatment across the state.

- Fixed health-care-related accounting stunts from last year’s budget. The final budget provides funding to make up for millions of dollars in unrealistic health care and pharmaceutical cost savings assumed in last year’s budget to make the books balance.

Effective & accountable government

The state government supports the foundations of our communities. Our public institutions should efficiently and reliably ensure that all Washingtonians can meaningfully participate in our democracy. Investments in effective and accountable government make up 9 percent of total community investments in this budget. Lawmakers:

- Enacted reforms to enable people to re-enter their communities more easily after being incarcerated. This budget includes funding to help administer long-needed reforms to our state’s legal financial obligations (LFOs), which are high-interest legal fines and fees imposed by criminal courts on top of a criminal sentence. The reforms in this bill will remove some of the financial barriers that previously incarcerated Washingtonians face when they re-enter their communities.

- Strengthened resources to help people with low incomes navigate the legal system. Lawmakers boosted resources for people with low incomes who need civil legal help. This will have significant positive impacts on the lives and communities of those people who need such legal support.

Economic security

All Washingtonians should have access to employment opportunities, living-wage jobs, and financial security and stability; and they should be economically secure in the face of a financial emergency. Investments in economic security make up 2 percent of total community investments in this budget. Lawmakers:

- Restored some of the devastating cuts made in recent years to poverty-reduction programs. The final budget takes some significantly positive steps to improve services for Washingtonians with low incomes by undoing some of the cuts made in recent years to basic assistance grants for people who participate in WorkFirst, the State Food Assistance Program, and the Refugee Cash Assistance Program. The budget also expands eligibility for the Housing and Essential Needs program, which provides housing-related assistance to people unable to work because of disabilities.

- Made common-sense reforms to public-assistance programs. Lawmakers smartly raised the financial-asset limit for people with low incomes who receive public assistance. This move will improve a previous law in which people living in poverty were forced to sell a decent car or spend down their savings to below $1,000 in order to receive help climbing out of poverty.

- Set up a study to ensure the WorkFirst program can meet the needs of the thousands of families that need help getting out of poverty. The budget includes funding for an important study of how the state could take steps to halt the rapid decline in the WorkFirst caseload, which is leaving more than 33,000 Washington families in poverty without basic support. The study calls for the state to investigate the impact of implementing recommendations the Budget & Policy Center made in our recent policy brief, “Reinvest in WorkFirst: How we can restore the promise of basic support to Washington families facing poverty.”