In the next two years, our communities will see stronger investments in their schools, students, and teachers; seniors and kids; clean air and water; and all the critical services that make our cities, towns, and neighborhoods thrive. With some important exceptions, the two-year spending plan that Democratic leaders in the legislature produced will make improvements across almost all areas of the state budget. Yet, while this budget begins to bring our state closer to the levels of investments that our communities actually need, there’s still much more work to be done to create a vision for our state that sets us all up for a bright future.

This budget moves in the right direction

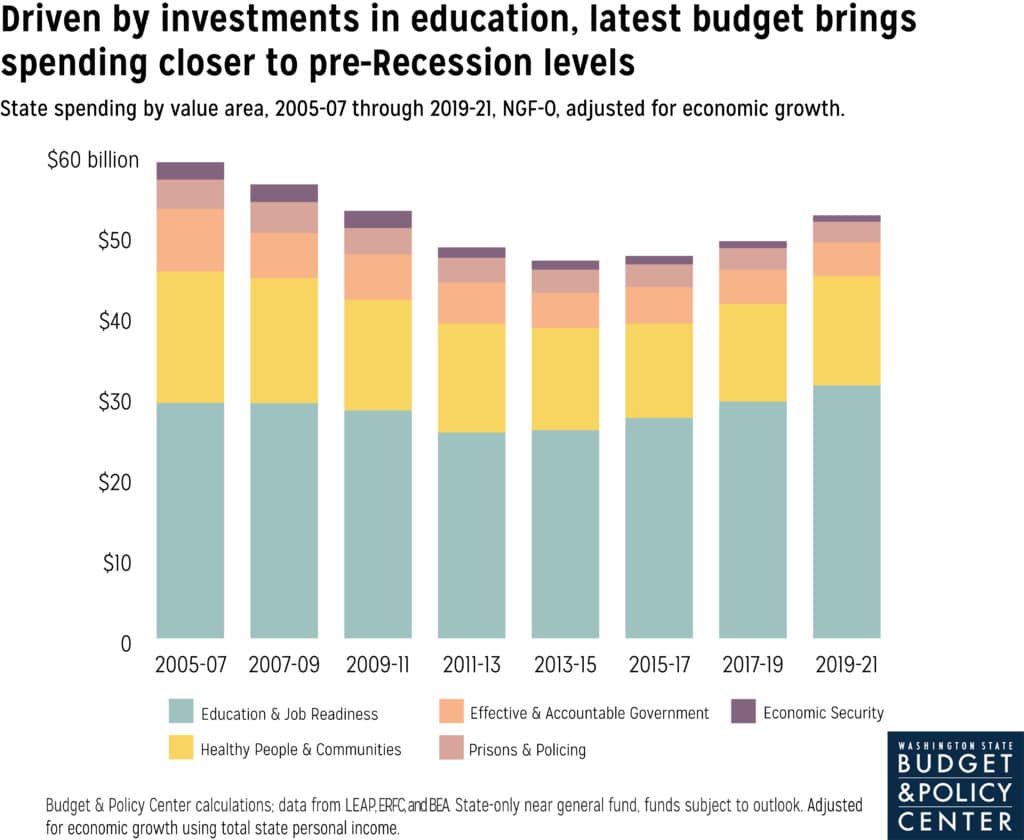

As the chart below shows, recent increases in two of the four Budget & Policy Center Progress in Washington value areas – Education & Job Readiness and Healthy People & Communities – have driven overall investments up in recent years. These changes are due in large part to historic additional investments in K-12 schools in response to the state Supreme Court’s McCleary case, which found that our state was unconstitutionally underfunding schools.

But it shouldn’t take a constitutional crisis to motivate budget writers to adequately fund the foundations of our communities. Today – even while our economy is thriving – our overall state investments are on par with what they were during the Great Recession. In order to build a vision for thriving communities, lawmakers need to abandon the austerity mindset that has dominated budget negotiations since the Recession, and instead set their sights on what all Washingtonians, and particularly those furthest from opportunity, need to lead healthy lives.

Smart tax reforms will support investments, but lawmakers could have been bolder

Lawmakers passed a collection of smart and equitable tax reforms in order to fund this year’s budget. Closing wasteful tax breaks, asking big banks to pay a little more, and making the Real Estate Excise Tax more progressive are moves in the right direction. That said, our upside-down tax code is a ubiquitous problem decades in the making, and it will require right-size solutions to fix it. One necessary strategy is to close the tax break on capital gains – a special deal enjoyed by less than one half of one percent of the very wealthiest households. If lawmakers would have enacted a capital gains tax this year, they would have had nearly a billion more dollars per year going forward to restore funding to basic needs programs, launch a promising statewide asset-building program, and even provide tax credits for working families.

Here’s how the budget stacks up by value area

Despite some missed opportunities, lawmakers funded some forward-thinking priorities that will put many Washingtonians on a path toward greater economic security. Included below are snapshots of how well the final budget promotes the well-being of Washingtonians based on the Budget & Policy Center’s Progress in Washington framework.

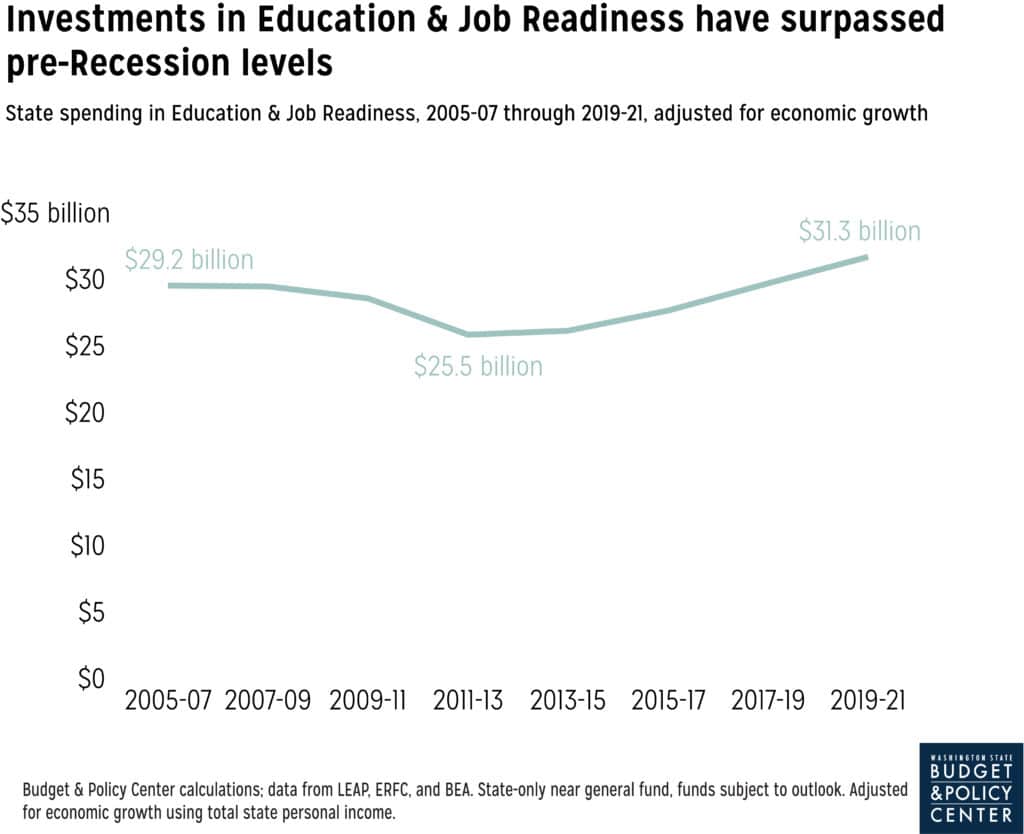

Education & job readiness

Funding for education and job readiness increased to more than $31 billion, which comprises 60% of the state budget. As the chart below shows, compared to Recession levels, spending in this area has increased relative to economic growth, due in large part to the court-mandated spending the legislature has authorized over the last several years in response to the McCleary case.

In this area, the final budget:

- Makes modest investments in promising early learning policy changes, such as the Child Care Access Now Act; expands access to Working Connections Child Care for some student parents; and funds additional slots for our state’s Early Childhood Education and Assistance Program (ECEAP) and home visiting services. However, there is more critical work to be done to expand access to affordable, high-quality early learning for kids and families across the state, including more significant increases to reimbursement rates for providers.

- Makes more progress on meeting the needs of K-12 students, such as increased funding for special education and health care benefits for teachers and other school employees. The legislature also made an important move to increase local school levy flexibility, allowing voters in school districts to raise additional revenue from local levies to pay for investments beyond basic education and prevent major cuts and layoffs. Going forward, lawmakers need to ensure there are adequate state resources for all school districts by raising the state levy and eliminating the damaging 1% levy growth limit.

- Expands financial aid for students from families with low and moderate incomes. This year’s budget both expands the number of students eligible for our state financial aid program and increases funding so that every higher education student who is eligible can actually receive financial aid. This is a huge victory to eliminate the wait list for the more than 20,000 students who had been eligible but couldn’t access aid due to insufficient funding of the program. Next year, lawmakers can build on this work by better supporting faculty and other workers, particularly at our state’s community and technical colleges.

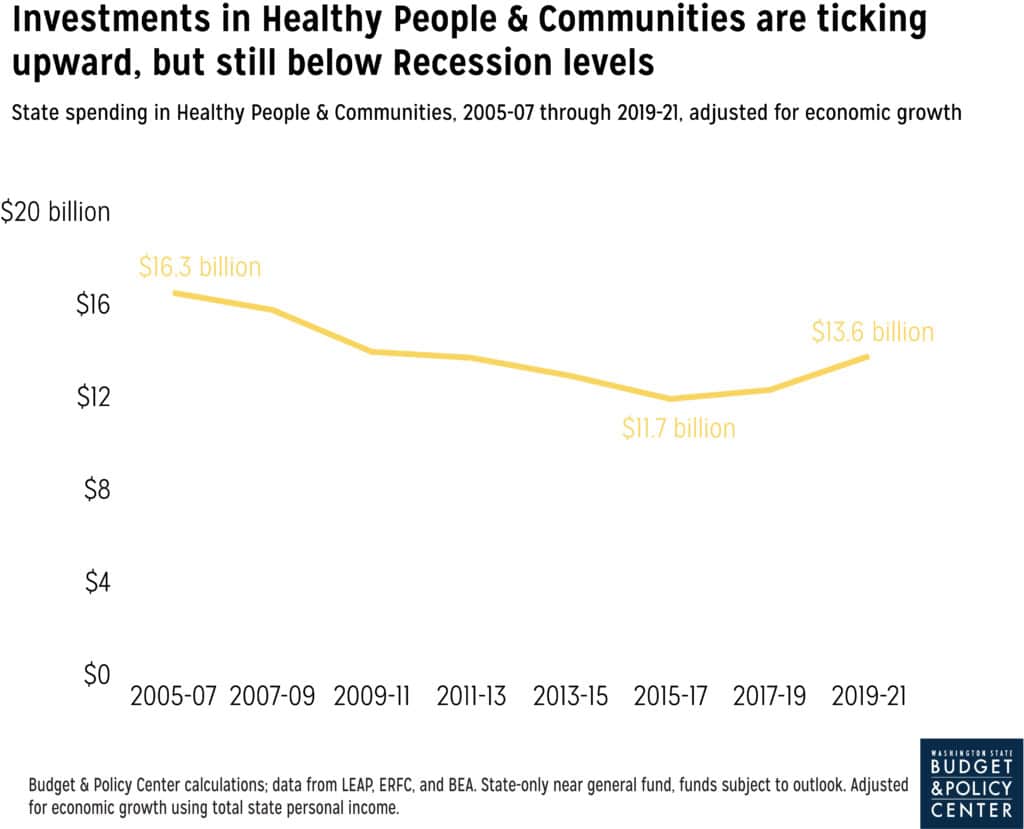

Healthy people & communities

Funding for healthy people and communities increased to more than $13 billion, which comprises 26% of the state budget. As the chart below shows, this investment area has also increased relative to economic growth during the last two budget cycles – again, due in part to court-mandated investments in behavioral health.

In this area, the final budget:

- Implements a first-in-the-nation public long-term care benefit. The Long-Term Supports and Services Trust Act will take steps to meet growing needs both in the long-term care workforce and of aging Washingtonians and their families who will be able to take advantage of this benefit.

- Establishes the COFA Islander Dental Care Program, making no-cost dental coverage available to adults from Compact of Free Association nations (the Federated States of Micronesia, the Republic of Marshall Islands, and Republic of Palau) who reside in Washington and are income-eligible for Medicaid. Adding a dental program to COFA Islander Health Care moves the program closer to parity with Medicaid and is a step forward in achieving health equity.

- Makes long overdue improvements to our behavioral and mental health system. The budget includes an array of funding enhancements to bring Washington’s behavioral health system into compliance with state and federal laws. This includes funding for additional staff and beds at state hospitals, and funding to expand and improve community-based services.

- Launches a new environmental justice task force, an important first step toward developing community-driven strategies to reduce environmental health disparities in communities across Washington state.

- Assumes unproven and unrealistic savings from the Medicaid program, which will put the health care of many low-income Washingtonians at risk.

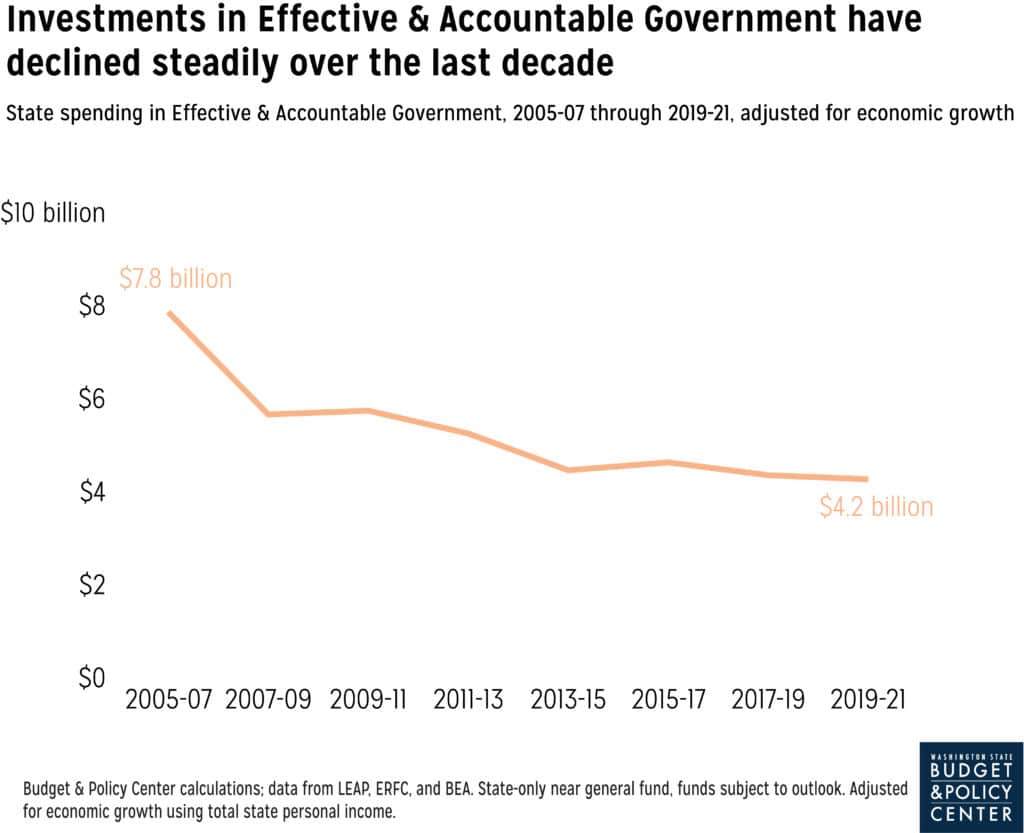

Effective & accountable government

Funding for effective and accountable government increased to more than $4 billion, which comprises 8% of the state budget. Even with some robust new investments in this budget, spending relative to the economy and community needs in this area has steadily decreased since before the Recession.

In this area, the final budget:

- Funds the collective bargaining agreements for our state’s frontline workers – the educators, long-term caregivers, early learning providers, emergency responders, and many others who keep our communities safe, healthy, and thriving.

- Includes funding to promote a complete and accurate count in the upcoming 2020 Census. These resources will increase the capacity of trusted community organizations that are best positioned to improve census participation in Washington’s historically undercounted communities.

- Creates a task force to develop a statewide office of equity. This is an important step to begin to improve outcomes and reduce disparities statewide in various areas of state service delivery such as health, education, employment, and environment.

- Cuts funding to larger state agencies by 1% across the board each of the next two years in order to make the budget pencil out. These blunt cuts risk negative impacts for the critical services that our state agencies provide to all of us.

Economic security

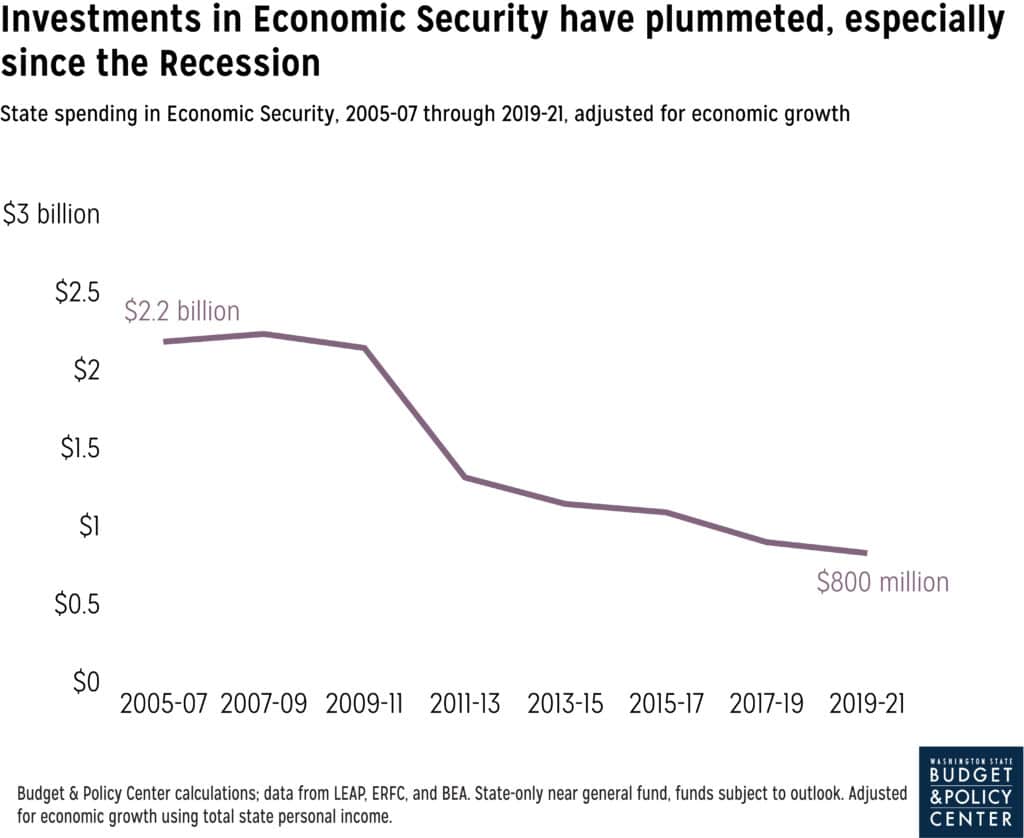

Funding for economic security increased to nearly $800 million, which comprises 1.5% of the state budget. But economic security is the area of the budget that was most negatively impacted during the Recession, and lawmakers have still not adequately restored funding to these critical, sometimes life-saving, programs. As a result, total funding in this area continues to trend downward compared to economic growth.

In this area, the final budget:

- Increases funding for the Housing and Essential Needs program, which helps people who are sick or have a temporary disability. Thousands of people facing illnesses and disabilities (like a cancer diagnosis, an injury, or a mental health crisis) are on waitlists to get this crucial support, and this funding will take a first step toward addressing a significant and pressing need.

- Eliminates an extremely harmful policy that permanently disqualifies families from getting help from the WorkFirst/Temporary Assistance for Needy Families (TANF) program when they get sanctioned three times. It also allows families experiencing homelessness to get time-limit extensions.

- Continues the troubling long-term trend of cuts to the TANF program (by $19.7 million this biennium) through the continuation of policies that are harming families facing homelessness and mental illness, and which have stark racist impacts for Black and Indigenous families. The final budget also failed to roll back another harmful Recession-era cut – child support pass-through payments – which would have allowed children to receive a portion of child support payments from their non-custodial parents when they are also on TANF.

- Makes fruits and vegetables more affordable for Supplemental Nutrition Assistance Program (SNAP) and Women, Infants, and Children (WIC) participants. This important change will enable thousands of low-income families to continue to purchase healthy food, fighting hunger and improving health.