Governor Jay Inslee recently released a revised funding plan for schools, health care, infrastructure, and other investments that benefit all Washingtonians. Although his proposal smartly makes some investments to address homelessness and a few other important priorities, it closely adheres to the budget lawmakers enacted in early 2019, which leaves far too many pressing needs unmet.

The good news is that lawmakers have a big opportunity in 2020 to reform Washington’s upside-down tax code, which exacerbates the detrimental impacts of systemic racism in our state economy, government, and culture. Doing so would bolster the resources needed to dramatically improve the quality of life in communities across the state, especially those furthest from opportunity.

Some lawmakers may argue that needed reforms must wait, because of a relatively short (60-day) legislative session and the fact that many of them will spend much of the year campaigning for re-election in November. But Washingtonians can’t wait another year for elected officials to meaningfully address the rapidly growing costs of child care and housing, congested transportation infrastructure, and other mounting pressures families and communities face.

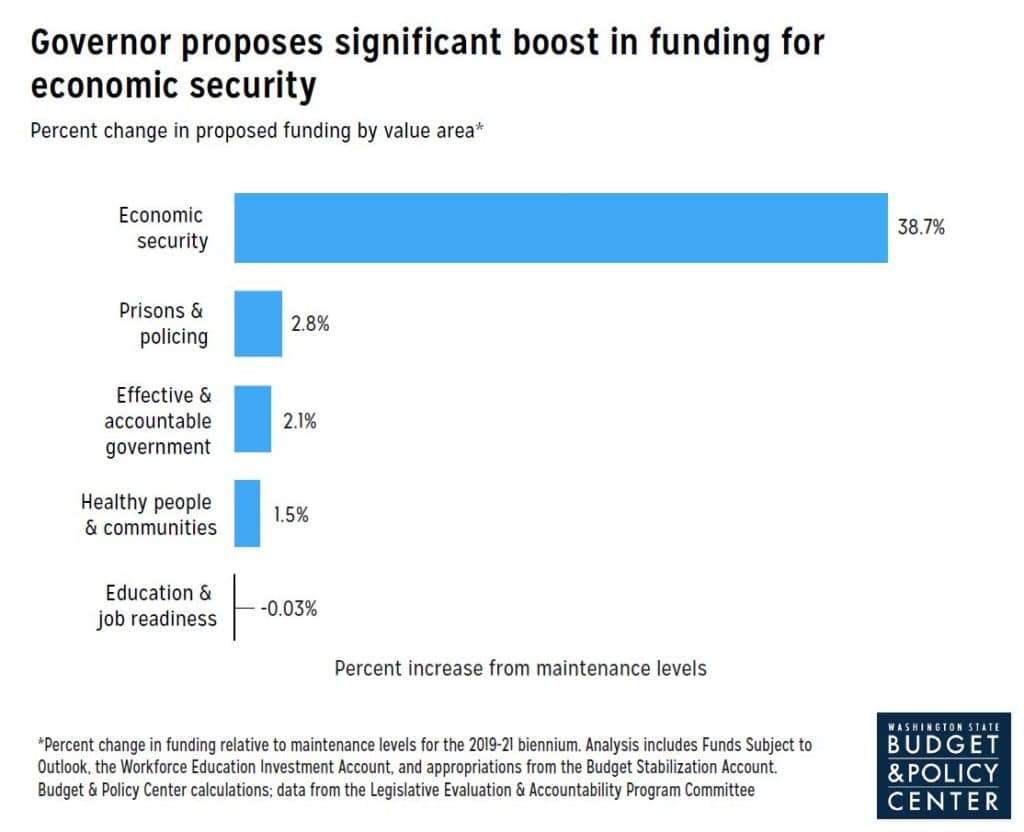

The graph below shows how the governor’s budget proposal would impact funding for Washingtonians’ shared values and priorities. The proposal would boost funding for investments in economic security by 39%. Funding that supports healthy people and communities would increase by 1.5%. Investments in effective and accountable government would rise by about 2%. Funding for education and job readiness would decline by a slight 0.03%. The budget for prisons and policing would increase by about 3%.

Click on graphic to enlarge.

Within this framework, the governor proposed some important and laudable funding enhancements, such as:

- A significant boost in funding to provide shelter and services to those experiencing homelessness

- Funding to create a statewide Office of Equity to help state agencies better serve communities of color and other communities that face systemic barriers to opportunity

- Additional funds to keep our rivers and other natural habitats clean and healthy

- New funds to help families with low incomes access affordable child care

It’s important to note that overall funding for community priorities in the governor’s budget would remain very low relative to Washington’s economic capacity, however. To restore funding all communities need to thrive, lawmakers should generate new tax resources from the richest Washingtonians who face some of the nation’s lowest overall state and local tax rates.

They should start by taxing capital gains, a form of wealth that is heavily concentrated among those at the very top. They should also fund a modern, expanded Working Families Tax Credit to put cash back in the pockets of people with low incomes who are currently paying a much higher share of their incomes in taxes than the ultra-wealthy. These changes would give lawmakers much more capacity to address pressing community needs.

In addition to the Working Families Tax Credit, some other important priorities the governor left out of his proposal that could be funded with the help of a capital gains tax include:

- Reinvesting in WorkFirst/Temporary Assistance for Needy Families to reverse more than a decade of cuts that have stripped families in dire straits of resources they need to make ends meet.

- Making quality and affordable child care much more widely available to Washington’s parents.

- Creating a statewide Child Savings Account program that sets up children for success later in life.

For more information on what lawmakers could do in the next couple of months to meaningfully boost the quality of life in communities across our state, check out the Budget & Policy Center’s 2020 legislative agenda.

The bottom line is that lawmakers must view Governor Inslee’s budget as a starting point for what is possible in 2020. It is not the high-water mark, but rather a framework that must be built upon by reforming the state tax code and investing new revenue into programs and services that address community needs.