Our state’s latest revenue forecast shows that revenue growth on its own is not setting lawmakers up for success as they prepare to write the state’s next budget in the 2019 legislative session. In order to fund the foundations of thriving communities – such as high-quality early learning for all children, a dependable state mental health system, and innovative solutions for housing and homelessness – lawmakers are going to have to bring in new resources.

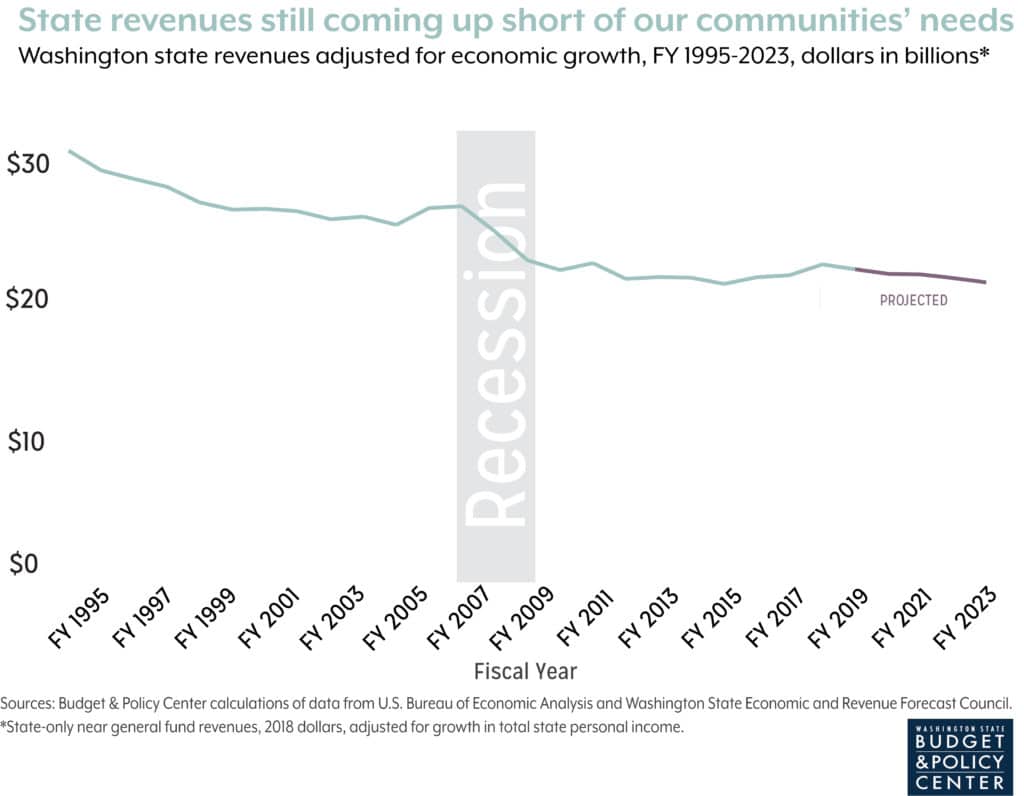

While revenues are up marginally ($163 million for the current 2017-19 biennium and $196 million for the 2019-21 biennium), this represents a fraction of a percent of our state’s nearly $46 billion two-year budget, and nowhere near the additional resources lawmakers already know they’ll need to make bold new investments in the next two years. It’s also important to note that the nominal boost in projected tax revenues doesn’t provide a complete view of our growing economy, the rising cost of living in many parts of the state, and the lack of investment in too many communities across the state. The graph below shows that total tax revenue remains mired at Recession levels, after adjustment for the growing economy.

Click on image to enlarge.

More worrisome: The picture isn’t projected to get any rosier over the next several years. The forecast shows lower levels of growth after the recent property tax revenue increase expires after 2021.

The good news is that Washington state has the capacity to generate substantial new resources for community investment. Bold, commonsense solutions are within reach. Closing unnecessary tax breaks for corporations and the ultra-wealthy – such as the tax break on capital gains – would bring in much-needed revenue and begin to make our worst-in-the-nation tax code more equitable.