Governor Inslee’s recently unveiled budget and revenue plan is a prescription for how to maintain a healthy budget and invest in communities across the state. His plan shows that the way to support the things that we value most – the well-being of children and their families; clean air and water; and the kinds of communities where more people can get ahead – is to enact progressive revenue to strengthen our tax code.

New, progressive revenue is the foundation for unprecedented community investments

A healthy budget requires a healthy tax code to fund the things we all care about. To remedy our perennial budget shortfalls, the governor proposes a series of equitable and necessary reforms to the state tax code that would enable our state to make nearly $3.7 billion in new community investments between 2019 and 2021. These reforms include:

- Closing the tax break on capital gains ($976 million in 2019-21; $2.1 billion in 2021-23): This proposal would add our state to the list of 41 states that currently tax capital gains, which are profits from the sale of corporate stocks, bonds, and other financial assets. Capital gains above $50,000 for married filers ($25,000 for single filers) would be taxed at 9 percent. Gains from the sale of all residences, retirement accounts, farm land and livestock, and small business equipment would be exempt, ensuring the tax would be paid almost exclusively by the wealthiest 1 percent of Washingtonians. The Budget & Policy Center has endorsed closing the tax break on capital gains for several years as an efficient and equitable way to generate new resources for community investments.

- Rebalancing the real estate excise tax ($402 million in 2019-21; $437 million in 2021-23): The current real estate excise tax (REET) is a one-time tax on the sale or transfer of real estate that is levied at a rate of 1.28 percent of the sales price or value. The governor smartly proposes to raise new revenue and make the REET more progressive by reducing the rate for lower-valued properties and increasing it for higher-valued properties. All new revenue from this change would be dedicated to reducing water pollution. He proposes:

- For properties valued below $250,000, decrease the rate from 1.28 percent to 0.75 percent

- For properties valued between $250,000 and $1 million, keep the rate at 1.28 percent

- For properties valued between $1 million and $5 million, raise the rate from 1.28 percent to 2 percent

- For properties valued above $5 million, raise the rate from 1.28 percent to 2.5 percent

- Increasing the business and occupation tax on service businesses ($2.6 billion in 2019-21; $3 billion in 2021-23): Increasing the business and occupation (B&O) tax rate applied to services – such as accounting, engineering, legal services, cosmetic services, and advertising firms – would help create a more stable and adequate state tax code in Washington state, since that industry represents a growing share of our state economy in recent decades. The governor proposes to increase the B&O tax rate applied to these businesses from 1.5 percent to 2.5 percent.

The governor also proposed forgoing making a regular $1.1 billion transfer into our state budget stabilization account or “rainy day fund.” Though this maneuver has become a common practice in recent years to help budget writers balance the budget, it’s risky for our state’s long-term financial health. The rainy day fund helps lawmakers maintain critical investments when the economy dips into a recession or after a natural disaster strikes, and this move would leave our budget reserves well below what is recommended by most public finance experts.

Governor Inslee’s budget invests in Washington’s values

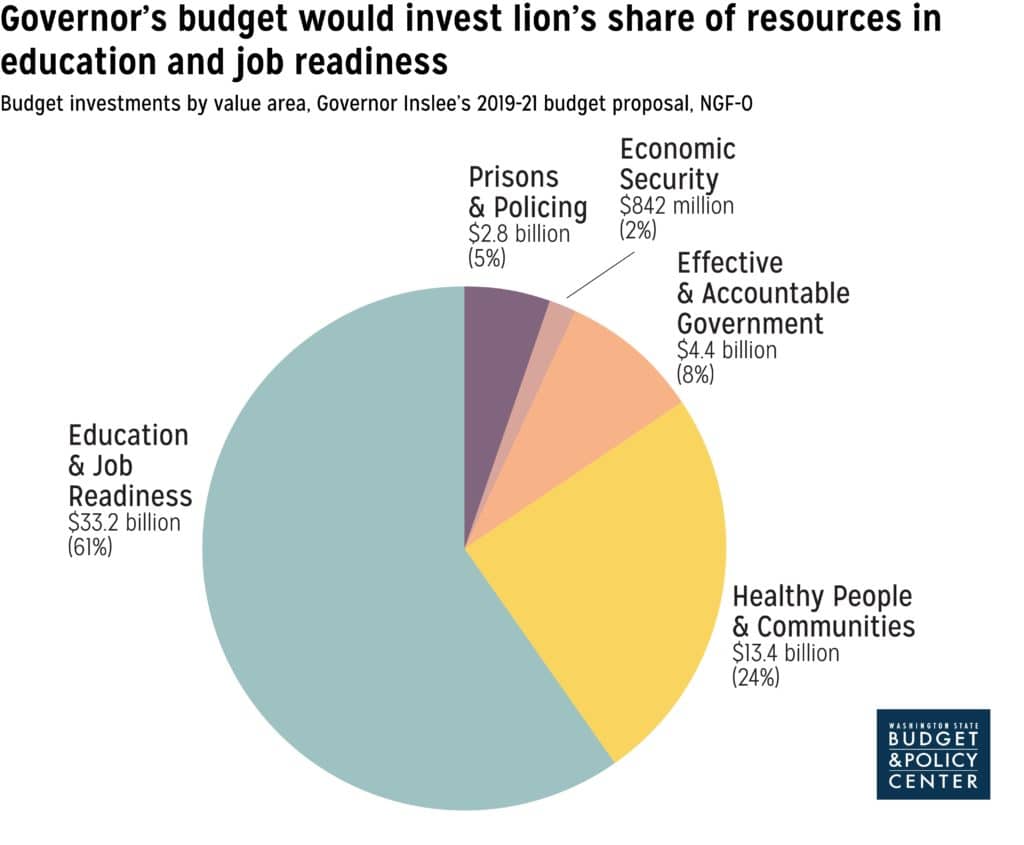

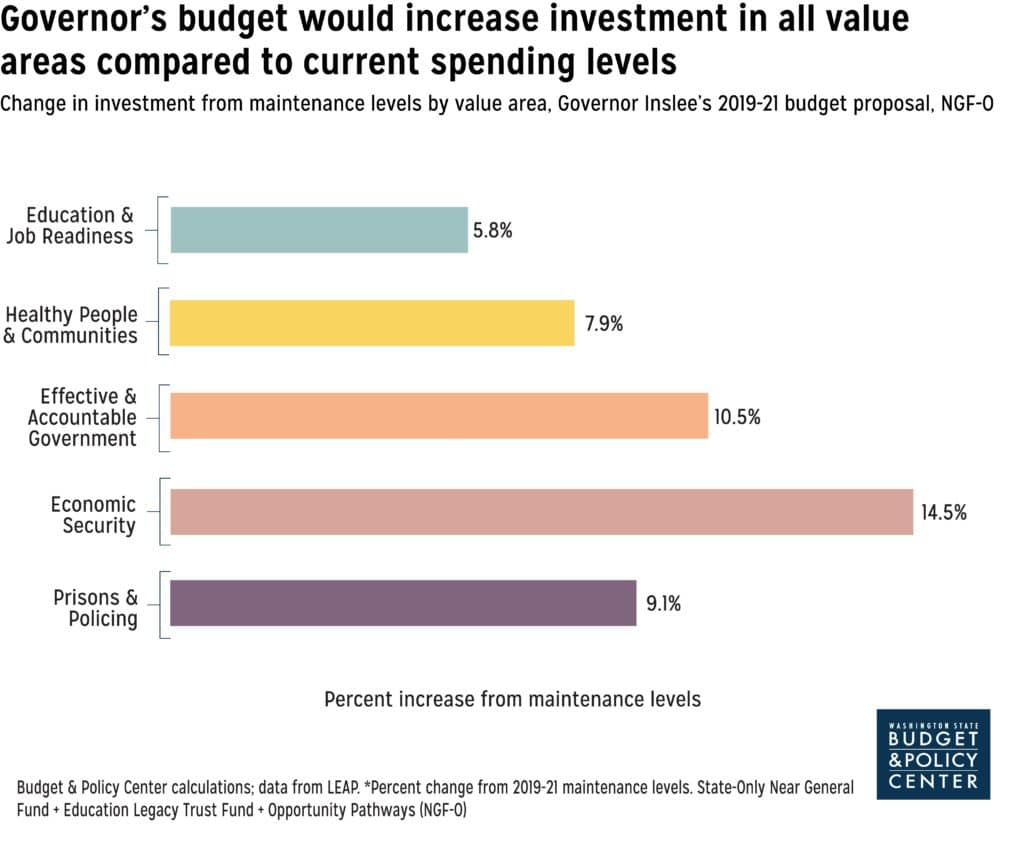

As noted in the graphics below, the governor’s budget would increase investments in all value areas, with the majority of state resources going toward education and job readiness.

Click on graphic to enlarge.

Click on graphic to enlarge.

Highlights of the governor’s proposed investments, according to the values laid out in the Budget & Policy Center’s Progress in Washington framework*, are described below.

Education and job readiness

Education is one of the greatest opportunity drivers we can provide for our kids. People with more education live longer, have higher earnings, are less likely to be unemployed, and have better access to health care and insurance. The governor’s budget would increase investments in this area by $1.8 billion (or 5.8 percent), and:

- Strengthen early learning opportunities for the youngest learners by making improvements and expansions to our state early learning programs, including funding nearly 2,400 new slots toward the state’s multi-year goal of funding 100 percent of the low-income kids eligible for the Early Childhood Education and Assistance Program. The governor also proposes to increase pay and create opportunities for early learning professionals to have sustainable careers in this important field.

- Expand dual-language learning opportunities and recruitment of bilingual teachers – a critical strategy to remove some of the educational barriers that many kids of color face.

- Increase school support staff, such as social workers and nurses, who are essential to providing a safe and healthy environment for kids to learn.

- Restore local levy authority, which was restricted by the legislature’s recent response to the McCleary Supreme Court case, to give school districts more flexibility to attend to the particular needs of their students.

- Commit to fully funding all low-income students eligible for our state’s higher education financial aid program, the State Need Grant (which the governor re-dubs the Washington College Promise Scholarship), by 2022.

Healthy people and communities

Health is about more than just the ability to get health care. It’s also about safe homes, clean air and water, and strong community infrastructure. The governor’s budget would increase investments in this area by $1 billion (or 7.9 percent), and:

- Provide universal access to home visiting and newborn assessments by nurses to help families of newborns get off to the healthiest start.

- Expand community-based treatment options for mental and behavioral health. Although this is a necessary step in the right direction, lawmakers should also look to strengthen critical investments in upstream supports, such as local crisis response, to care for people before they are in need of more substantial care.

- Support both in-home care workers and their clients, who are seniors receiving long-term care, by eliminating co-pays for very low-income seniors, and significantly reducing co-pays for others. This will help aging Washingtonians stay in their homes by allowing them to keep more of their limited incomes to use on necessary expenses like rent, prescription drugs, or other necessities.

- Make a variety of investments to increase housing stability and reduce homelessness, particularly in populations most at-risk of homelessness, such as youth and people with disabilities.

- Increase funding to protect the environment, including a wide range of investments to protect and recover the declining population of orcas living in the Puget Sound. It would also include new investments for state parks, improvements to state forest management, heightened efforts to keep our air and water clean, and more.

Effective and accountable government

State and local governments should ensure that all Washingtonians – Black, Brown, and white – are equally able to access the kinds of resources that allow communities to thrive. The governor’s budget would increase investments in this area by $416 million (or 10.5 percent), and:

- Commit to funding collective bargaining agreements for frontline workers who serve essential roles in keeping communities across the state safe, healthy, and thriving.

- Dedicate funding to help make sure that all Washingtonians are counted in the 2020 Census, a critical investment in the health of our democracy and well-being of our communities.

- Invest in a new statewide Office of Equity to promote equitable opportunities, reduce disparities, and improve outcomes statewide in a wide range of state services.

- Boost state capacity to help immigrants and refugees become U.S. citizens.

Economic security

When people fall on hard times they shouldn’t go without the basics – family-wage jobs, food on the table, and a roof over their heads. The governor’s budget unfortunately continues some harmful cuts to critical programs, but it would increase investments in this area overall by $106 million (or 14.5 percent). His plan would:

- Provide targeted support for individuals to get and keep jobs, including funding to increase supported employment opportunities for people with disabilities and funding for connecting incarcerated individuals with work opportunities to improve economic opportunities upon re-entry.

- Increase cash assistance to pregnant individuals who are ineligible for Temporary Assistance for Needy Families (TANF).

Although there is a lot to be excited about in this budget, the governor’s plan continues harmful policies that are pushing thousands of families off of Washington’s WorkFirst/TANF programs, many of whom are homeless and facing serious mental health challenges. The budget uses a fiscal maneuver to cut $18 million from the WorkFirst program and re-appropriate the money for other purposes. The legislature should reverse these policies and secure adequate funding for people struggling to make ends meet.