In their two-year budget and revenue proposal, House Democratic leaders proposed modest investments across the state budget while taking critical steps to balance our upside-down tax code. While their proposal needs more work to ensure that all Washingtonians can make ends meet, enacting a capital gains tax on the wealthiest Washingtonians is a good start. It would begin to move our state away from having inadequate, pre-Recession level community investments.

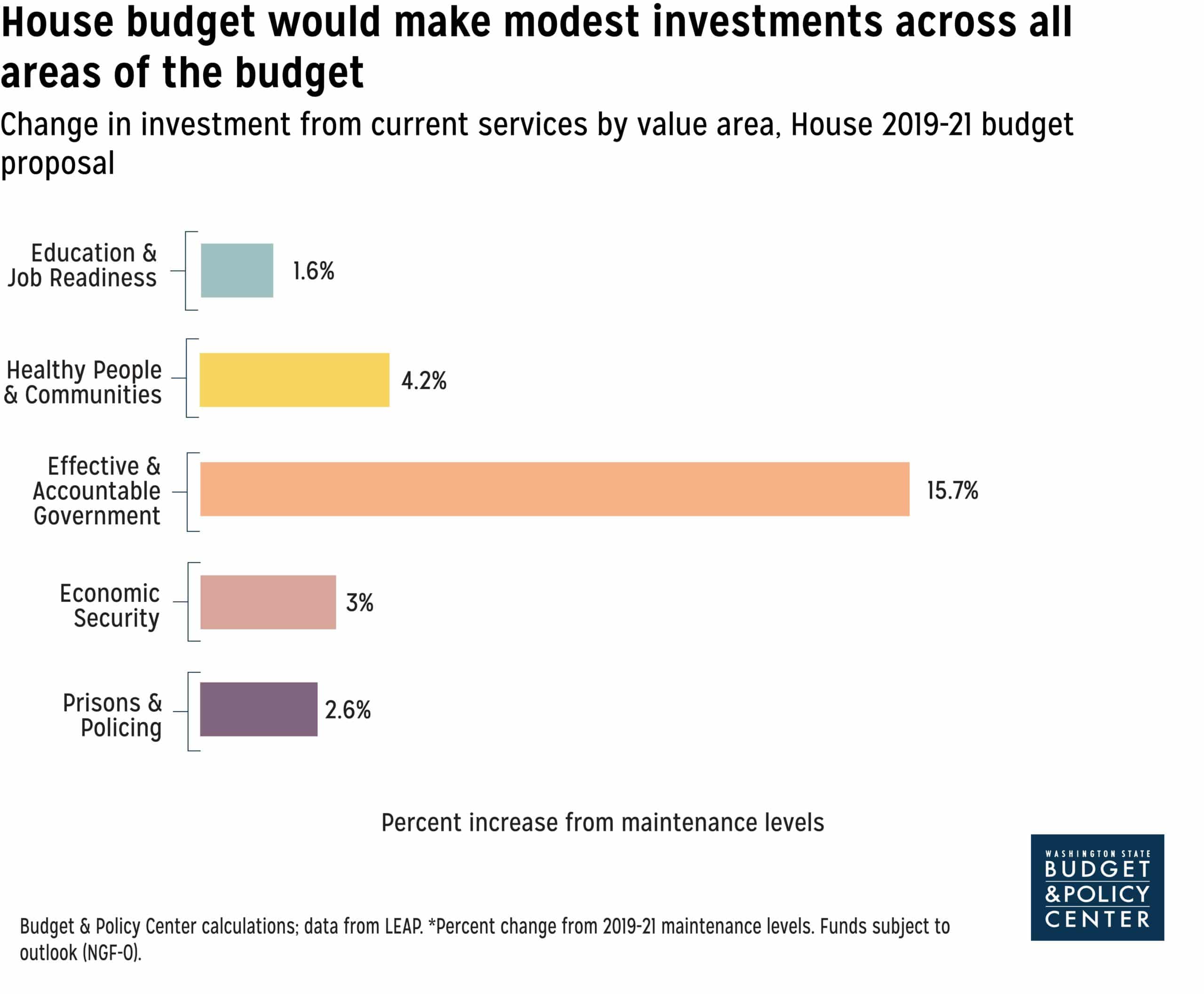

House leaders’ two-year proposal, which comes in at $52.8 billion for the 2019-21 biennium (about $1.8 billion less than the governor’s proposal), makes modest but responsible investments on top of maintaining current services. (See chart below*).

Note about data in the chart: Although prisons and policing are not one of the value areas in our Progress in Washington framework, the Budget & Policy Center recognizes that Washington state dedicates significant resources to incarceration and law enforcement. Our analyses reflect those investments alongside our other value areas.

Stronger investments are needed, but this budget is a step in the right direction for keeping families housed, ensuring kids and adults have access to a world-class education, making sure our communities can access mental and behavioral health services, and helping all Washingtonians have the opportunity to make ends meet.

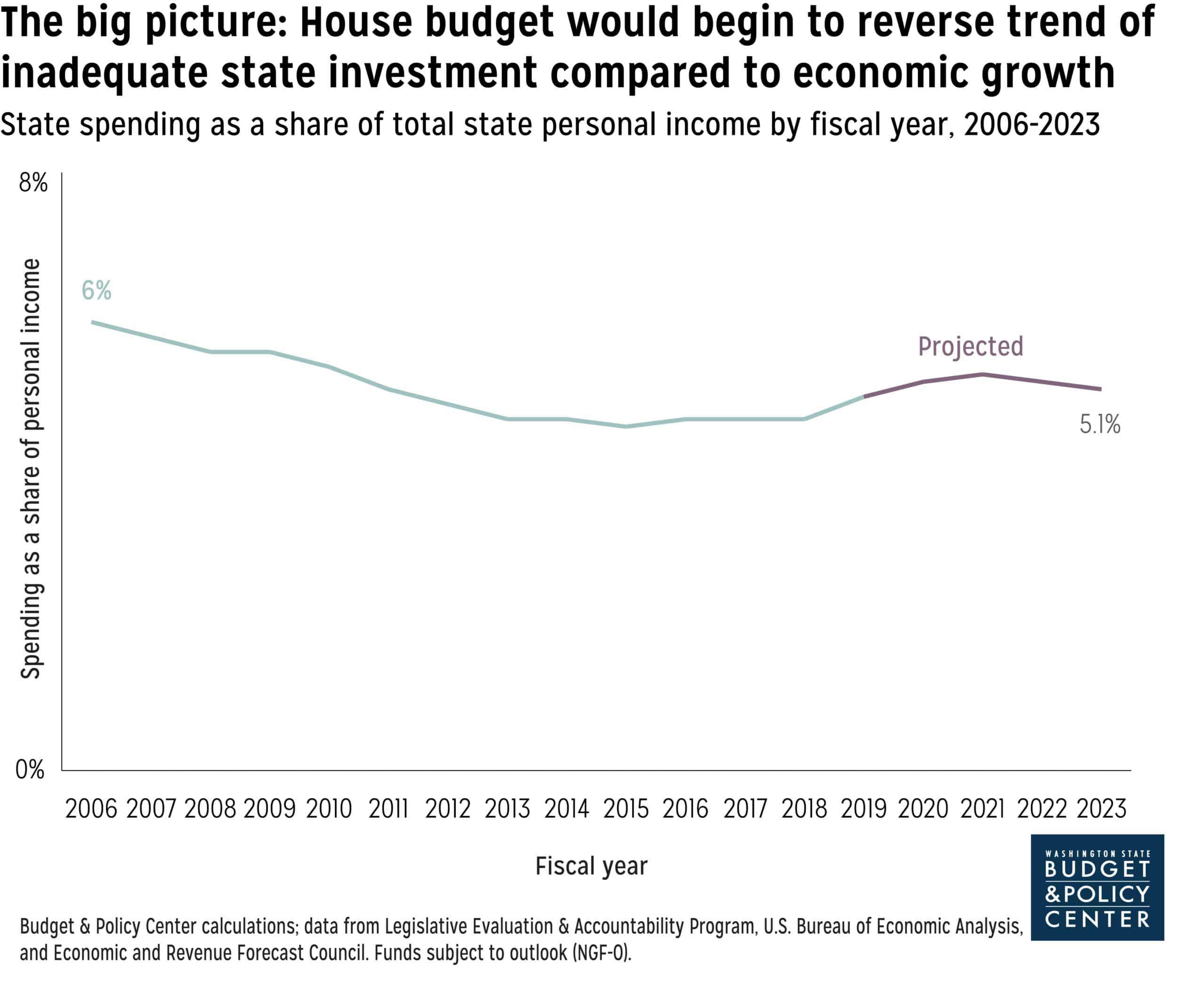

And importantly, enacting new, progressive revenue will allow state lawmakers to begin to reverse the trend of austerity budgeting that has plagued our communities for the past decade. Although spending levels would still remain below Recession levels with this proposal, this budget would mark a modest, important uptick in investments relative to economic growth, which our state hasn’t seen since prior to the Great Recession. (See chart below).

Reforming the tax code by closing wasteful tax breaks, including the tax break on capital gains, and making other existing revenue sources more equitable will pave the way for stronger community investments into the future. Senate budget writers should follow suit.