Women and people who are gender diverse[1] face more barriers to economic security than men. In Washington, our regressive tax structure creates just another one of those barriers. This session, lawmakers have an opportunity to change this by supporting policies that advance gender equity, such as the Working Families Tax Credit, WorkFirst/Temporary Assistance for Needy Families (TANF), and a capital gains tax.

Gender-based inequities are systemic. Women face workplace sexism and discrimination, are over-represented in low-paying fields, and are paid less than men for the same work. These realities are even more present for women of color, who earn less on average than white women due to intersecting sexism and racism. Moreover, women are more likely to do vital, but unpaid work that – while crucial – can disrupt career pathways or make it harder to earn wages. For example, upwards of 75% of all caregivers are women, and women generally spend more time on caregiving tasks than men. Taken together, these factors create a reality in which women systemically and unjustly earn less (see graph below).

Click on image to enlarge.

People who are nonbinary, transgender, genderqueer, and two-spirit, and LGBTQ face even greater economic hardship due to homophobia and discrimination. Although Washington-specific data on earnings are limited to binary “male” and “female” categories, national data help fill in the gaps. Nationally, people who are LGBTQ and gender diverse disproportionately experience poverty. Trans[2] people face poverty at a rate that is twice the national average. Due to a legacy of racist economic policies that kept people of color from opportunity, economic hardship affects LGBTQ, transgender, and nonbinary people of color even more. African American and Latina women in same-sex couples are three and two times more likely, respectively, to experience economic hardship than white women in same-sex couples, for example.

Lower-income households pay six times their share of incomes in taxes as the wealthiest 1%.

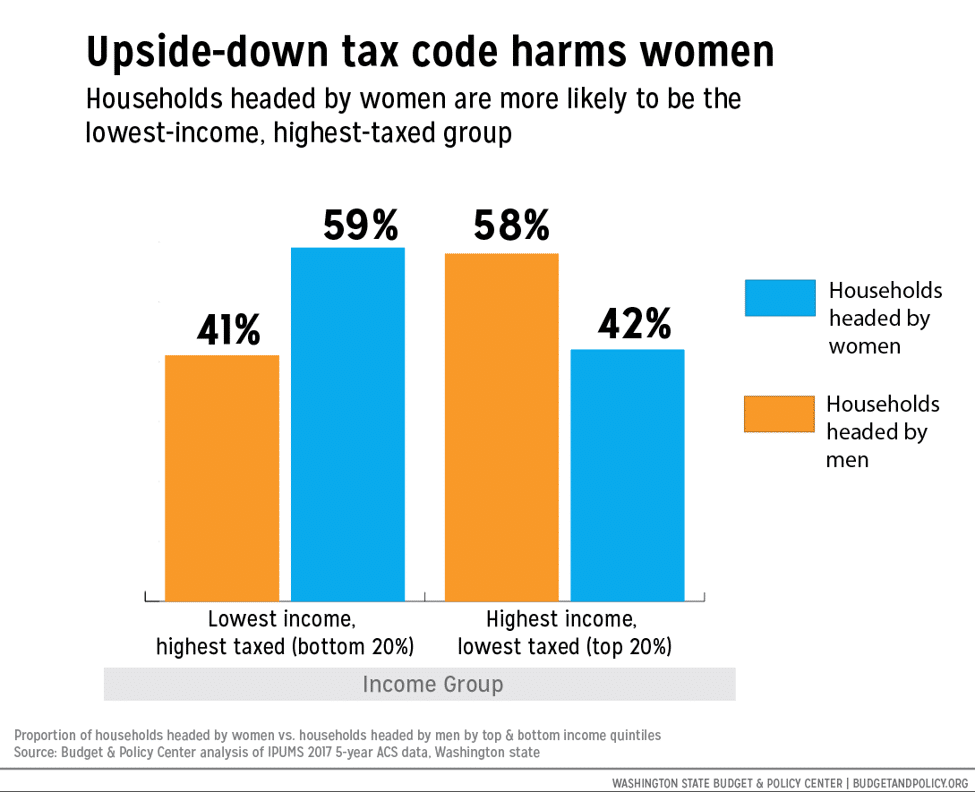

Our regressive tax structure compounds these economic inequities. Washington state relies too heavily on sales and excise taxes to raise revenue for community investments, while simultaneously under-taxing wealth. The result is a regressive tax system in which lower-income households pay six times their share of incomes in taxes as the wealthiest 1%. And because women and gender-diverse people are more likely to have low incomes, they are more likely than men to pay a higher share of their incomes in taxes. Women, people with periods, and families with children also pay more in sales taxes for certain costly essential goods, such as menstrual products and diapers.

Washington state can do better. The good news is that legislators can improve gender equity by creating a more progressive tax structure. Legislators can enact an expanded Working Families Tax Credit, reinvest in targeted cash assistance programs – like Workfirst/TANF – that offset the high cost of essential goods, and pass a capital gains tax.

The Working Families Tax Credit would support moms, caregivers, and survivors of intimate partner violence – who are all more likely to be women. The Working Families Tax Credit, our state’s expansion of the highly successful federal Earned Income Tax Credit, would put money back into the pockets of people who work hard for low wages and those who do vital, but unpaid work. Money from the credit – an average of $350 and up to $997 for a family of four – would help almost a million households throughout our state put food on the table or pay an emergency medical bill. The tax credit’s income boost is especially meaningful for households with low incomes, with some of the biggest impacts for women and groups in which women are overrepresented. Passing the credit in Washington would support:

-Women of color: Women of color would overwhelmingly benefit from a Working Families Tax Credit. That’s because women of color are more likely than white women to work in low-paid occupations and earn lower wages within given occupations due to a legacy of racist policies and ongoing discrimination.

-Moms, including parents raising children in same-sex relationships: The work of women, both paid and unpaid, is more important than ever to the health and financial security of families. Research shows individuals who receive the Earned Income Tax Credit while pregnant have better infant health outcomes, and young children in families who receive the credit do better in school (especially in households headed by single moms). Moms now, more than ever before, make up almost two-thirds of co- or primary breadwinners for families. Black moms are even more likely to be the primary, sole, or co-breadwinners than moms of other races. And women of color in same-sex couples are nearly twice as likely to be raising children as white women in same-sex couples. Additional income from the credit can help moms cover the costs of essential expenses like childcare or diapers and improves the well-being of families generally.

-Caregivers: In Washington, unpaid family caregivers would be eligible for the Working Families Tax Credit, a groundbreaking element of our state’s proposal. The work of family caregivers will become more crucial as the state faces an “age wave,” with the state’s long-term support and service population forecasted to increase by 91% by 2040. A modern Working Families Tax Credit would counteract the growing pressure this trend places on women and their families by raising their incomes and compensating the invaluable work of family caregivers.

-Survivors of intimate partner violence: The Working Families Tax Credit would give extra security to survivors across Washington. Flexible financial assistance is a lifeline for survivors of violence, who overwhelmingly identify as women. In King County, survivors of domestic violence who received flexible financial assistance averaging $353 reported feeling more stable and better equipped to move forward and rebuild. Survivors know what is best for their families in times of crisis and need to have financial freedom in order to help their families find safety and stability.

Targeted assistance programs would help women and gender-diverse people. The heavy reliance on sales taxes to fund vital investments in our state squeezes people with low incomes. A broad-based sales tax exemption on essentials like diapers and period products is one strategy to balance the tax code; however, broad-based sales tax exemptions on goods are not the most effective way to reduce the strain of our regressive tax code on people with low incomes. Instead, targeted assistance programs for people with low incomes, like the free diaper program in San Francisco, would enable people with low incomes to access essential goods like diapers. In Washington, WorkFirst/TANF helps people pay for diapers and other basics, but lawmakers have made budget cuts that limit the program’s ability to support Washingtonians across the state. Reinvestment in TANF/WorkFirst could help more people across the state afford essentials and offset the cost of sales taxes on essential goods.

A tax on capital gains would help lawmakers pay for tax credits and programs that would benefit women, nonbinary and trans people, and other communities overrepresented among households with low incomes. Legislators do not have to sacrifice revenue in order to reduce the strain of our tax code on Washingtonians with low incomes. Enacting a tax on capital gains – which are profits from the sale of corporate stocks, bonds, and other financial assets – would generate revenue to fund an expanded Working Families Tax Credit and reinvest in WorkFirst/TANF. And the tax would almost exclusively be paid by Washington’s millionaires, who have benefited most from the thriving economy we all help to build and maintain.

A short legislative session should not get in the way of advancing gender equity in Washington. Lawmakers can and must take these steps to address gender- and race-based economic inequities exacerbated by our tax code.

Spread the word.

See our new fact sheet on how the tax code can advance gender equity.