People seeking a more equitable state tax code and stronger supports for parents scored major victories earlier this year in Washington state, after more than a decade of hard work and focused advocacy by community leaders. By enacting a new excise tax on extraordinary stock profits (capital gains) and an expansive new tax credit for residents with lower and moderate incomes, lawmakers brought some balance to Washington state’s notoriously inequitable state and local tax code. Revenues raised from the capital gains tax will be used to fund the Fair Start for Kids Act, an important new law that will make high-quality child care, preschool, and other early learning services more affordable and accessible to parents with young children while increasing support for the workers who care for them. These investments will strengthen our recovery and create major economic gains in the long run.

While these changes will benefit all communities, they are especially important to Black, Indigenous, and people of color (BIPOC). Due to generations of explicitly racist public and private policies, too many BIPOC residents have been excluded from the wealth-building opportunities that many wealthy white residents take for granted. Lawmakers were right to heed calls from their communities by taking meaningful actions to confront this historical damage and mitigate the harm it continues to inflict on people across our state.

Tax reforms will advance economic and racial equity

For generations, Washingtonians have been saddled with an exceedingly upside-down tax code in which the poorest households pay six times more of their incomes in state and local taxes than the wealthiest 1%, on average. The regressive nature of our state tax code and its harmful impacts on BIPOC and residents with lower or moderate incomes has been confirmed by multiple studies from state agencies and national tax experts over many years. In fact, Washington’s tax code is more tilted against households with lower incomes than any other state in the nation, according to studies from the Institute on Taxation and Economic Policy spanning nearly 30 years.

The good news is that the new excise tax on highly concentrated capital gains wealth will generate $500 million annually for child care and early learning. The tax will be paid exclusively by the richest 0.2% of households, since each resident’s first $250,000 in capital gains wealth will be exempt from taxation each year, along with all gains on the sale of real estate, family-owned small businesses, retirement accounts, and other common assets.

Millionaires’ lawsuit threatens progress toward justice and equity

A small group of ultra-wealthy investors are pulling out all the stops to reverse the progress made this year by challenging the capital gains wealth tax in court and spreading falsehoods about who would pay it. If they succeed, working parents will receive no relief from the limited and expensive child care and preschool options they currently face. That is far too high a price a to pay simply for preserving the special tax deals enjoyed by a tiny group of unimaginably wealthy residents who have avoided paying what they owe to support the common good.

Meanwhile, an expanded Working Families Tax Credit will meaningfully reduce taxes for struggling residents who face the highest overall tax rates. Beginning in 2023, those eligible for the federal Earned Income Tax Credit (EITC) will be able to claim tax rebates of up to $300 for single adults and up to $1,200 for families with children.1 The rebates will help more families afford the basics and improve the quality of life for hundreds of thousands across the state. Immigrant taxpayers, who are unjustly excluded from the federal EITC because they use an Individual Tax Identification Number (ITIN) in place of a Social Security Number to file taxes, will also receive the state’s Working Families Tax Credit.

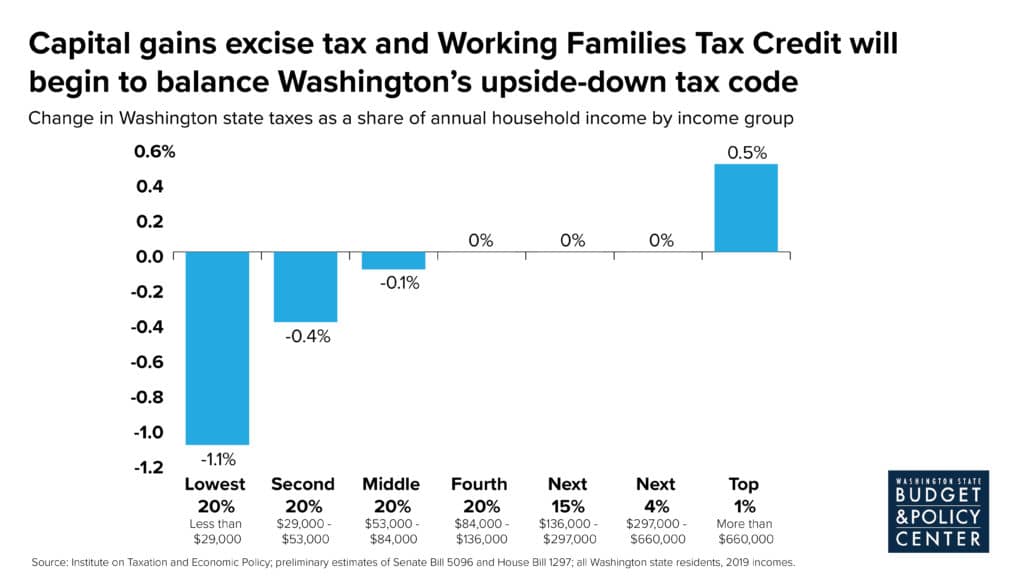

As the chart below shows, together these actions will begin to shift Washington’s tax code toward economic justice and equity. On average, the richest 1% of Washingtonians, who earn a minimum of $660,000 per year, will see a modest, 0.5% increase in their annual state and local taxes. By contrast, the Working Families Tax Credit will reduce annual tax bills among households earning less than $29,000 per year by 1.1%. Households in the second fifth of the income scale, who earn between $29,000 and $53,000 per year, will see their taxes decline by 0.4%. And residents earning between $53,000 and $84,000 per year, those in the middle fifth of the income scale, will see a 0.1% reduction. Overall, more than 400,000 Washingtonians will receive the Working Families Tax Credit.

Click on image to enlarge.

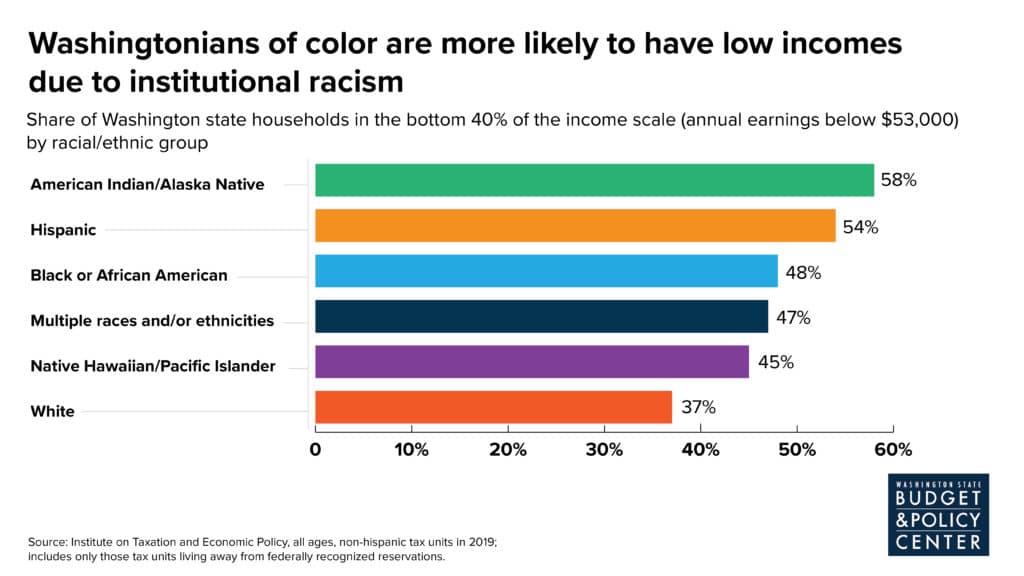

The Working Families Tax Credit will also help advance racial justice in our tax code and economy. Because of centuries of racist public and private policies – such as redlining, employment and housing discrimination, racist policing practices, and exploitative “guest worker” programs targeting immigrant workers – BIPOC households are much more likely than white households to be concentrated in the bottom 40% of the income distribution (see chart below).

Since the expanded tax credit is designed to bring relief to Washingtonians with lower or moderate incomes, it will have outsized positive impacts for BIPOC. Black and Hispanic households earning less than $53,000 per year will see the greatest average annual tax reductions: $195 and $286, respectively. Asian and Multiracial households in that income group will experience yearly reductions averaging $173 and $162, respectively. And white households with lower incomes will see their taxes decline by an average of $135 each year.2 All in all, the Working Families Tax Credit delivers the largest benefits to the households who have the least, helping to right past wrongs while creating a more equitable state economy – one in which race does not determine Washingtonians’ chances of prosperity.

Click on image to enlarge.

New investments in parents and young children will boost and sustain our recovery

During the 2021 legislative session, lawmakers also enacted the Fair Start for Kids Act, a groundbreaking new law that will invest hundreds of millions of dollars per year to support high-quality child care, preschool, and other essential early learning programs, and making those services more affordable for struggling parents. To better reflect the true value of these important services to our communities, the law will also increase the amounts paid to child care centers and early learning teachers.

In the recently enacted, two-year state budget, this important investment in young children and working parents will rely on approximately $300 million in federal funding from the American Rescue Plan Act. Because this federal funding is temporary, the investment will be incrementally boosted and sustained with revenues from the state’s capital gains wealth tax after 2023.

The benefits of the Fair Start for Kids Act to our quality of life and economic well-being will be enormous. In the short term, investments made under the new law will help jumpstart our state’s recovery from COVID-19 – supporting our kids’ growth and allowing parents to return to work or school. In the long run, these investments will substantially boost the earnings of current and future workers across Washington state. Every $10,000 invested today in a child’s early learning will boost their lifetime earnings, and those of their parents, by more than $120,000.3

Every $10,000 invested today in a child’s early learning will boost their lifetime earnings, and those of their parents, by more than $120,000.

Washingtonians of all races will benefit from the Fair Start for Kids Act, but – as with the Working Families Tax Credit – outsized benefits will go to BIPOC families and childcare providers. Decades of inadequate public investment mean that families across our state struggle to find and afford child care, facing costs that can exceed in-state college tuition or rent.4 While this harms all families, BIPOC kids and parents feel the strain most acutely. Paired with other inequitable barriers to access – like the lack of culturally affirming, linguistically appropriate care options or the challenge of finding care during non-standard work hours – the crisis in affordability makes it extremely difficult for BIPOC families to find the care they need.

The COVID-19 pandemic has exacerbated these challenges, especially among essential workers and parents who do not have the flexibility to work from home. In Washington state and across the nation, women of color have disproportionately been forced to reduce their work hours or leave the paid workforce entirely to care for their families.

The Fair Start for Kids Act begins to address these challenges by expanding Working Connections Child Care (WCCC), Washington state’s subsidized child care program, to serve more families, and reducing the amount those families are required to contribute in WCCC copayments. It also expands the Early Childhood Education and Assistance Program (ECEAP), Washington state’s free preschool program, to provide services to additional children with low family incomes and those experiencing homelessness.

To ensure child care providers also have the resources they need to provide high-quality care, the Fair Start for Kids Act increases the amount paid to providers serving families in the WCCC and ECEAP programs.5 This is an essential support for women of color, who are more likely to work in child care and be under-compensated for that vital job or to operate child care businesses on very thin margins. Before the pandemic, nearly two in five early educators in Washington state received wages so low they relied on one or more forms of public assistance, and the industry suffered significant job and revenue losses during the crisis.6

We must continue to improve our state tax code

Washington will be a more just and prosperous state thanks to the equitable tax changes and new investments in young children enacted this year. While these are targeted investments in kids, families, and workers, their benefits will carry over to all people in Washington state – improving the health of our communities and the strength of our economy for years to come.

To build on this progress in the coming years, lawmakers should also increase and expand taxes on multi-million-dollar estates and inheritances, further increase and expand the Working Families Tax Credit, and enact new taxes on billionaire wealth and large salaries paid to corporate executives. Not only would these actions bring greater balance our state tax code, but they would also stimulate the state economy by injecting billions of additional dollars into schools, health care, infrastructure, and other community investments that benefit us all.