The Working Families Tax Credit rebalances the tax code, boosts incomes among low- and moderate-income families, injects money into local economies, helps small businesses, reduces racial inequities, and promotes work. And yet, lawmakers in Olympia are on the verge of letting another legislative session go by without funding or implementing this commonsense policy that should be a no-brainer.

Here are the key reasons why lawmakers should make the Working Families Tax Credit part of their final budget deal:

It’s the other side of the coin to rebalance the tax code.

People with low incomes in Washington pay up to six times more in local taxes as a share of income compared to the top 1%. Washington state is literally the worst in the country when it comes to tax inequity, and it has been for decades. To fix it, lawmakers have to address both ends of the tax code – the fact that ultra-wealthy people pay too little and working people pay too much. That means requiring the wealthiest to pay their share by closing the tax break on capital gains, and allowing working people to pay a little less. That’s where the Working Families Tax Credit comes in – a targeted tax reduction for those who need it most.

And the other side of the coin? The capital gains proposals in the House and Senate would raise taxes on only the very highest-income households in the state, less than one-half of one percent of us. And many of those households are themselves asking to pay their share to help working families get by. A small tax increase for fewer than 14,000 wealthy Washingtonians to ensure nearly half a million working families can better afford to put food on the table and a roof over their heads? That’s just good math.

It’s the most targeted way to turn our tax code right-side up.

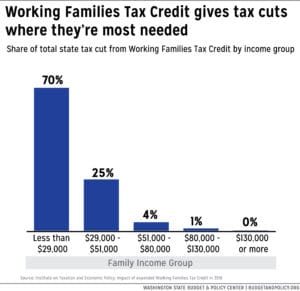

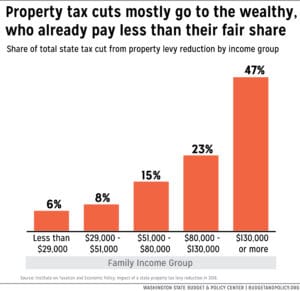

The Working Families Tax Credit is the most efficient way to reduce taxes for low- and moderate-income workers, because it provides a targeted sales tax credit that would go to the people who need it the most. Across-the-board tax cuts, such as property tax or sales tax cuts, waste resources on tax cuts for those who don’t need it. And despite the fact that they would reduce the rate the same amount for everybody, these tax cuts are not equal across income groups. In fact, they mostly benefit the wealthiest.

See how well the Working Families Tax Credit stacks up against a property tax in the charts below. Whereas 99% of the money spent on the Working Families Tax Credit would go toward tax reductions for low- and moderate-income workers, property tax cuts would disproportionately benefit the wealthy. With an across-the-board property tax reduction, nearly half of the tax cut would go to the top fifth of the wealthiest households in Washington.

Click on graphics to enlarge.

It’s a needed poverty reducer as the cost of living is skyrocketing.

How the Working Families Tax Credit works is simple: It would significantly reduce poverty in our state by boosting working people’s incomes. There are various proposals on the table this session – their benefits range from an average annual tax credit of $350 to $500 a year, with maximum credits topping out at more than $1,200 a year. People who need it spend that money on things like fixing their cars, paying bills, or paying for public transportation. But don’t just take our word for it.

It reduces persistent racial inequities in income and wealth.

Here are two things that are especially unjust with income and wealth in our country and state: 1) Wealth is undeservedly concentrated among mostly white people; and 2) Working poverty rates1 are highest among Washingtonians who are Latinx, American Indian, Black, and Pacific Islander. These outcomes are the result of continuing systemic and institutional racism that creates barriers to opportunity for many communities of color – seen in policies like discriminatory hiring practices, exclusionary banking practices, and an education system centered on the success of white kids. Those same communities are most likely to be in the lowest-income, highest-taxed population in Washington. So when we think about who pays taxes in our state, and how much, it’s clear that people of color are paying more than their fair share compared to white people. Rebalancing the tax code with the Working Families Tax Credit, as is true for similar policies in other states, would have outsize positive impacts in communities of color.

It injects money into local economies and helps businesses and workers alike.

When working people receive an income boost, they spend it on necessities, often at local businesses in their communities. This puts money back into the local economy, which is good for workers and businesses. On top of that, credits like the Working Families Tax Credit benefit many small business owners directly, by helping them get their businesses off the ground and boosting the economic security of their employees and customers. It’s a win-win.

It’s a proven and simple policy with wide-ranging benefits and a history of bipartisan support.

Study after study shows that the federal Earned Income Tax Credit – the program on which the Working Families Tax Credit is based – and other state versions are successful at reducing poverty and helping people make ends meet. They’ve enjoyed a history of bipartisan support because they’re easy to administer, they promote work, and they give people the resources they need to solve their own problems. The federal and state programs are associated with wide-ranging benefits from reducing income inequality to improving health, education, and job outcomes.

We can have those benefits and more in our state, where lawmakers have the opportunity to construct a tailored program that works for Washington. They should enact a Working Families Tax Credit that modernizes the definition of work and extends the program to key populations who are excluded at the federal level. And they should maximize the impact of the credit by providing options for regularly receiving credit payments over the course of the year to better align with what families need.

Working families are counting on lawmakers to do what’s in the best interests of all Washingtonians, not just the wealthy few. There’s not much time – but there’s enough time to get this important step done.